Learning Made Easy:

Insurance Learning Space

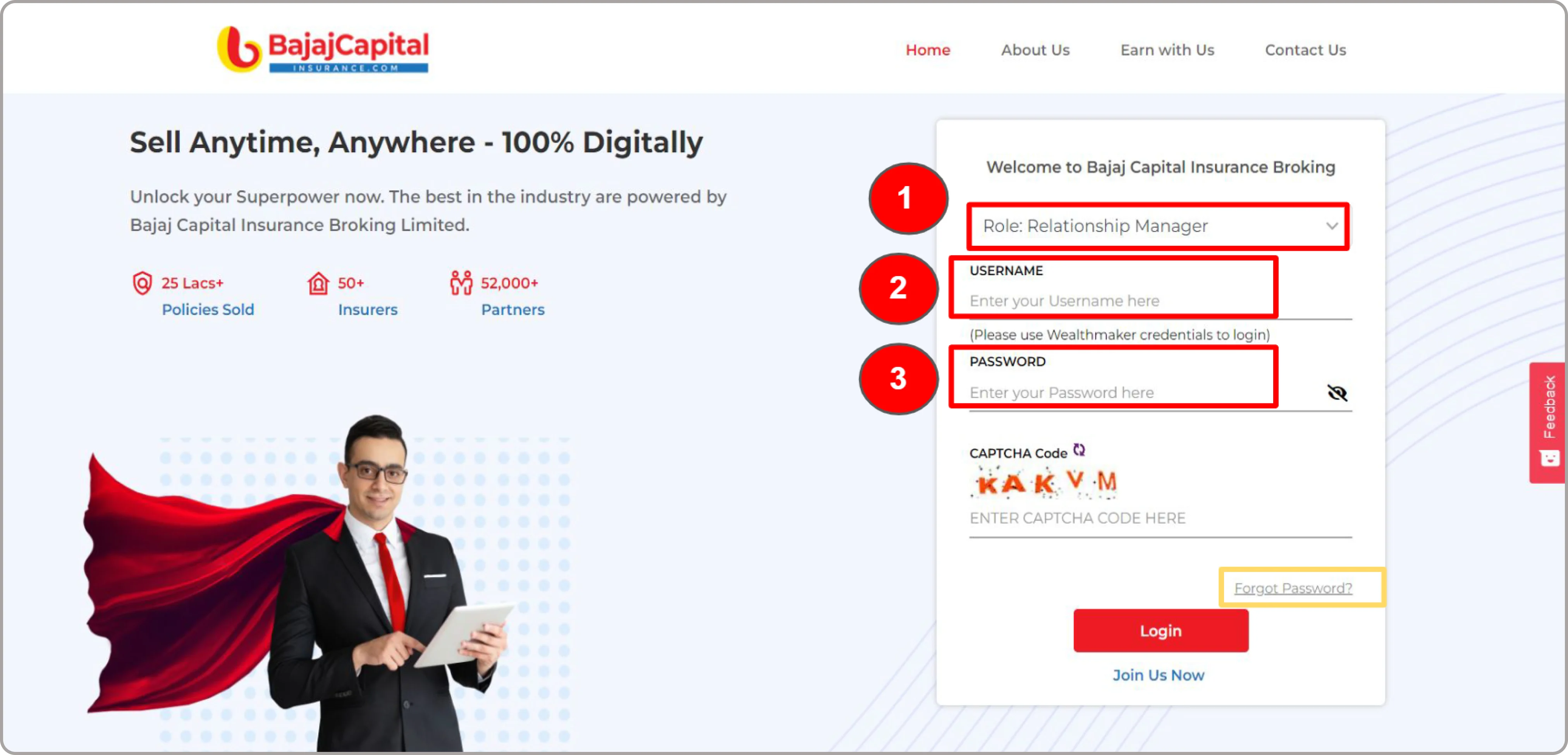

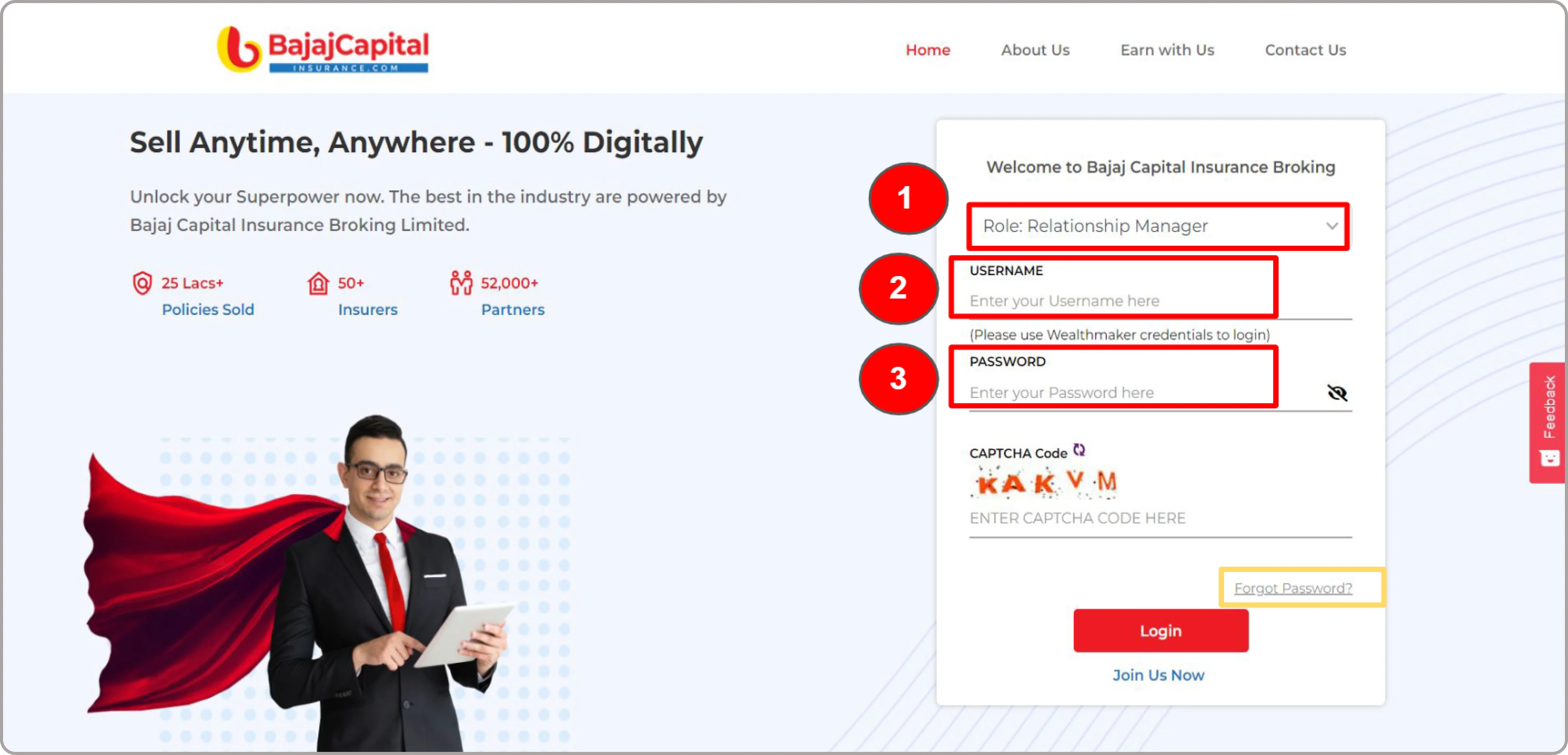

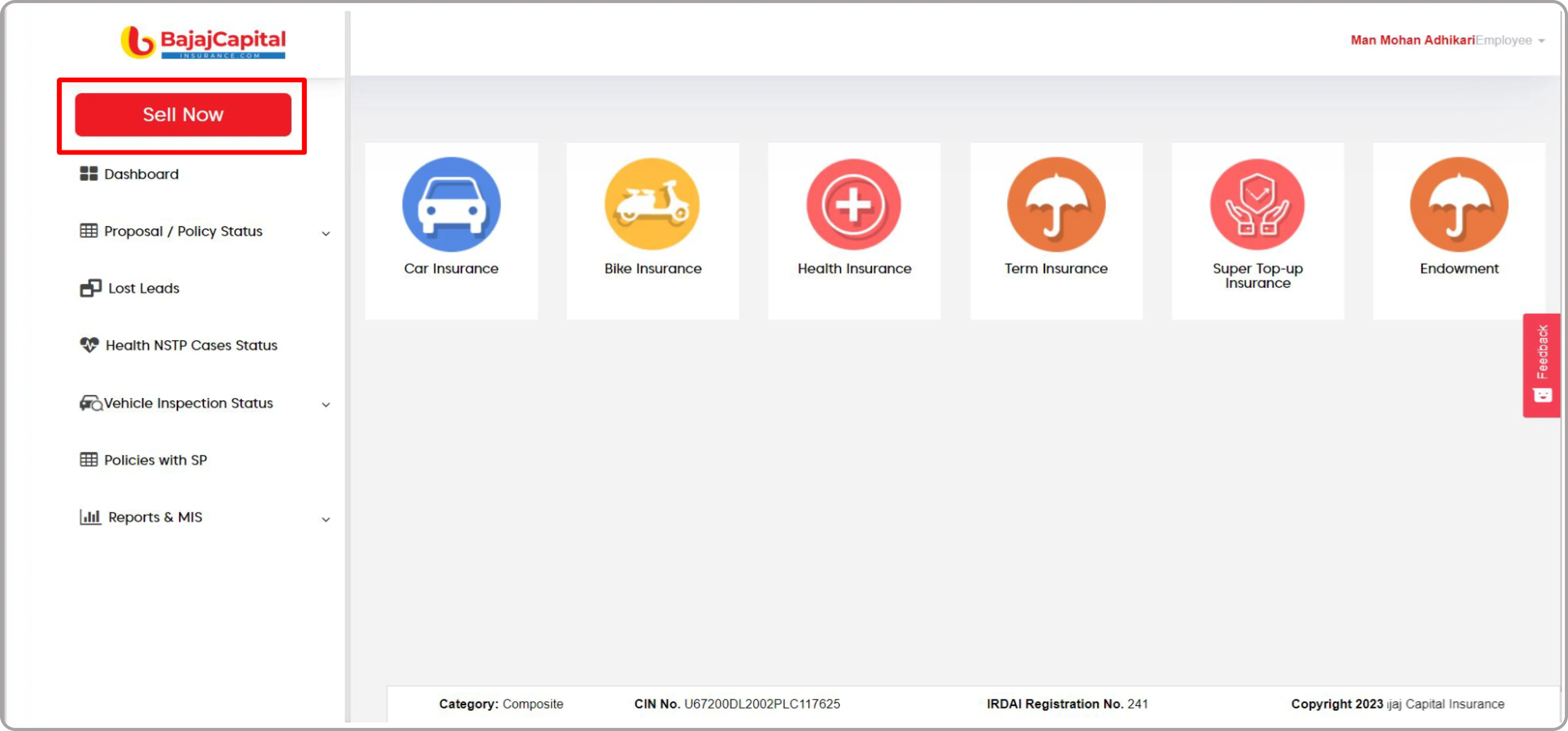

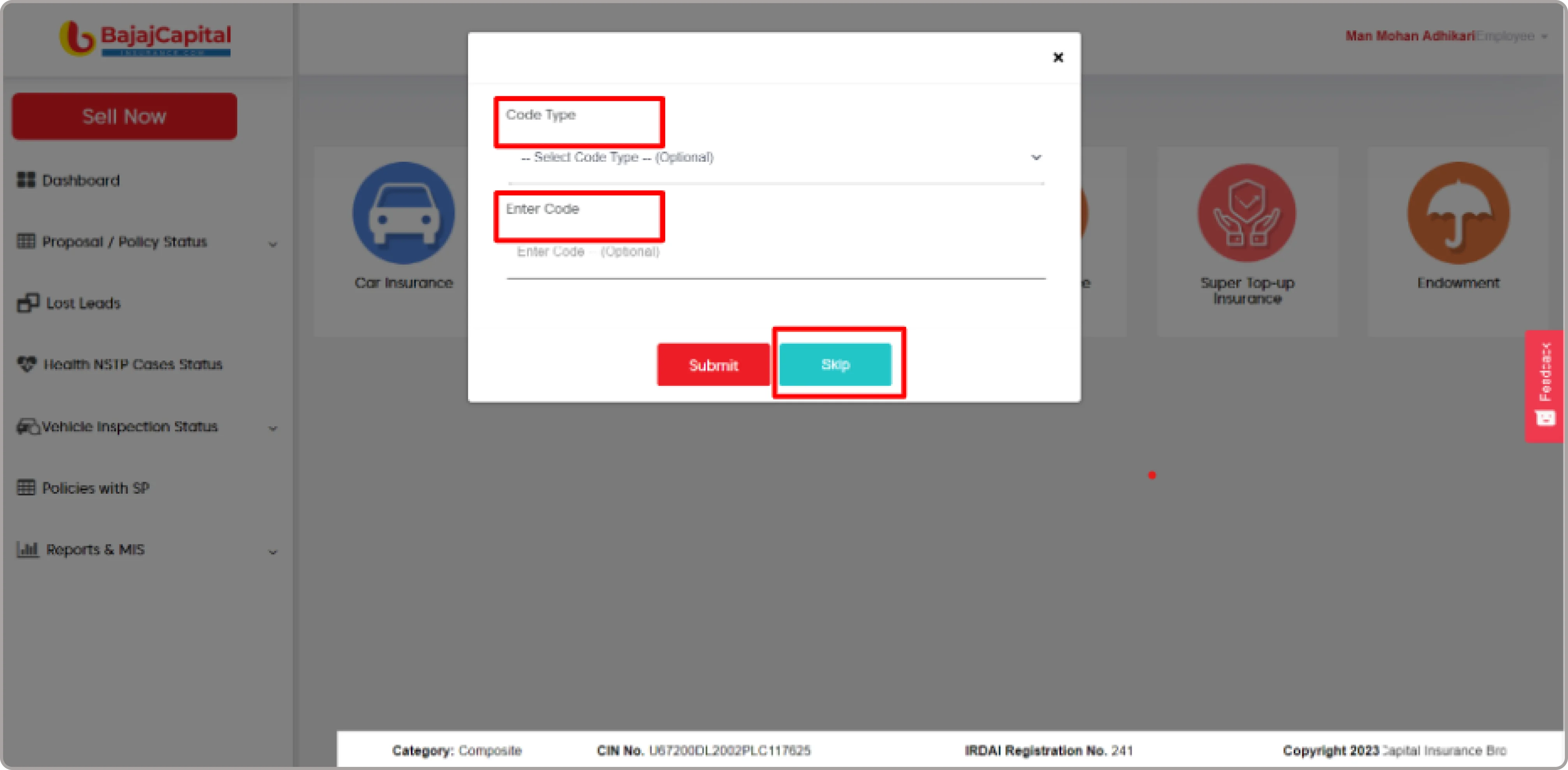

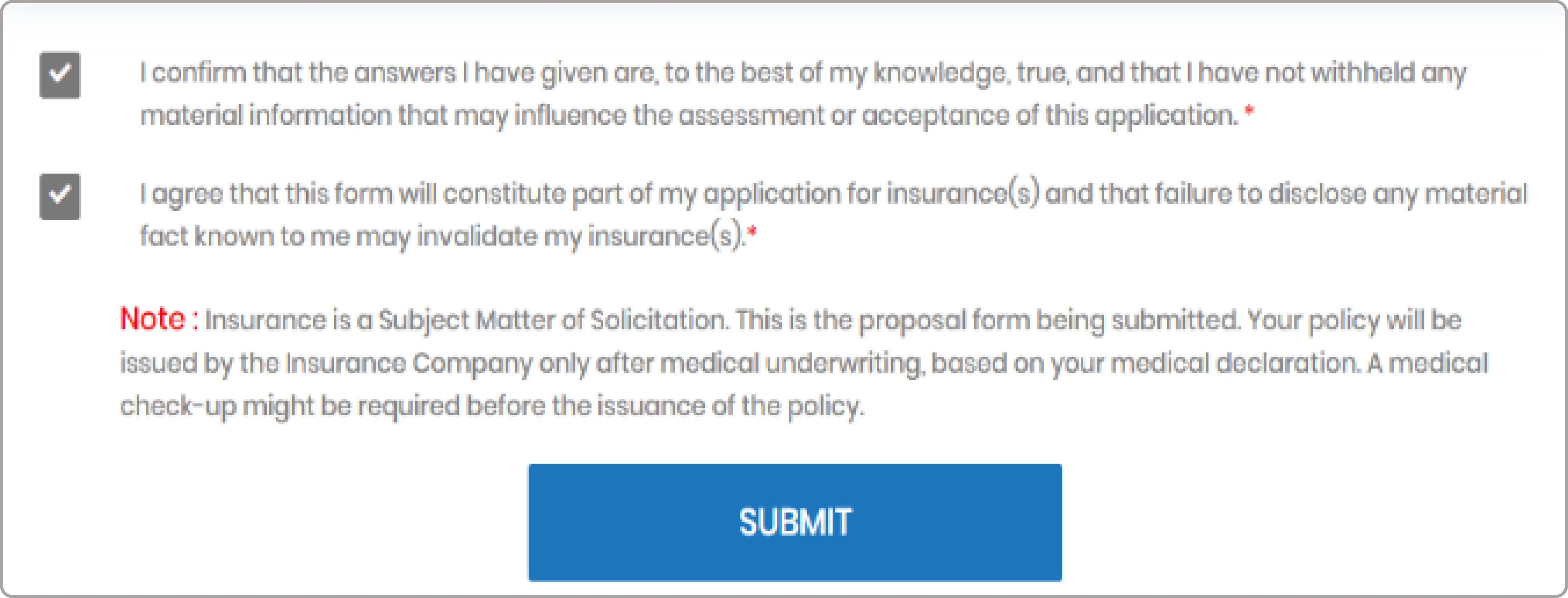

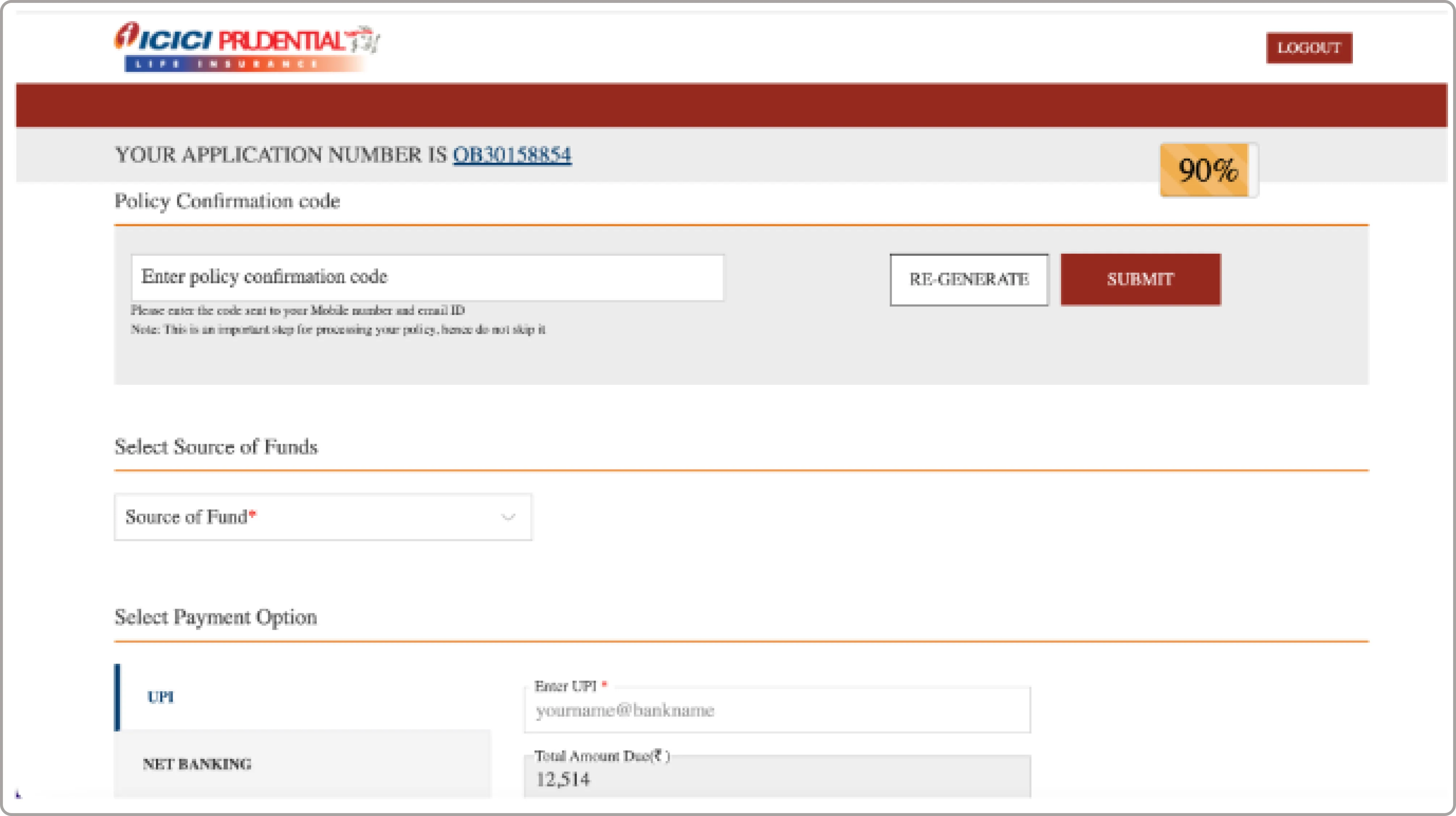

Insurance Learning Space is tailored to enable learners to explore the important features & understand the benefits of Digital First Insurance Platform.

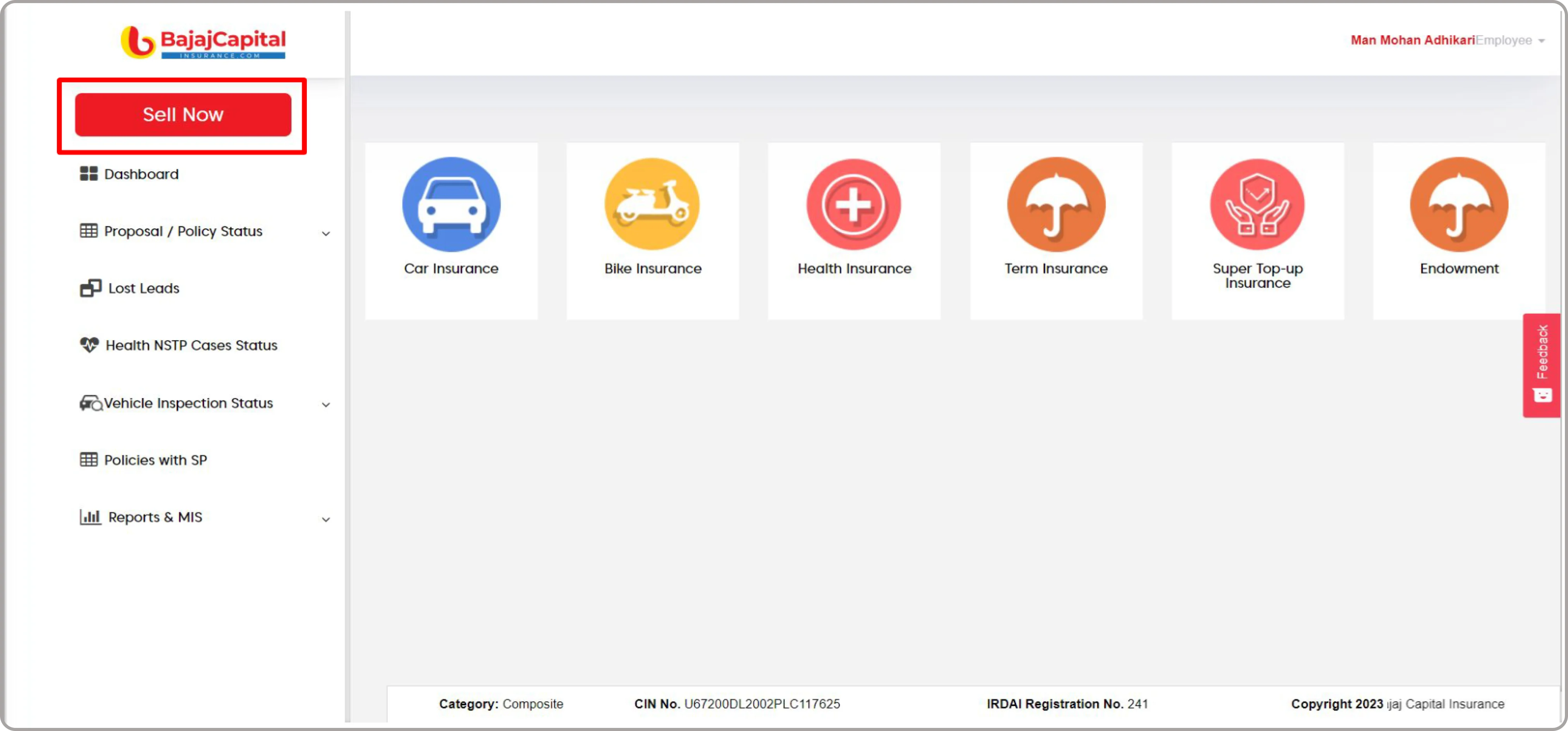

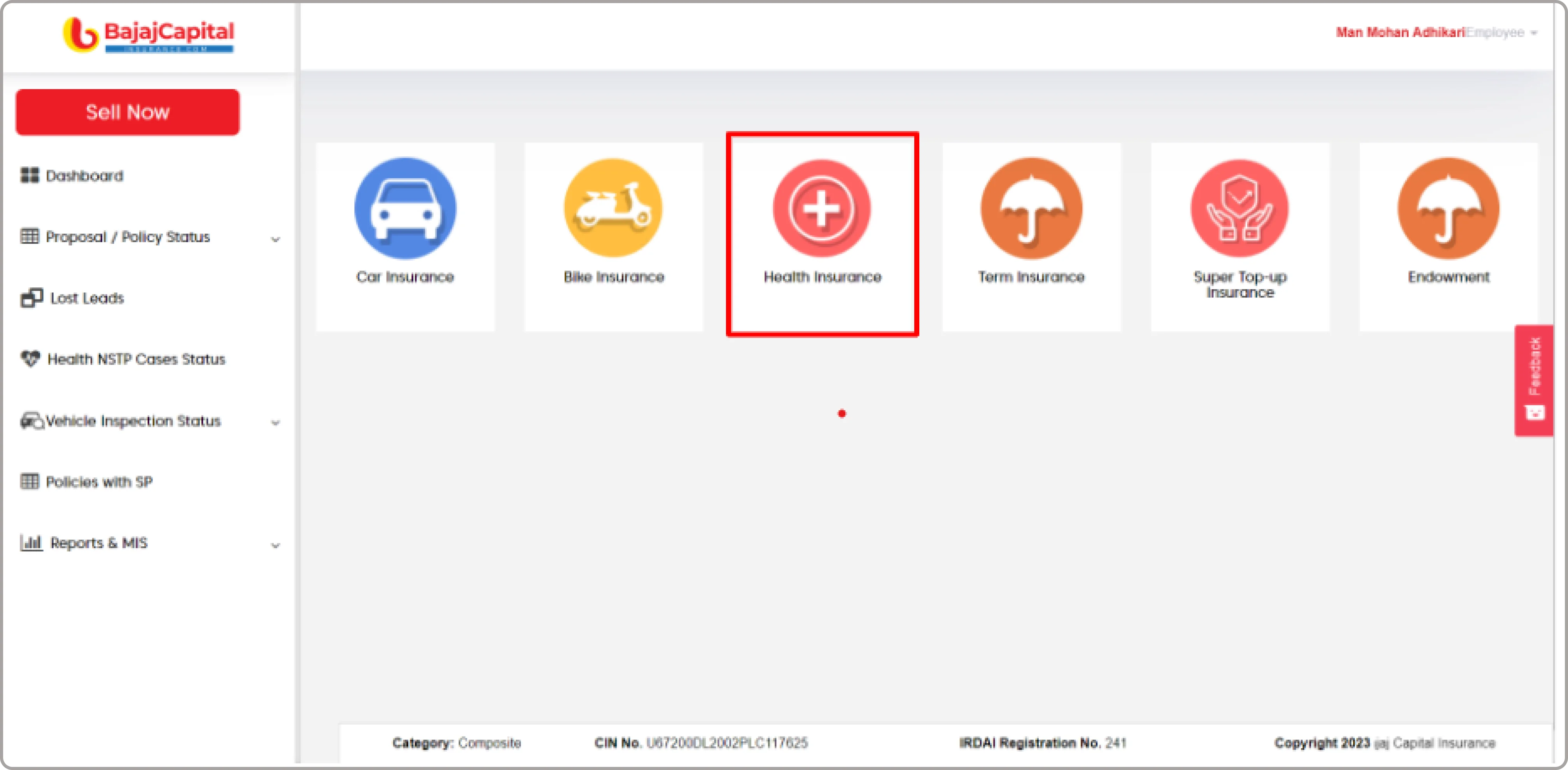

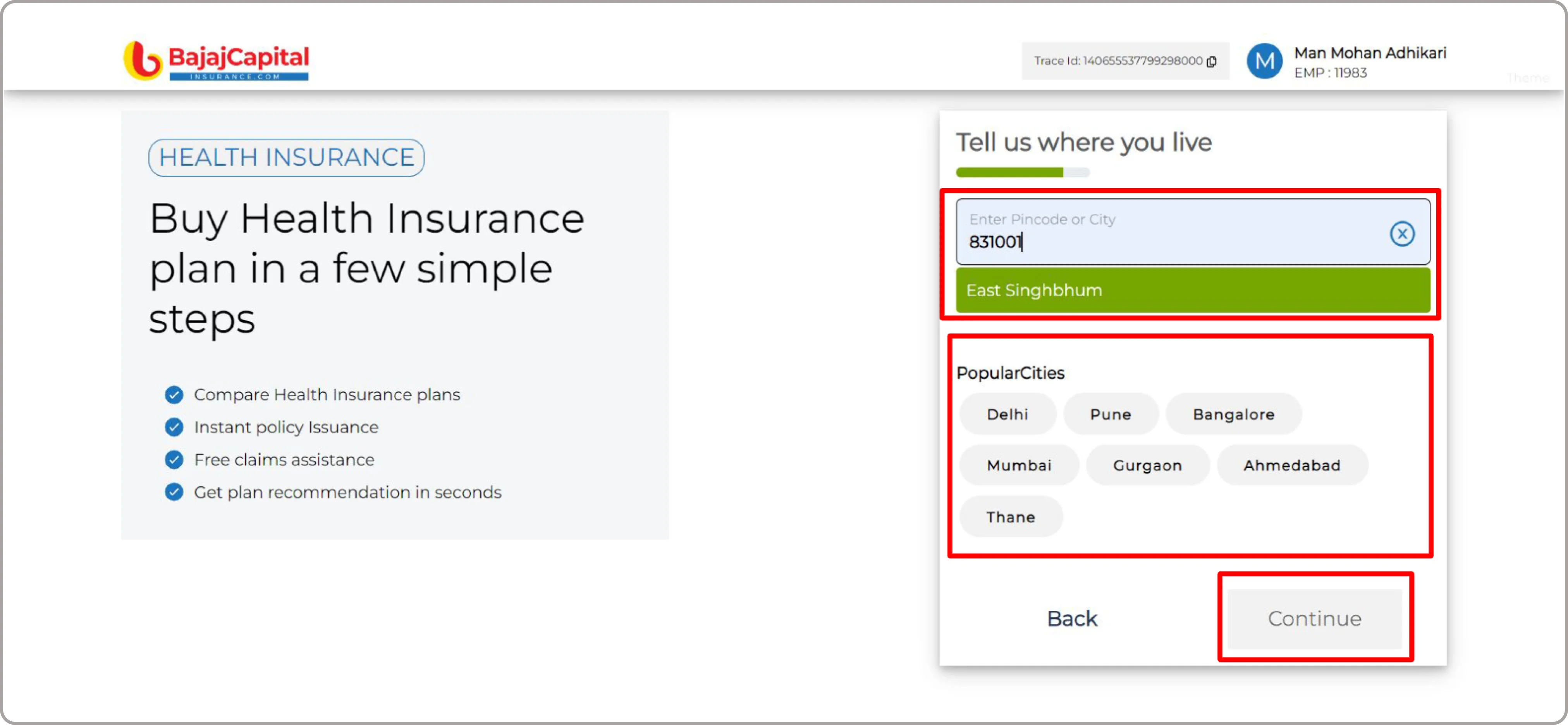

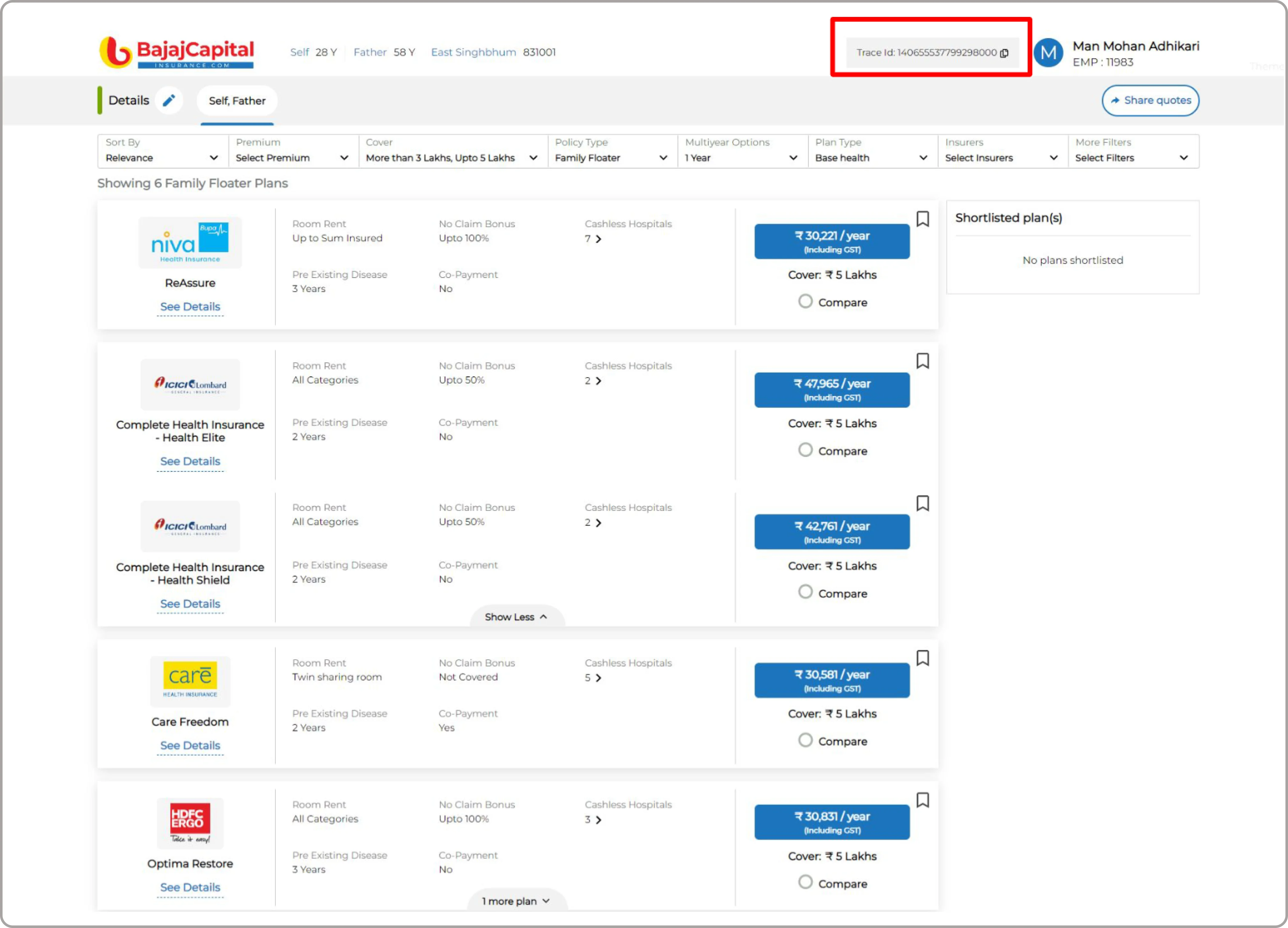

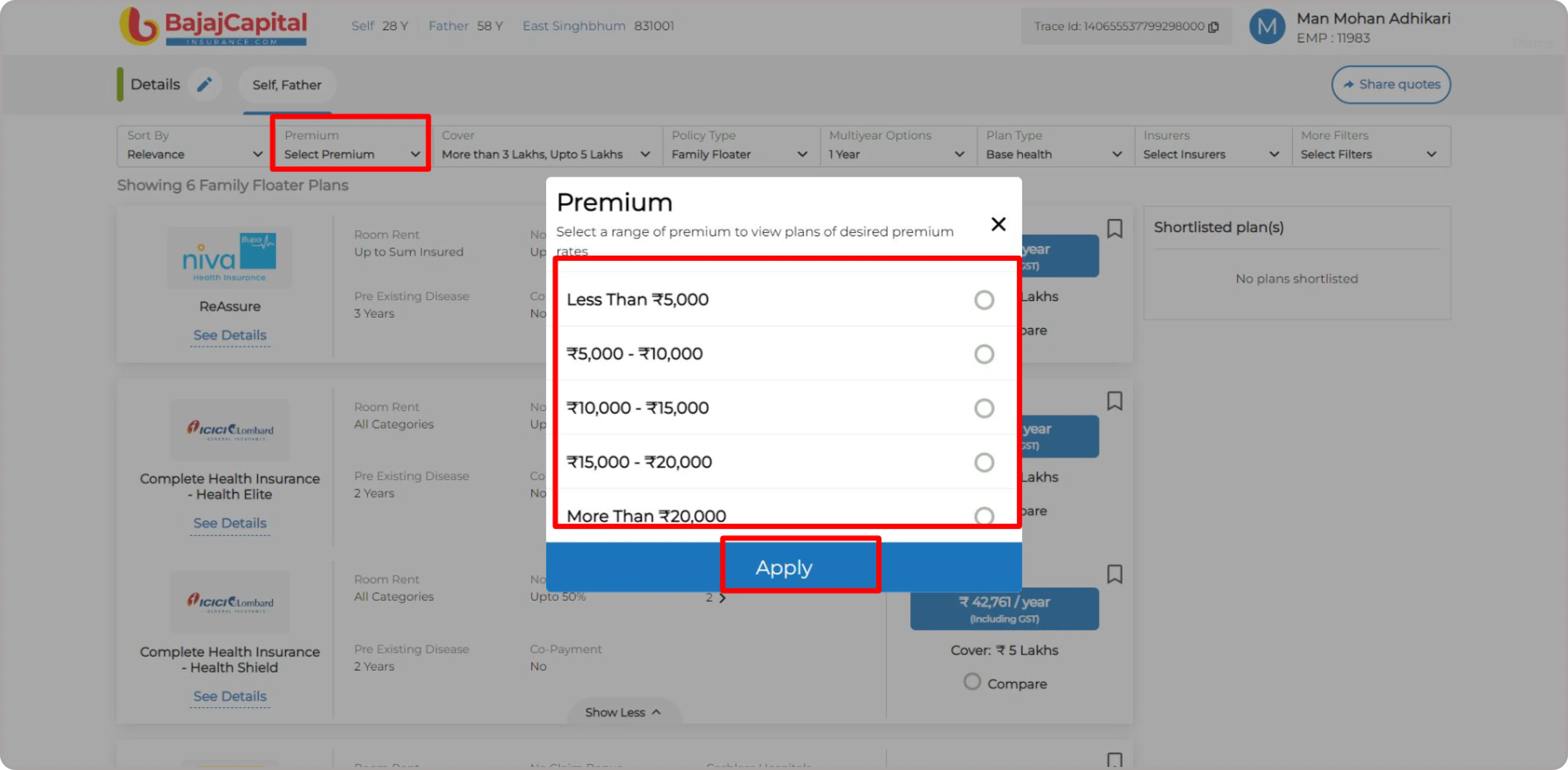

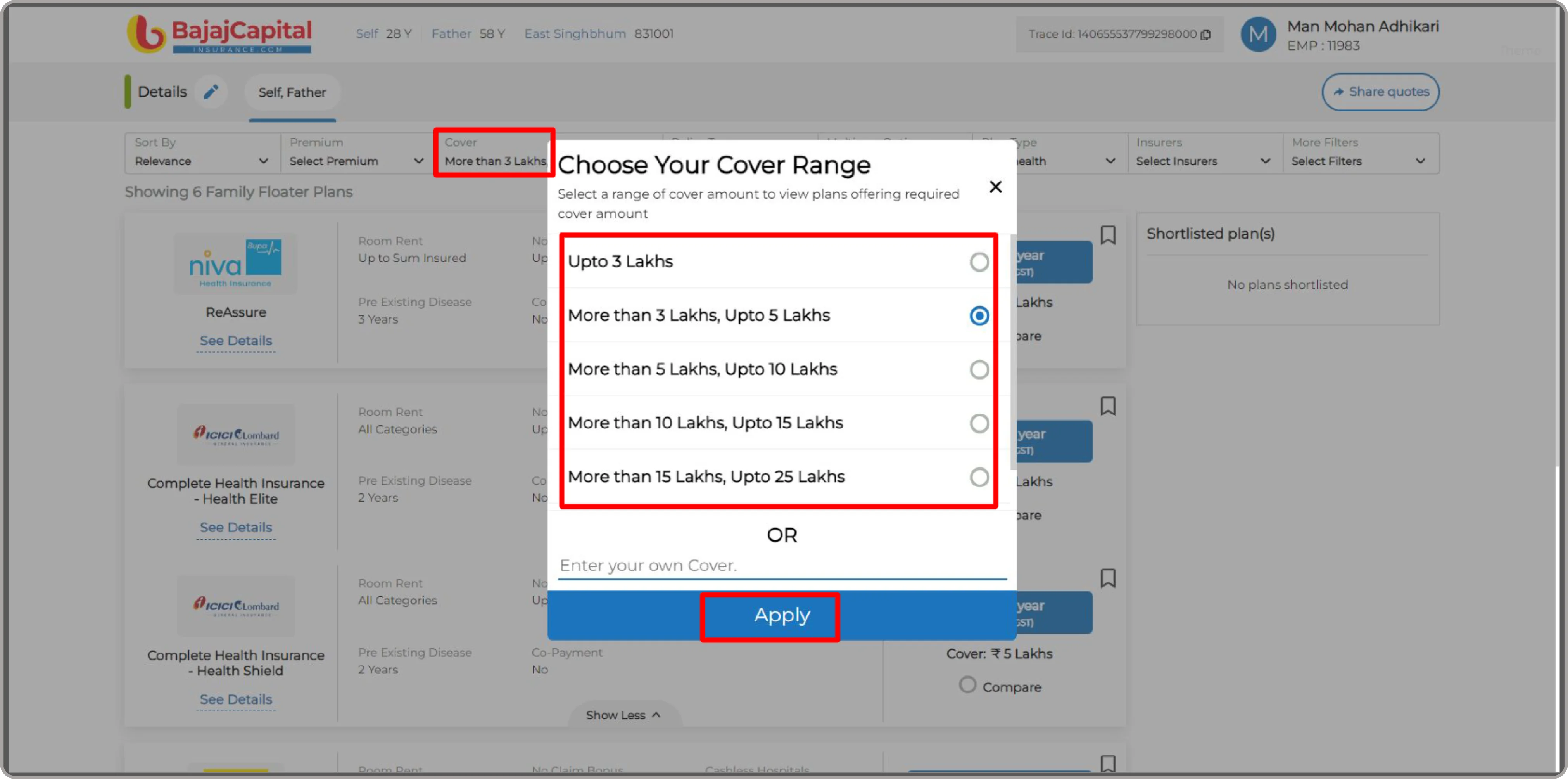

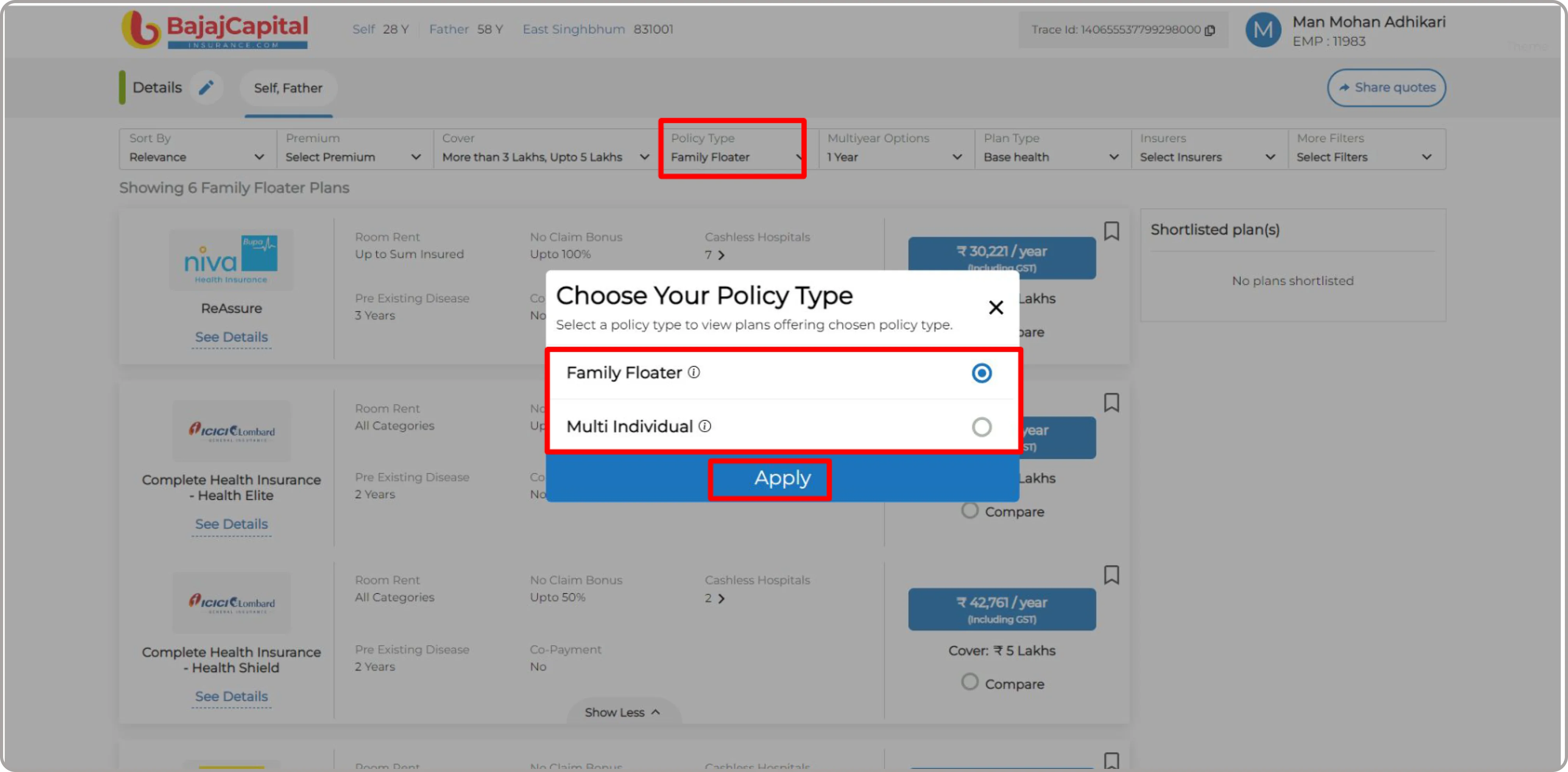

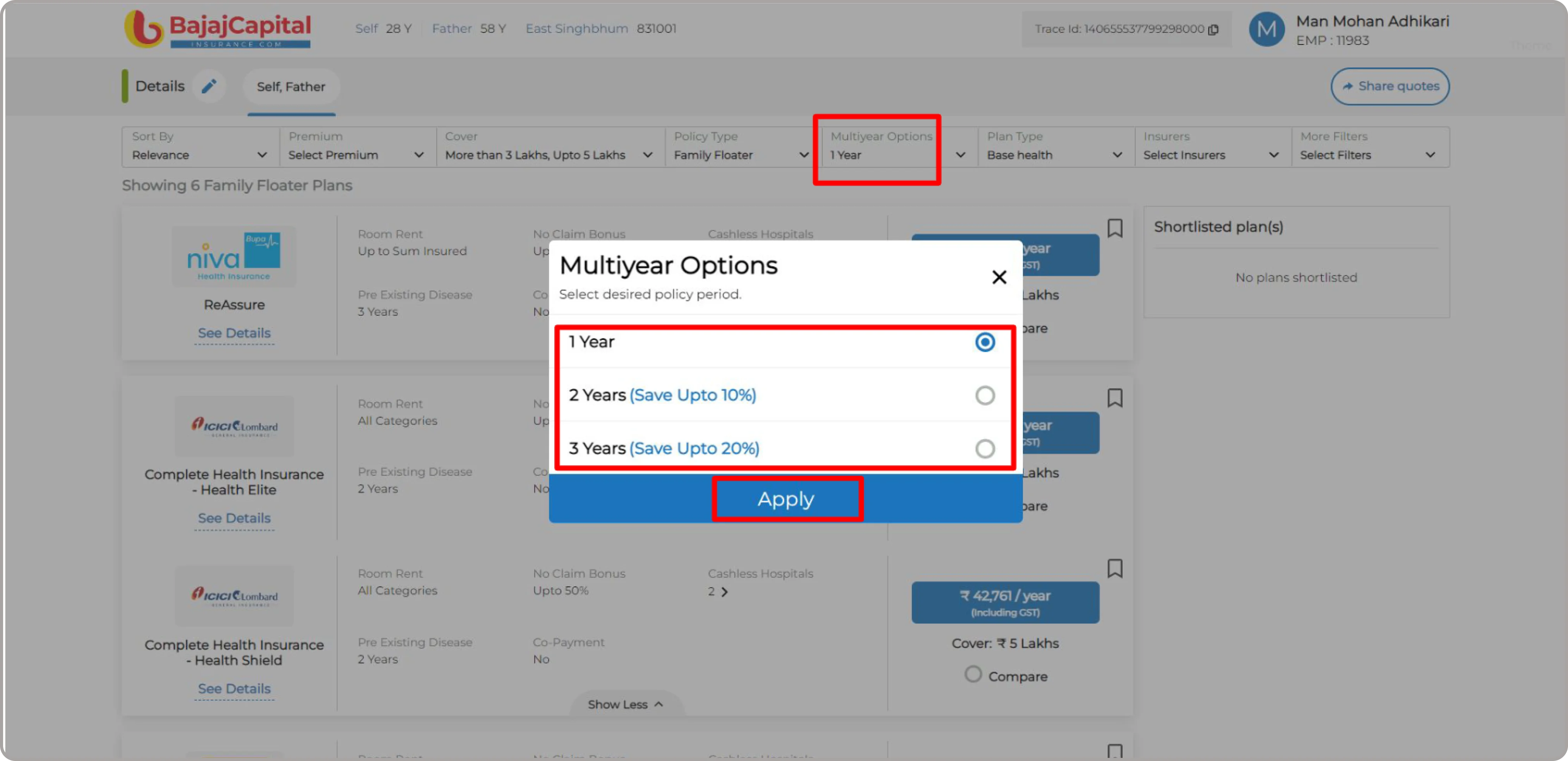

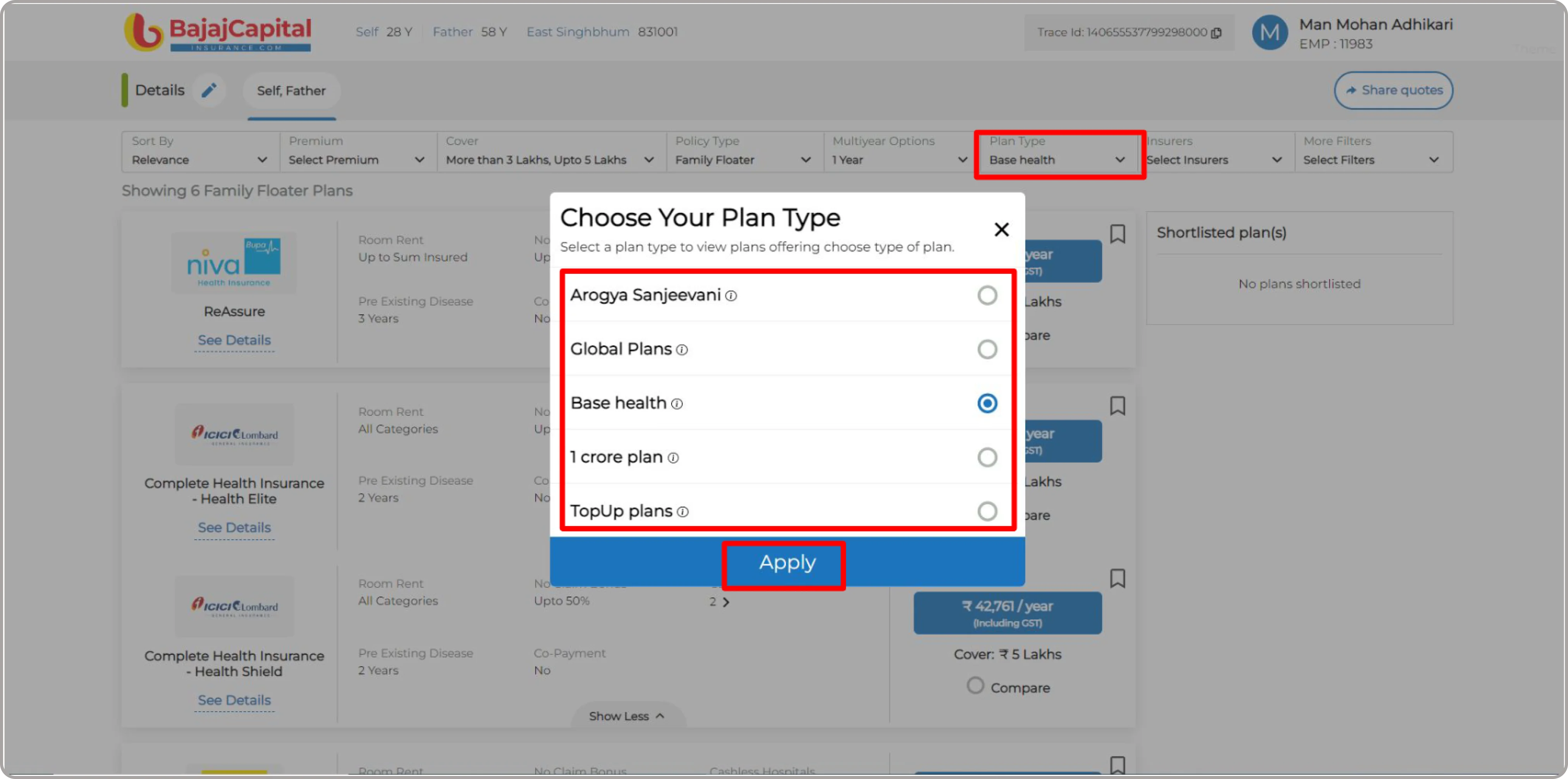

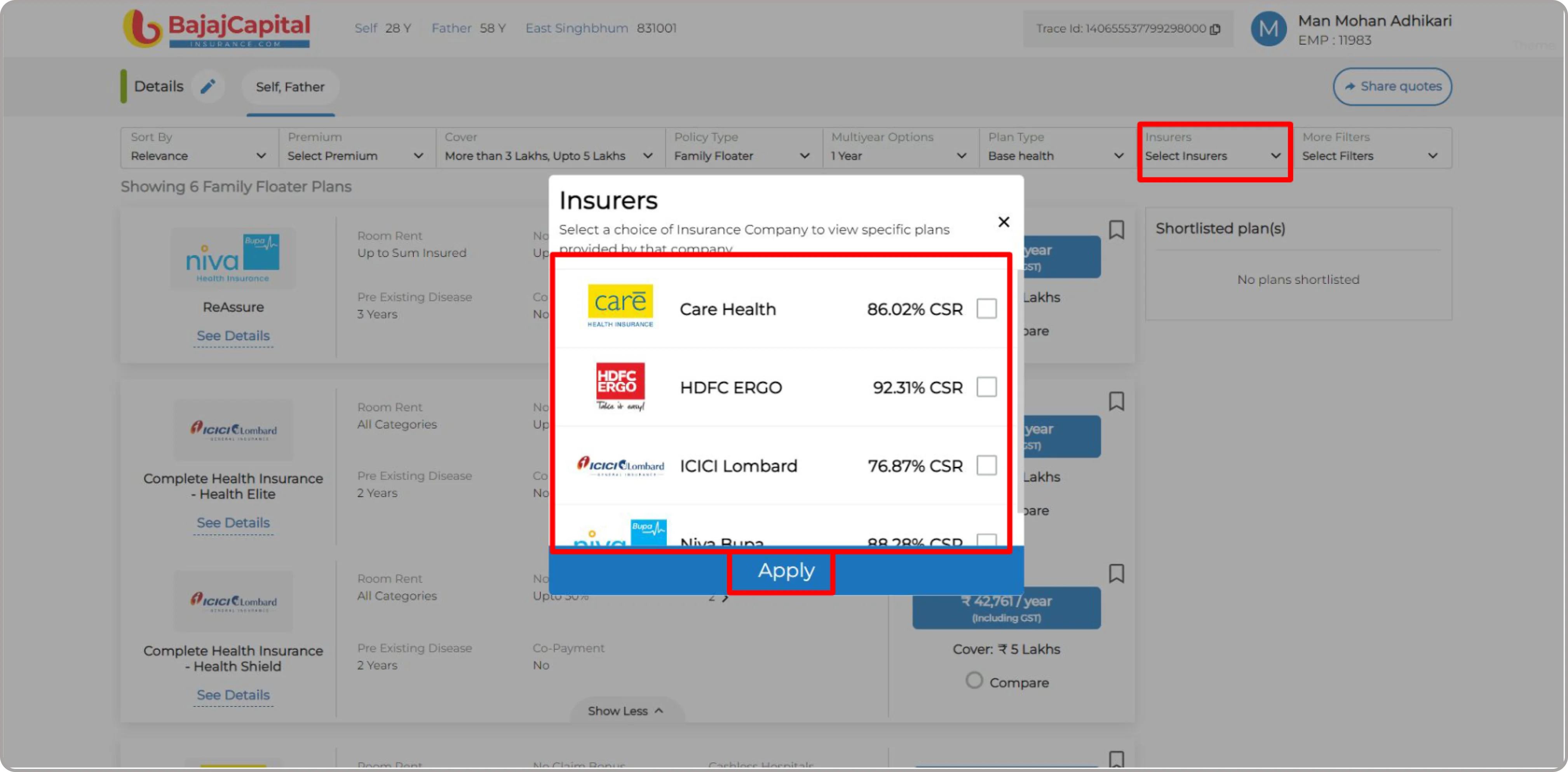

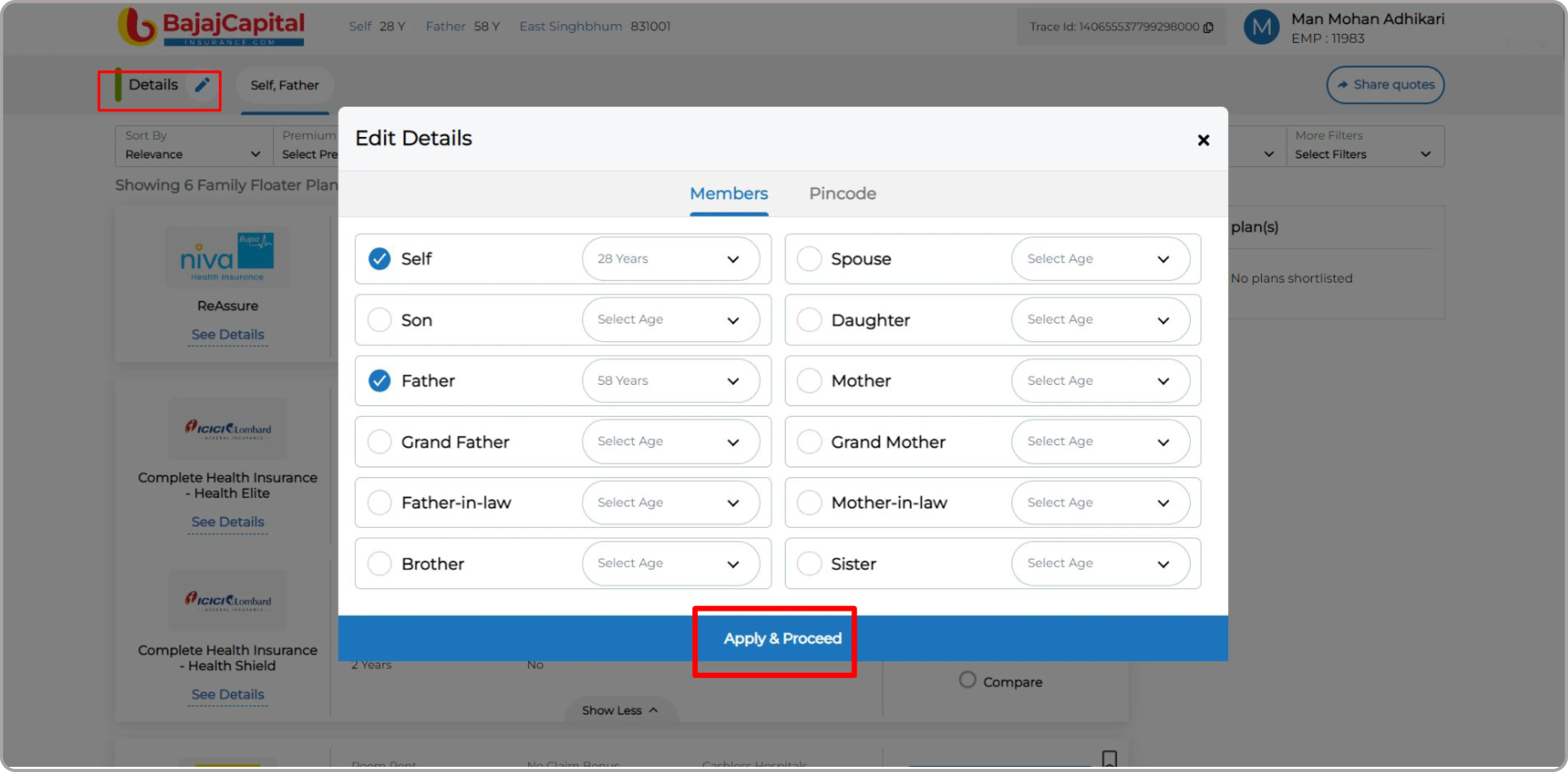

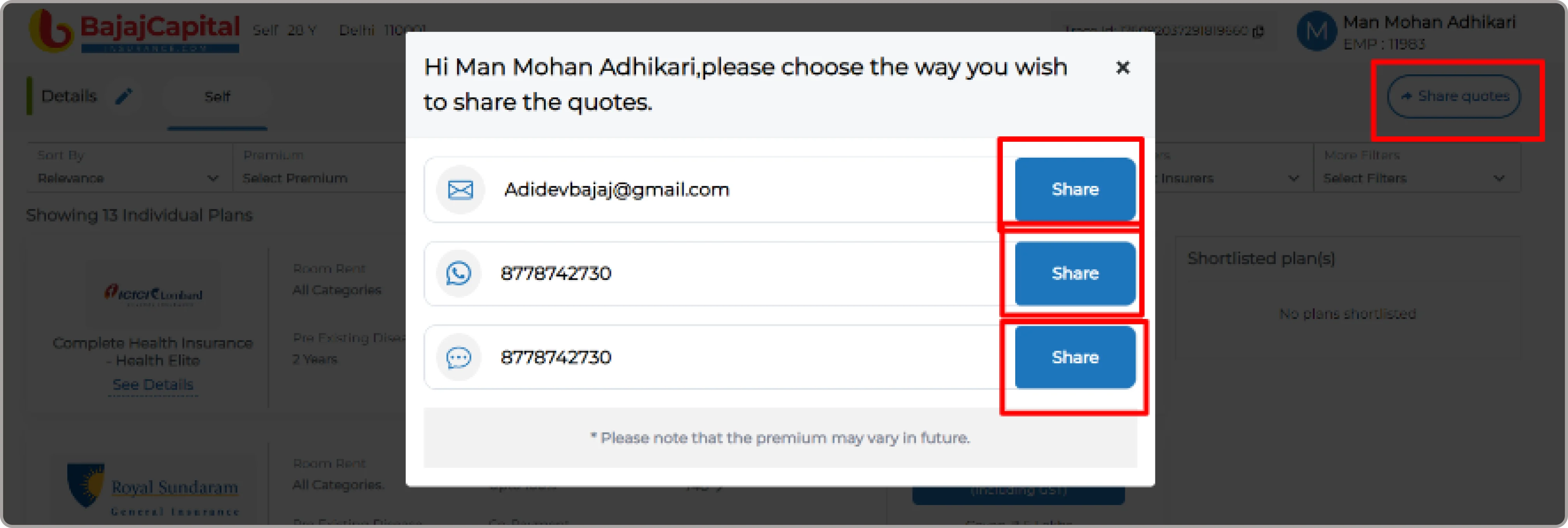

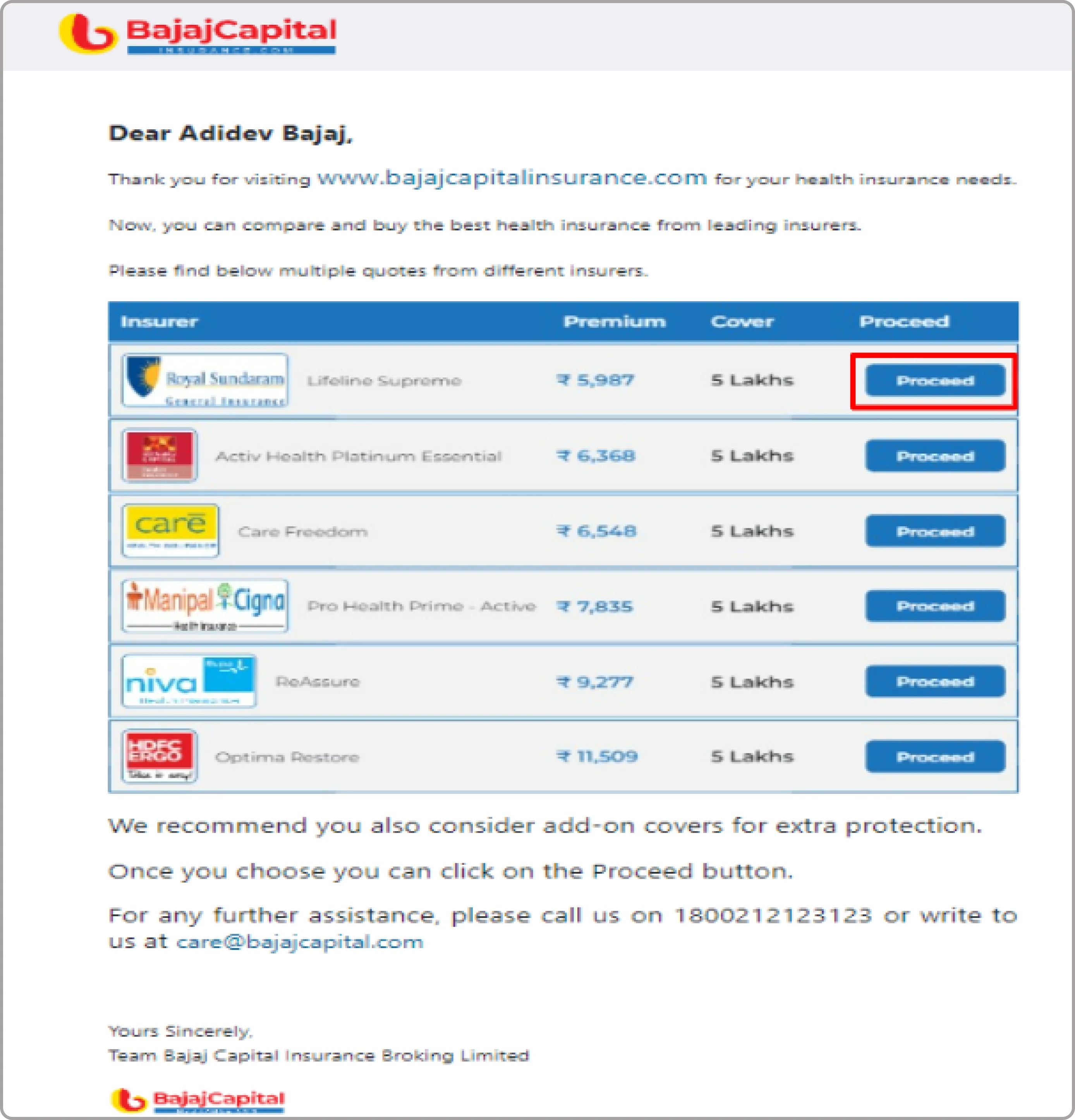

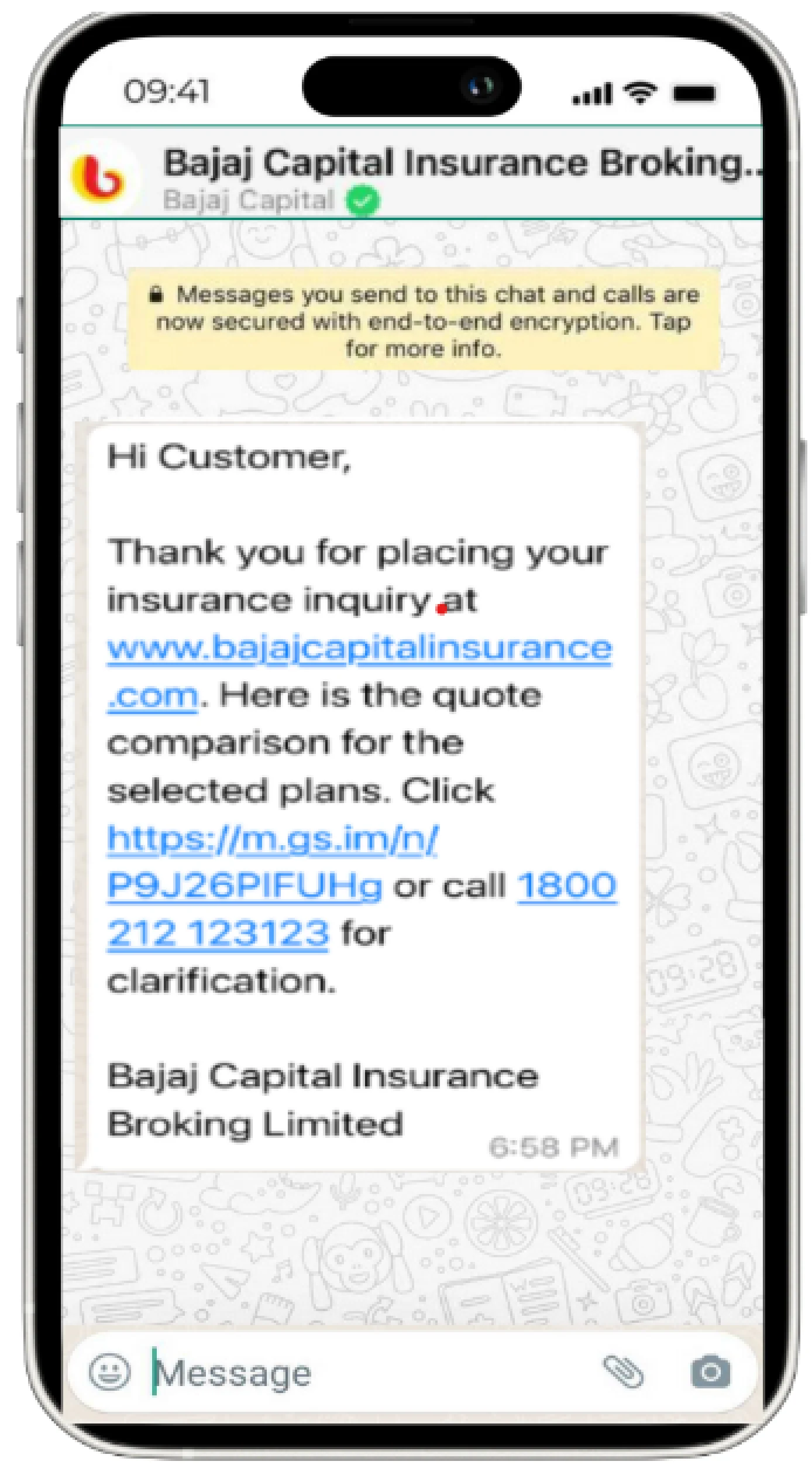

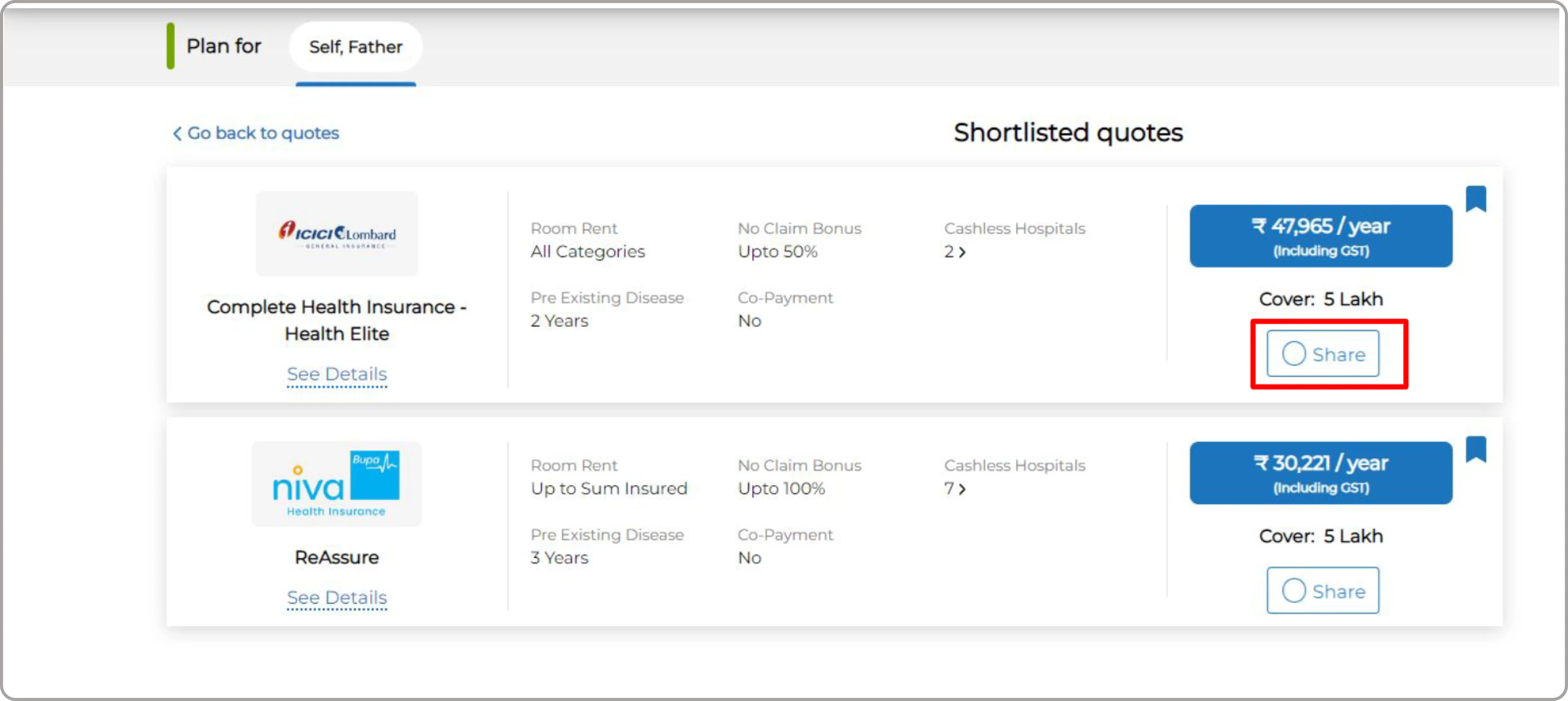

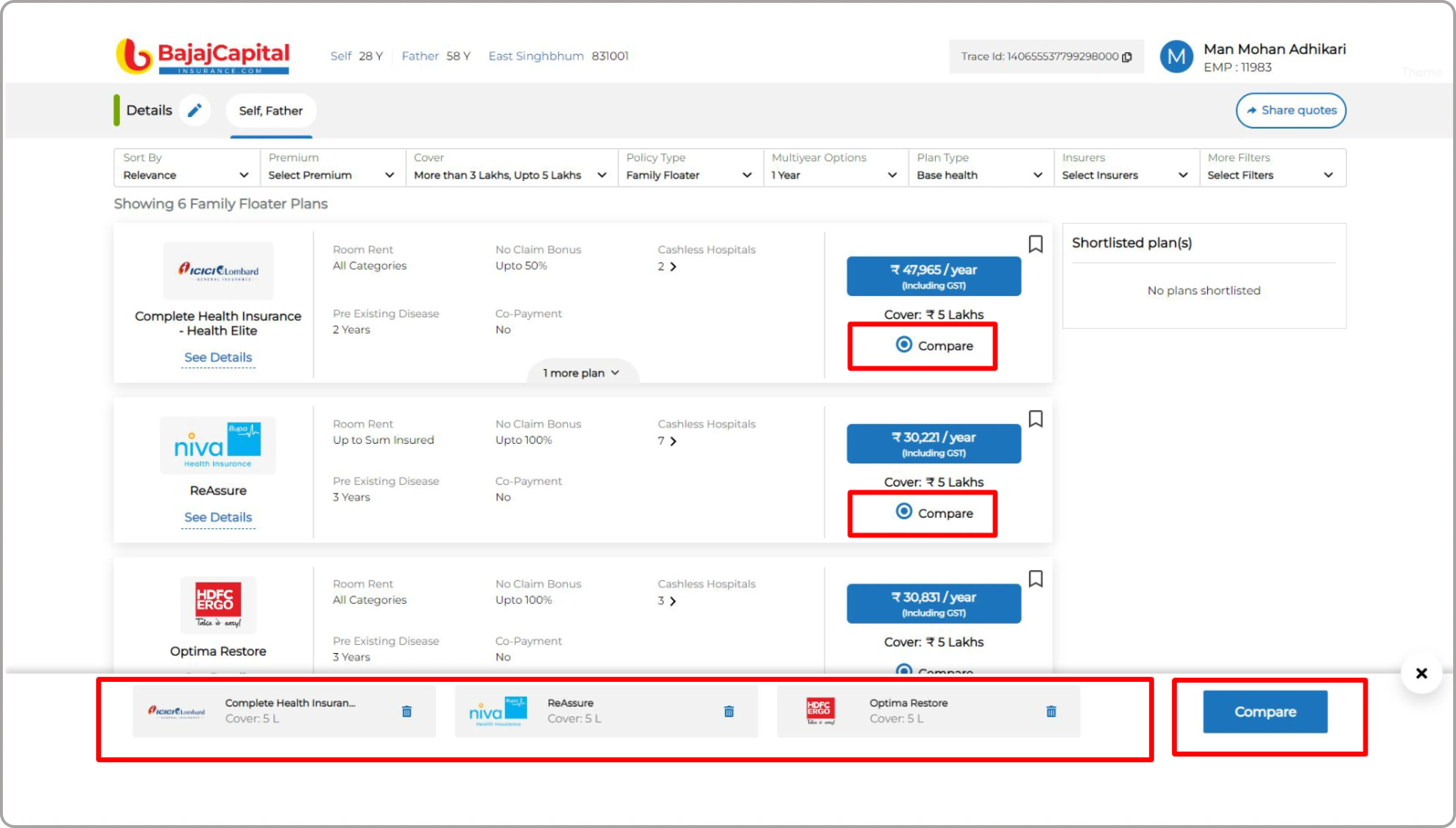

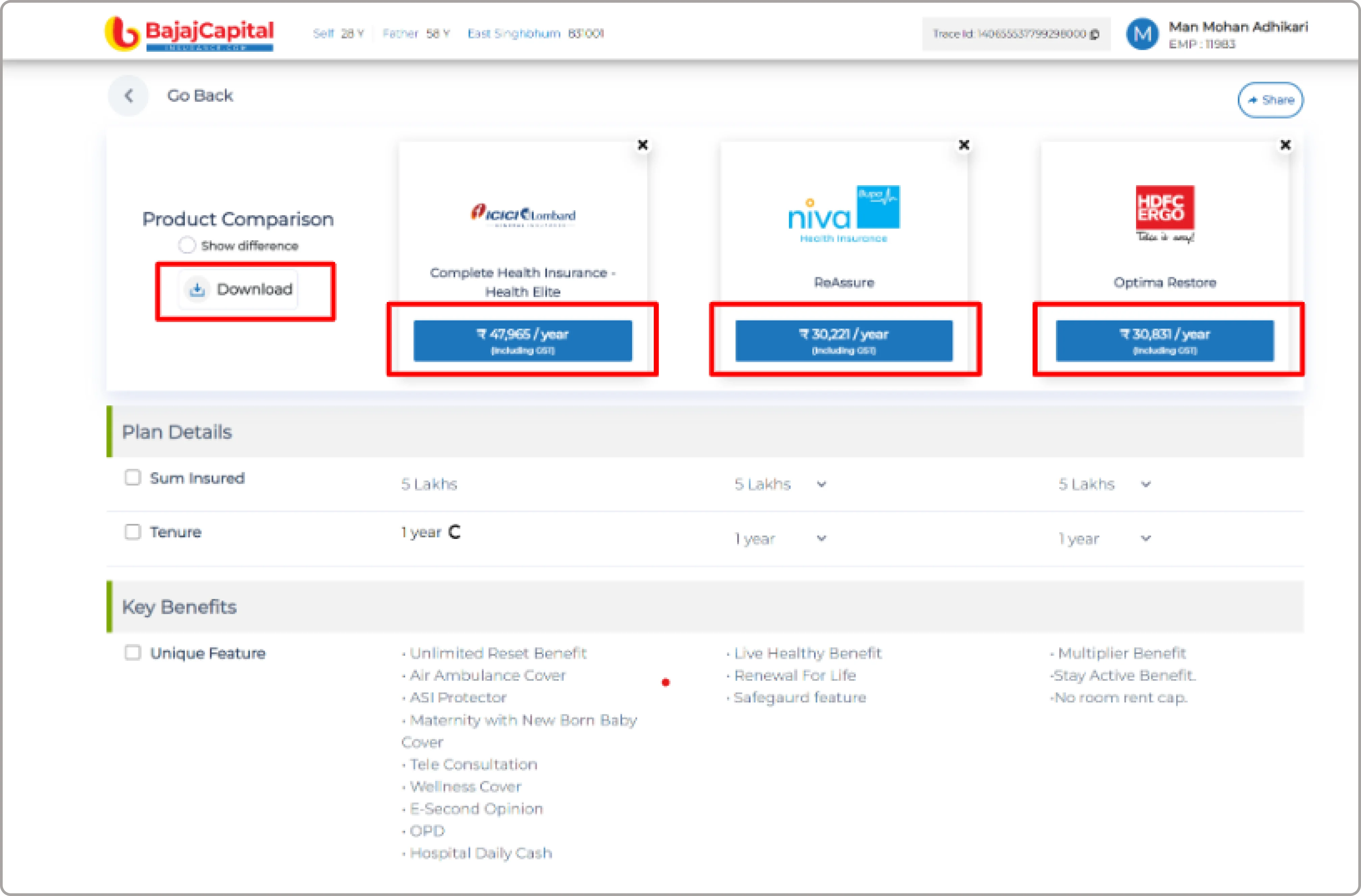

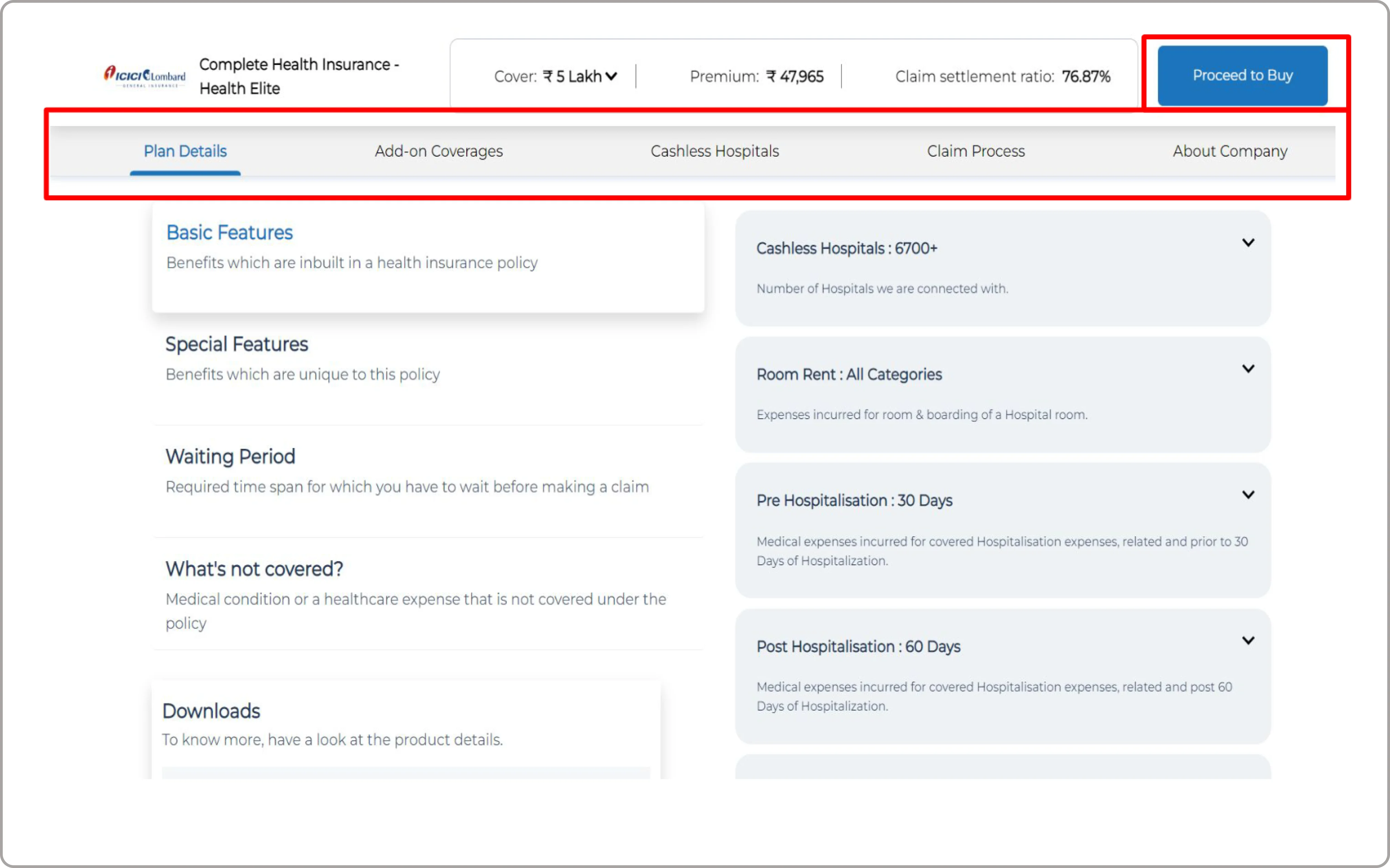

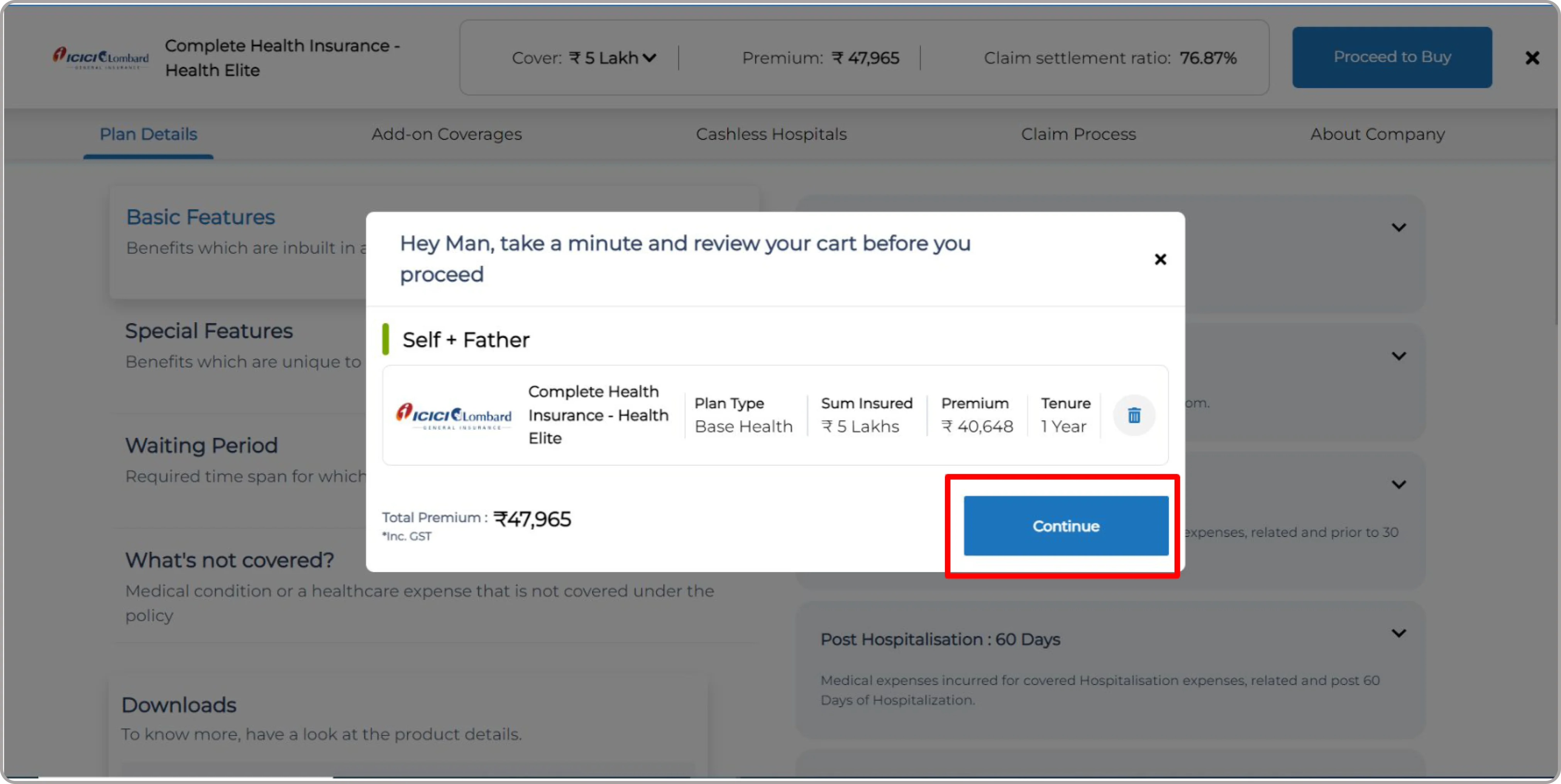

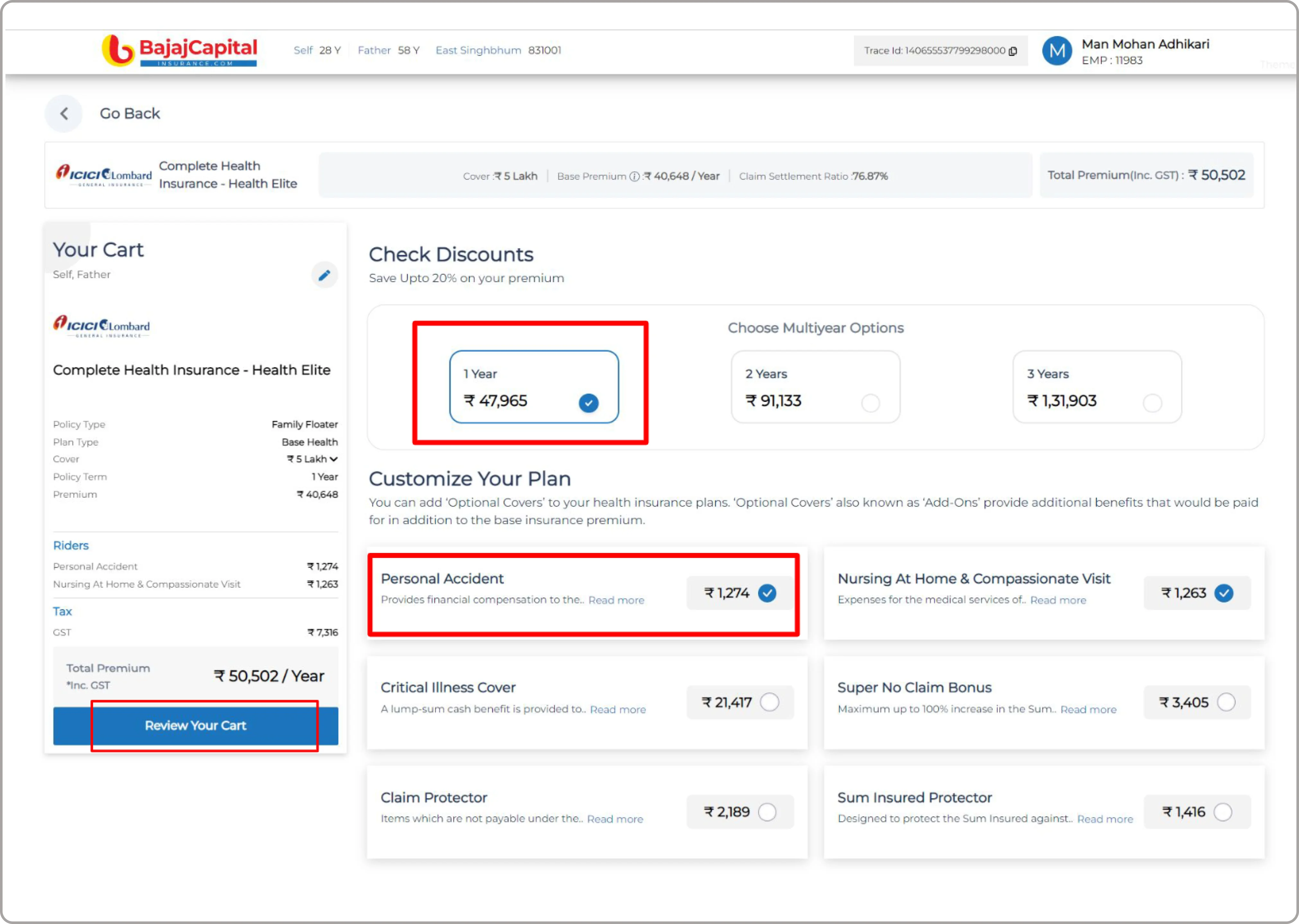

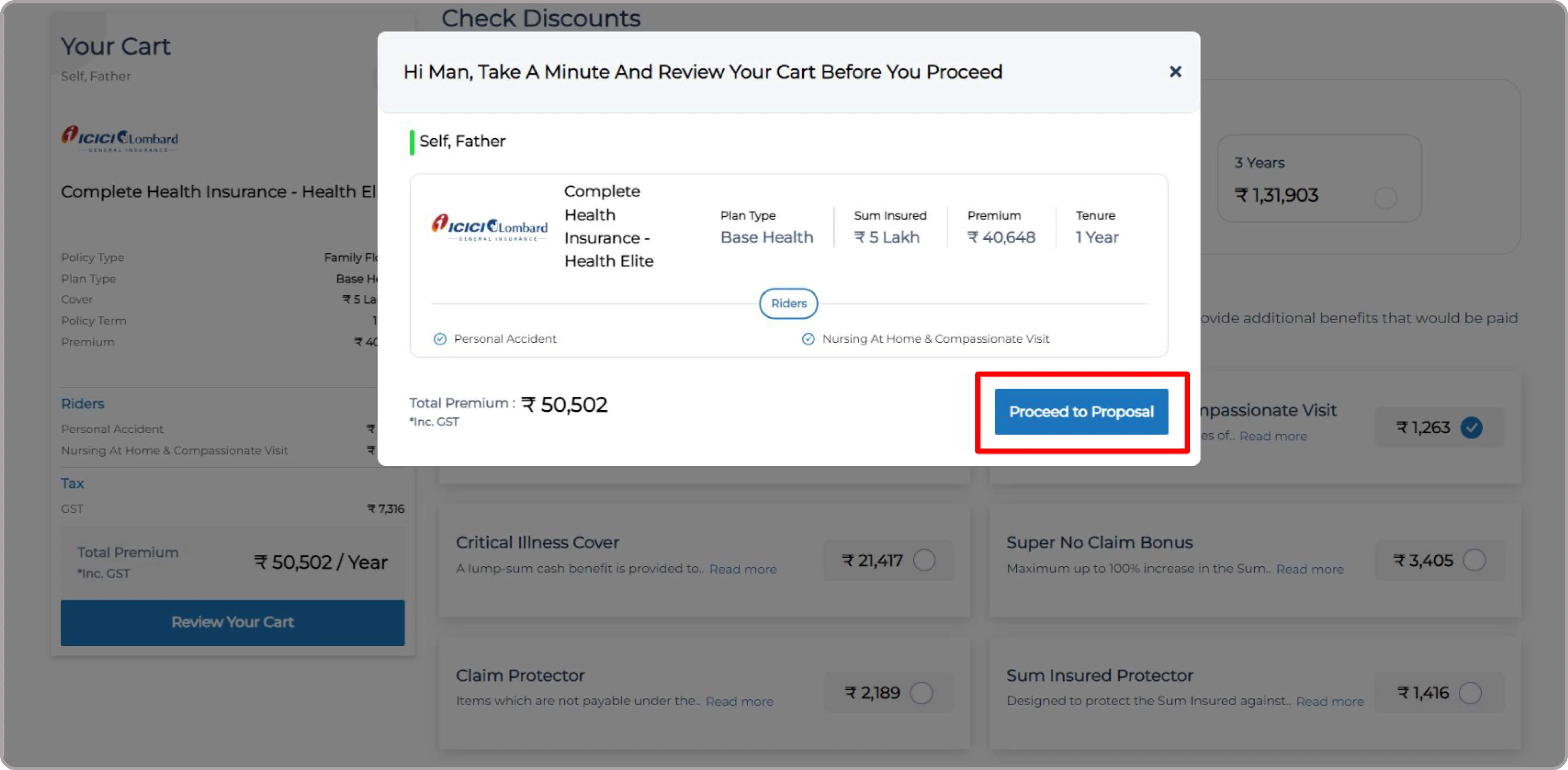

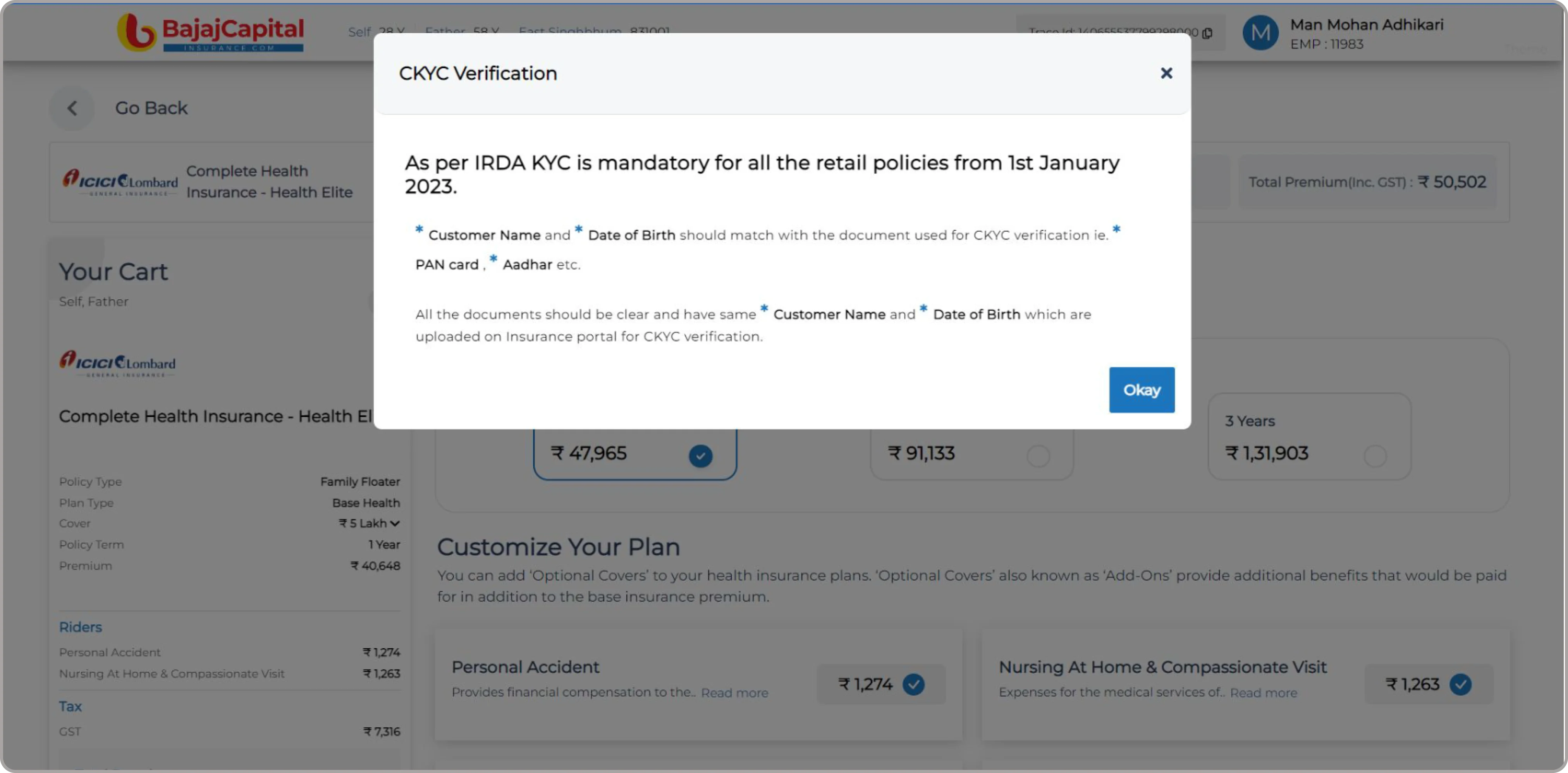

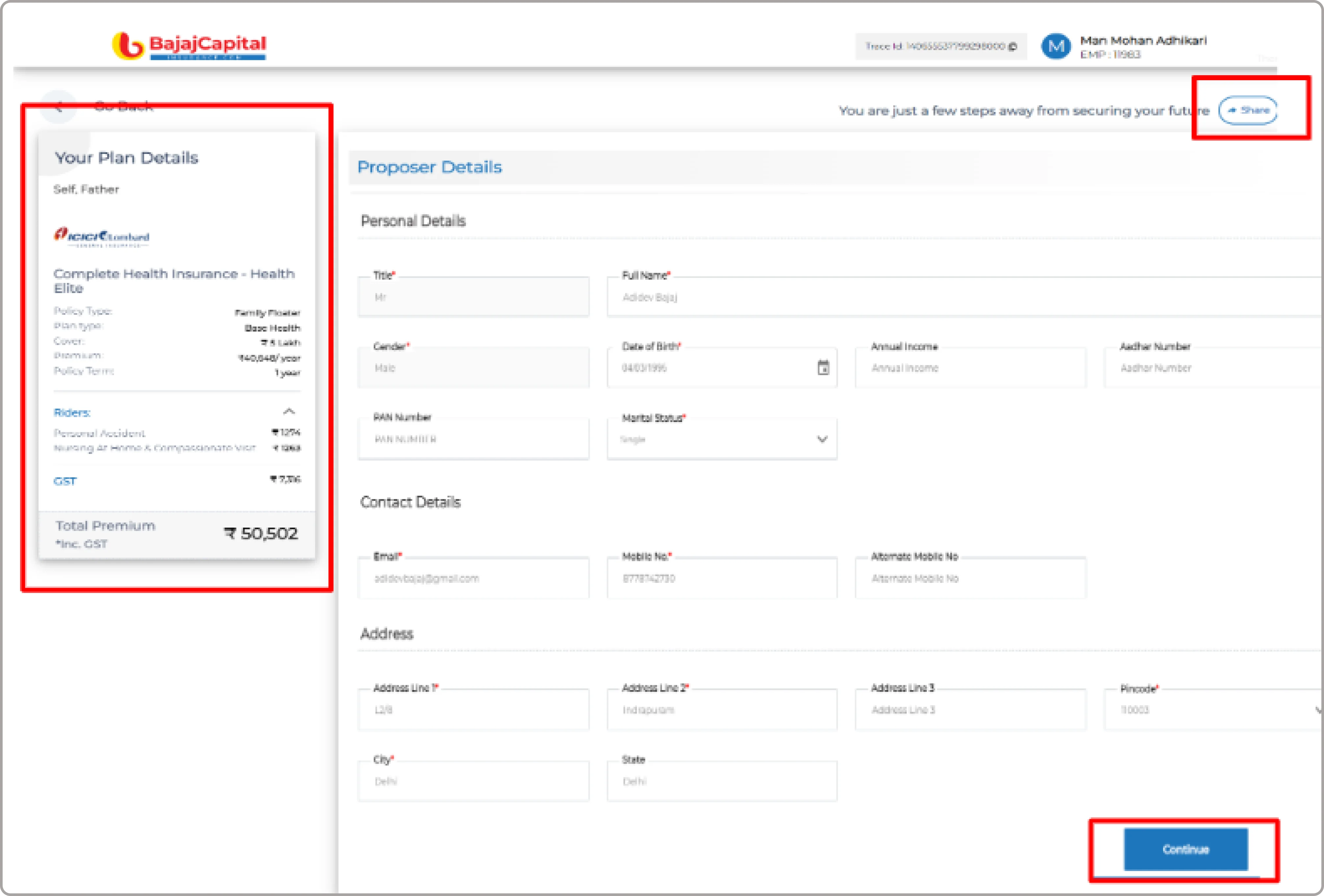

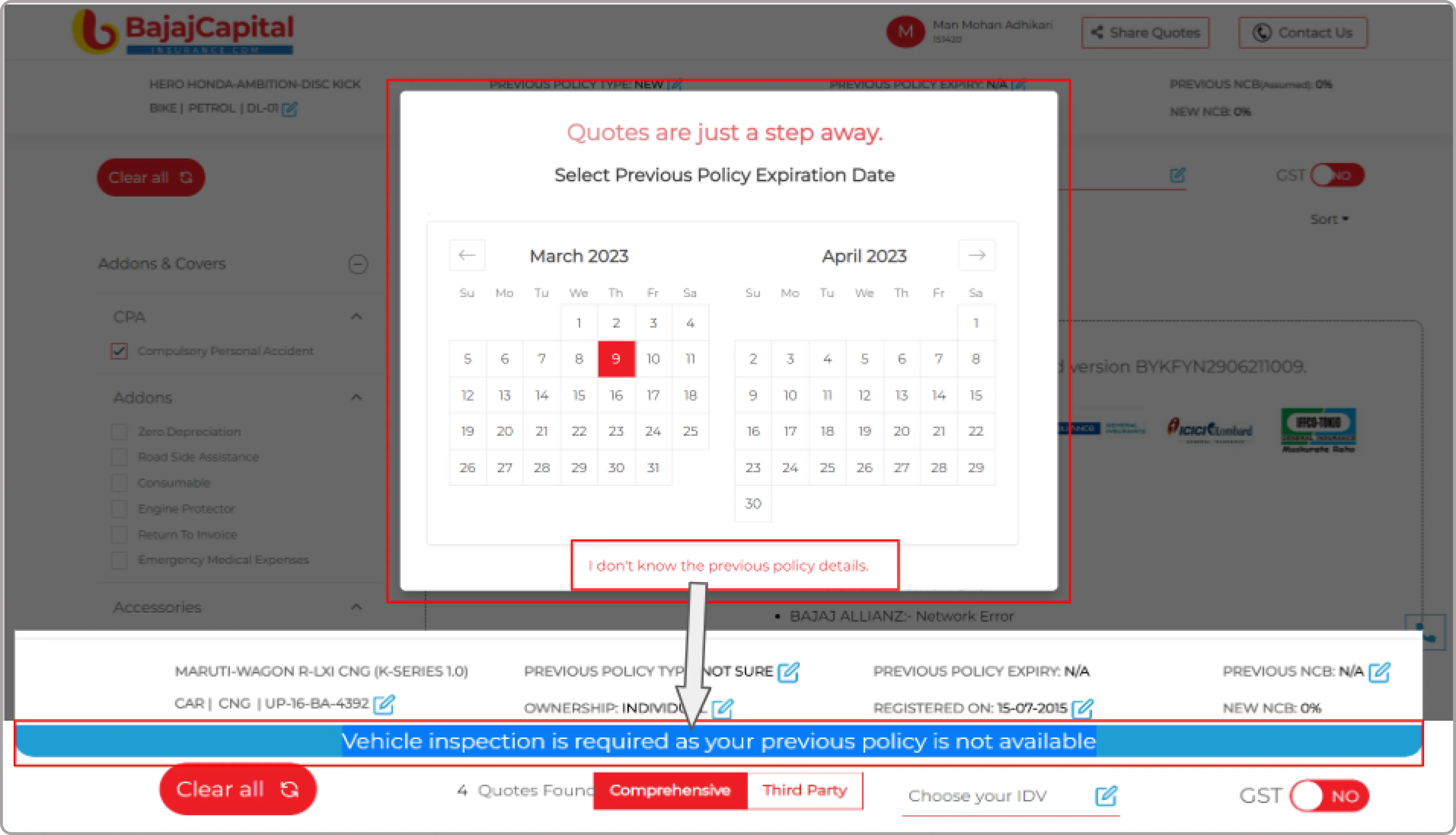

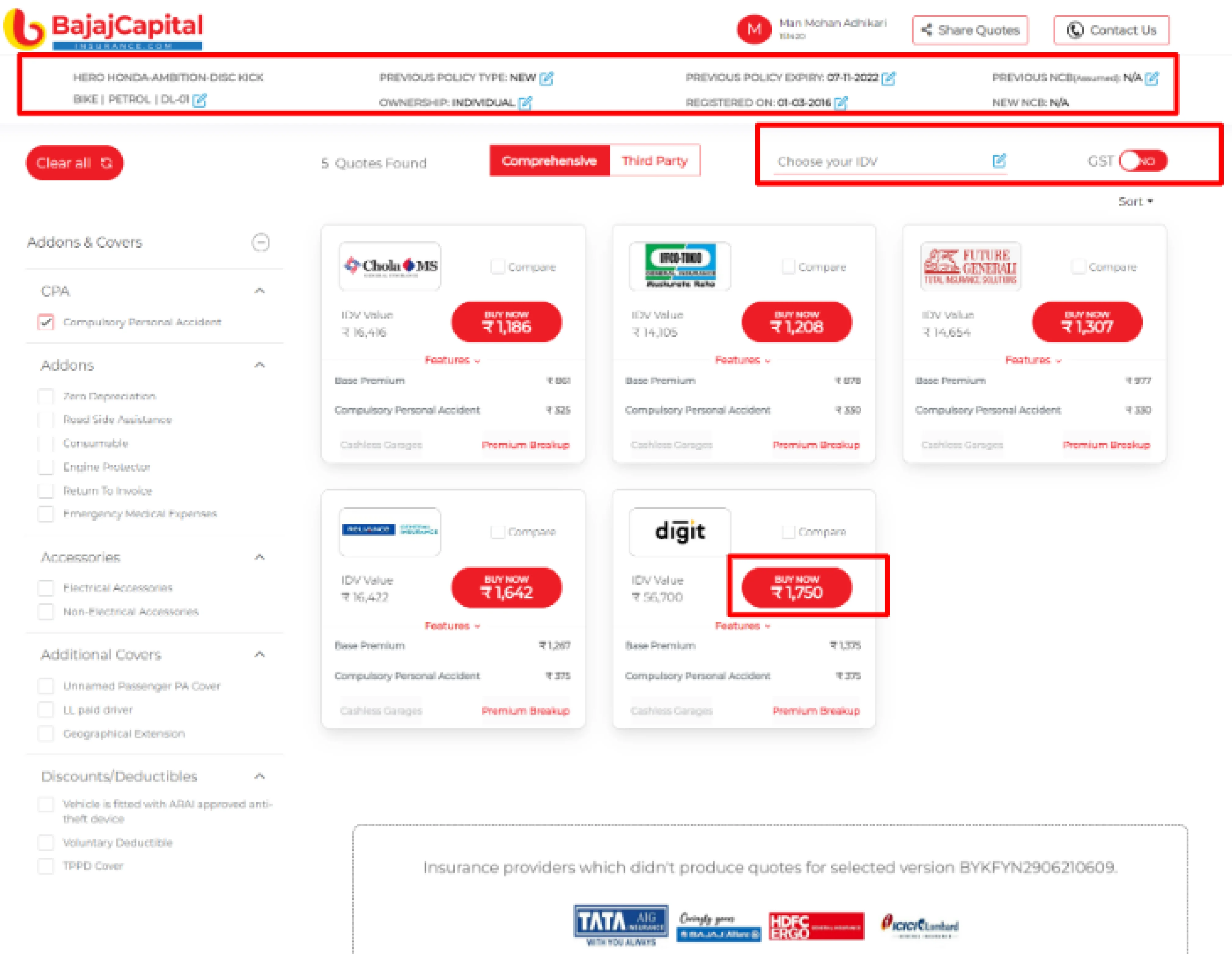

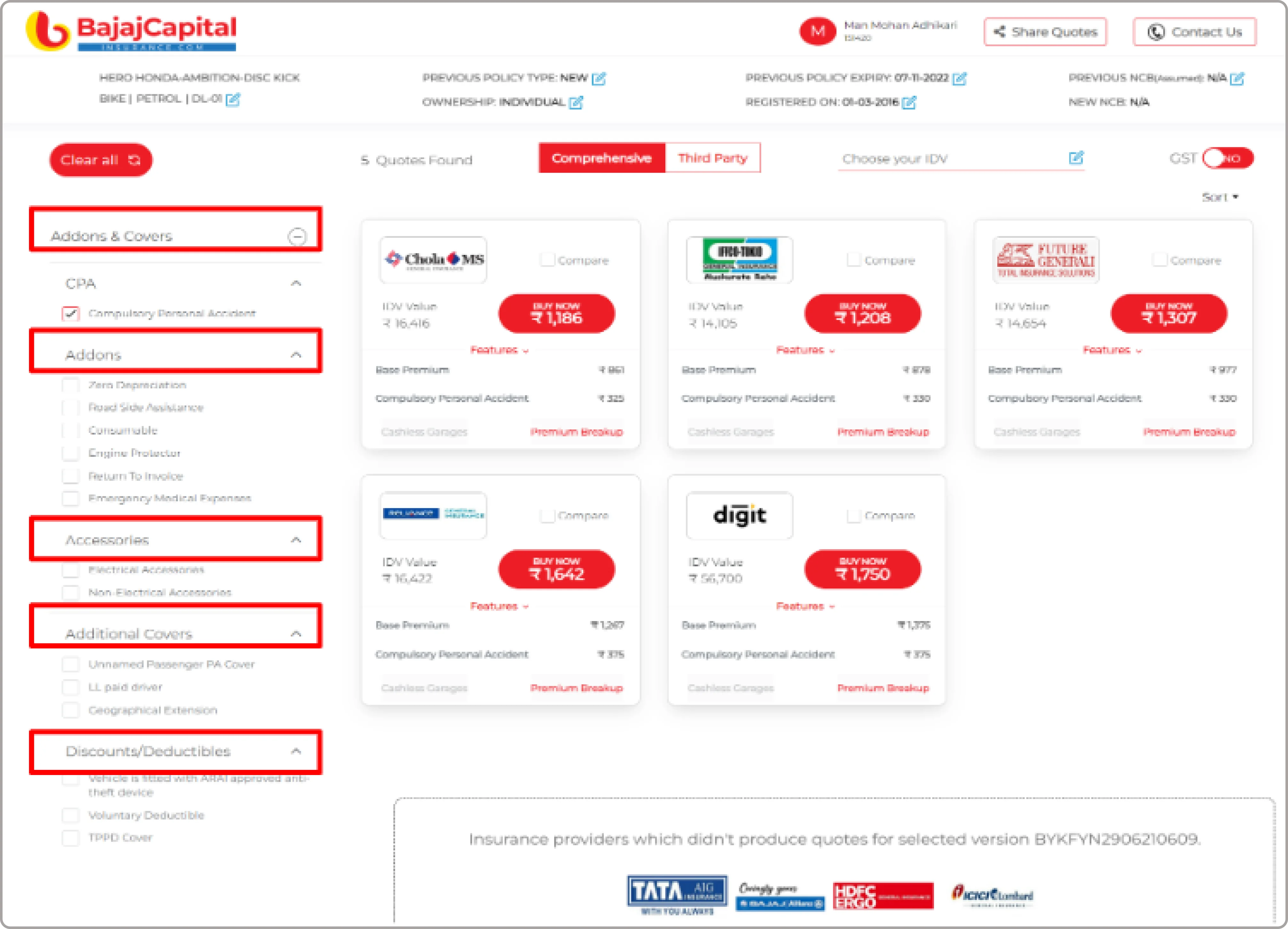

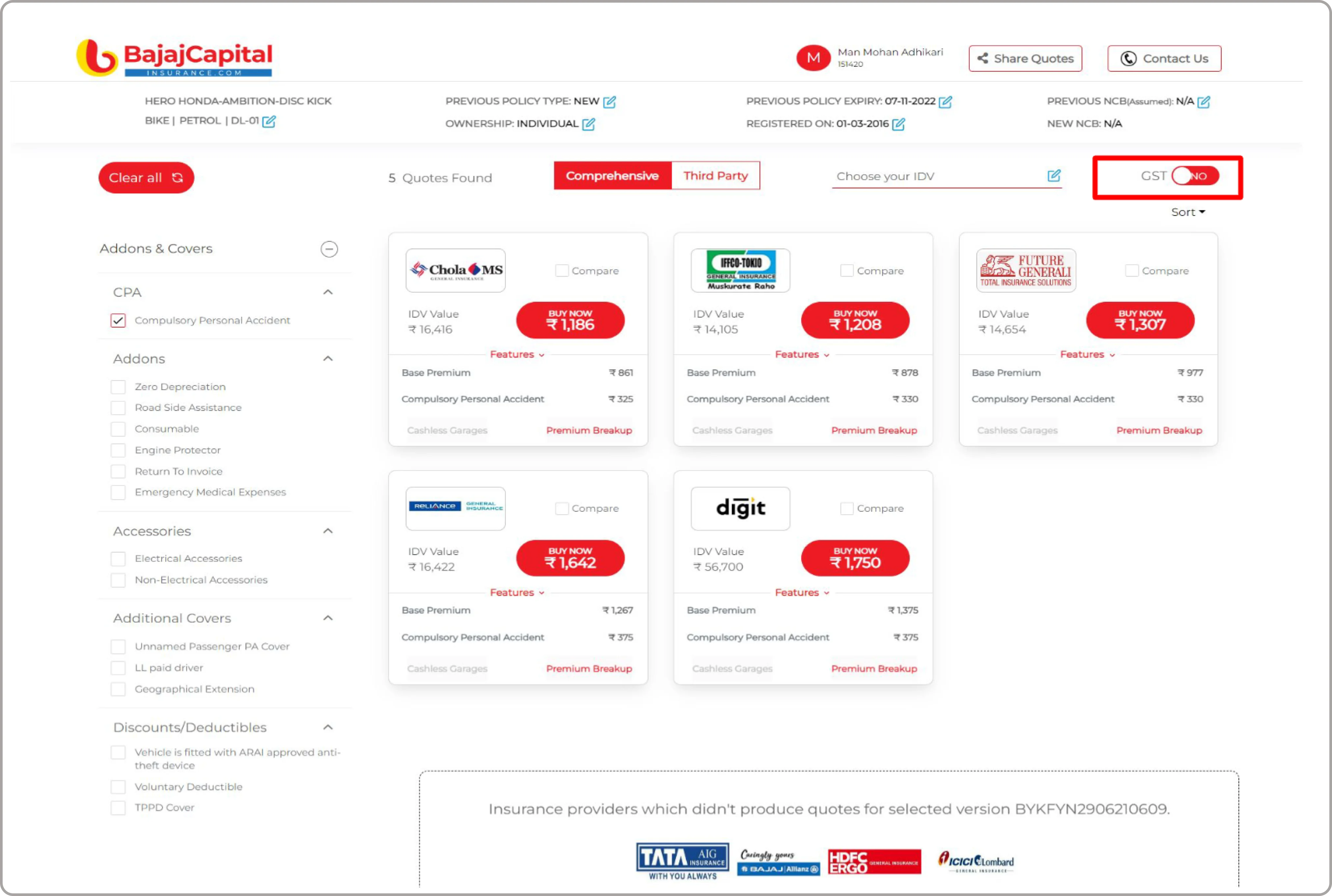

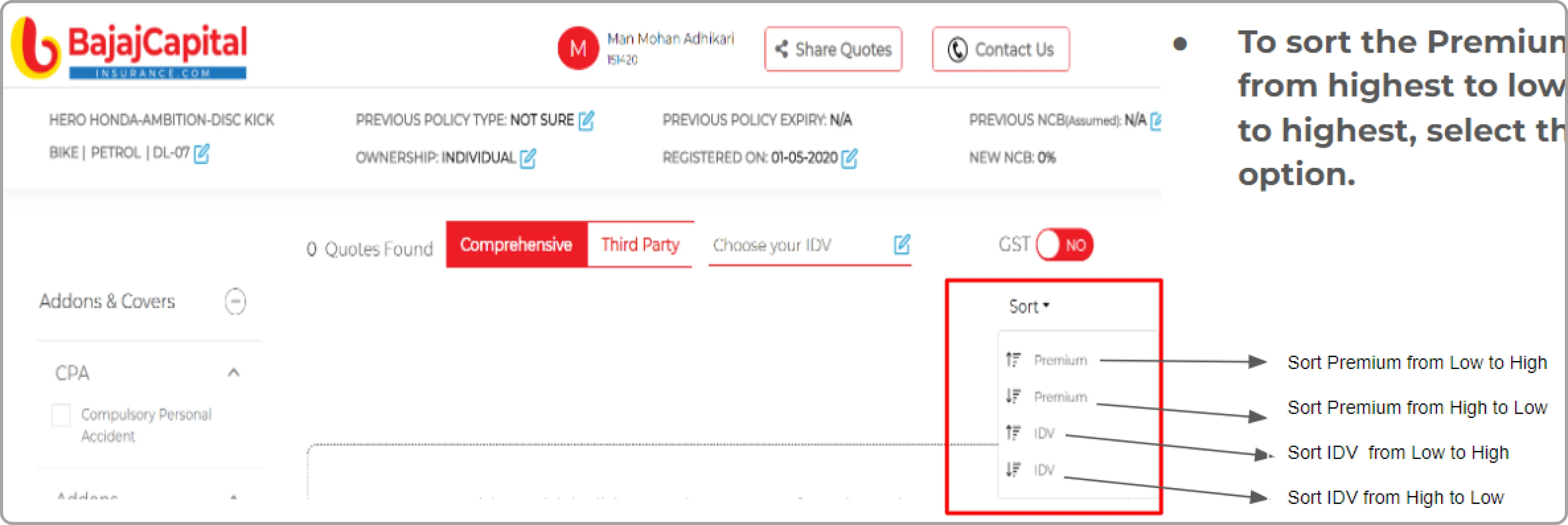

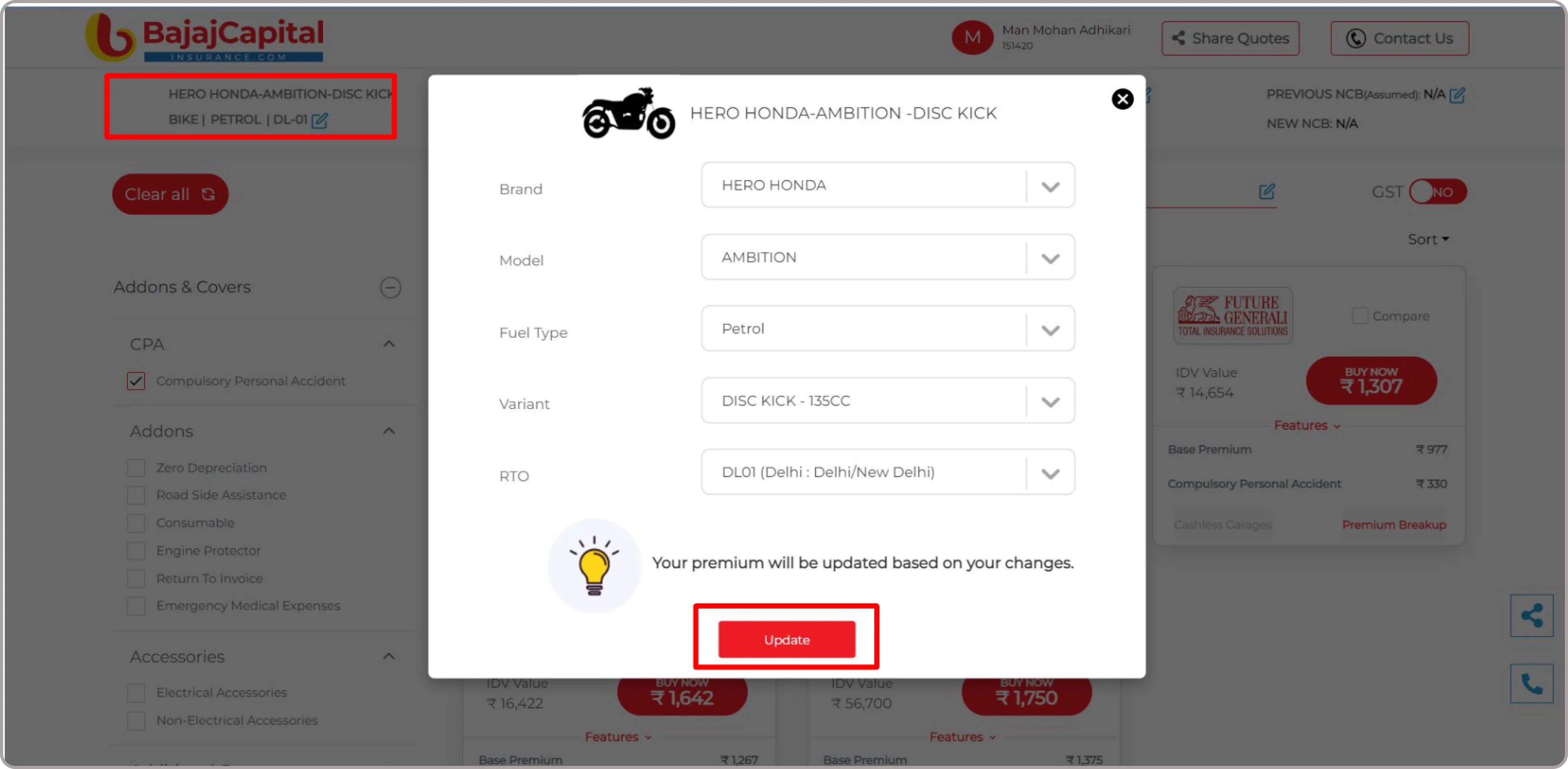

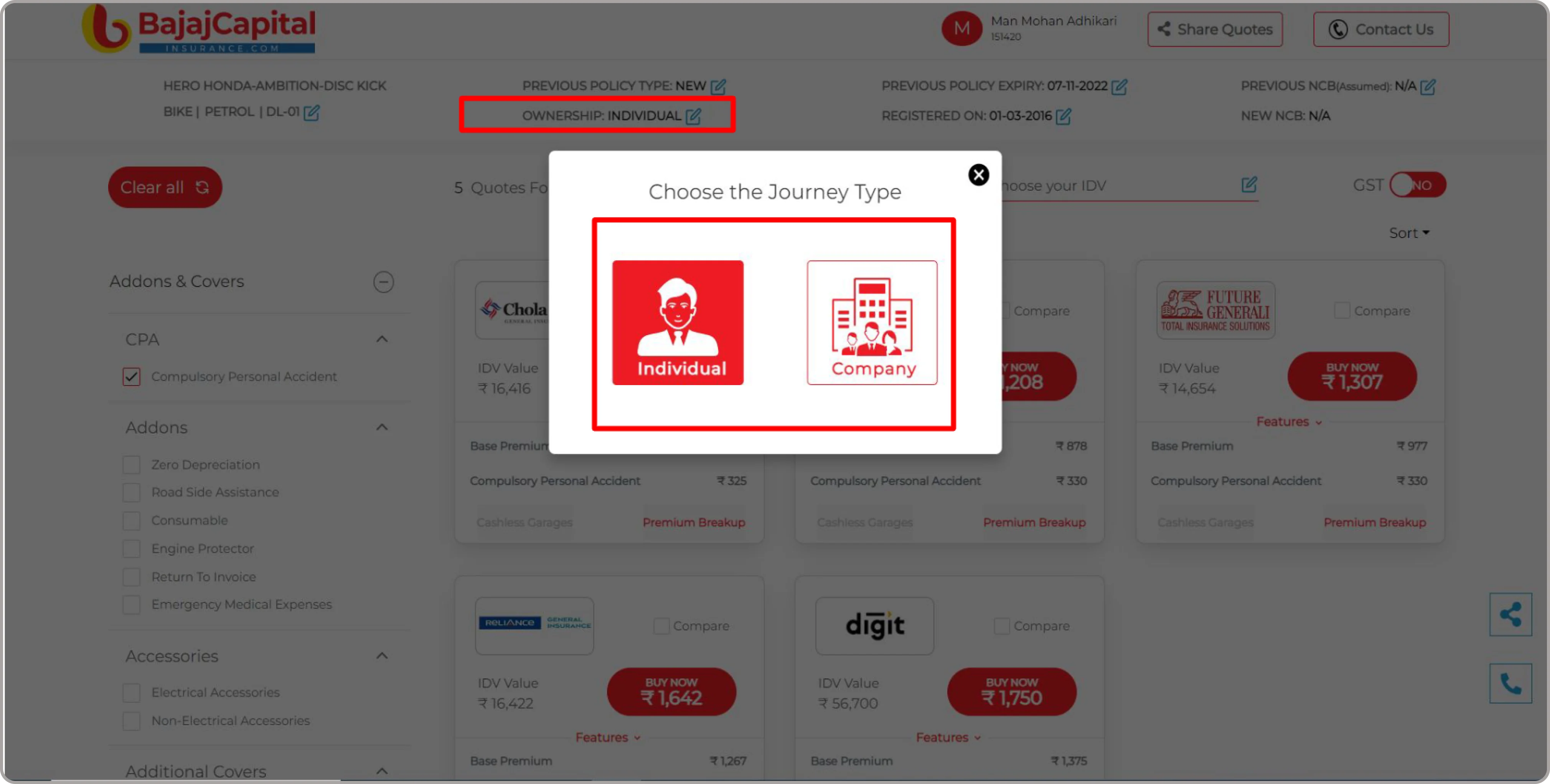

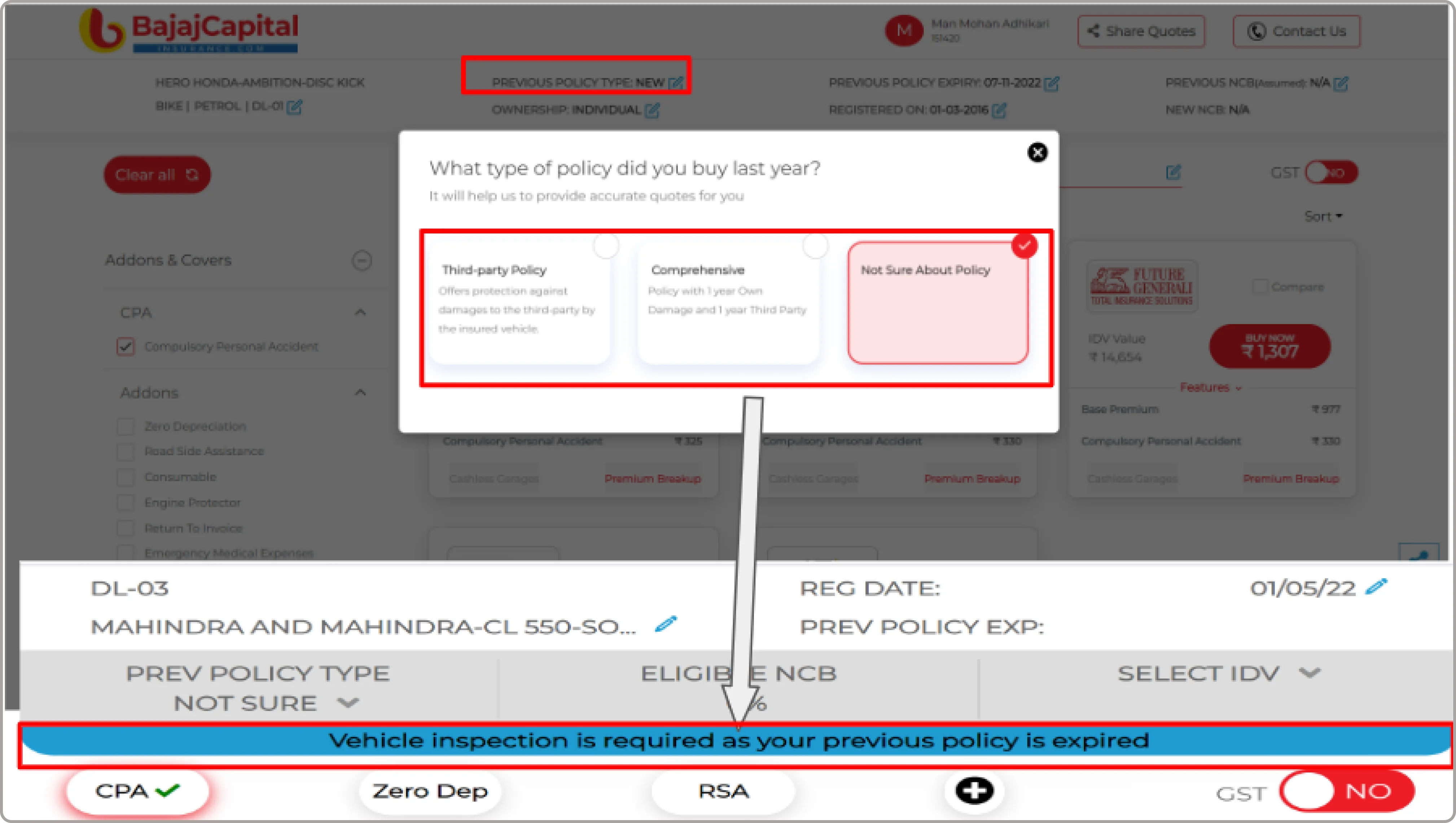

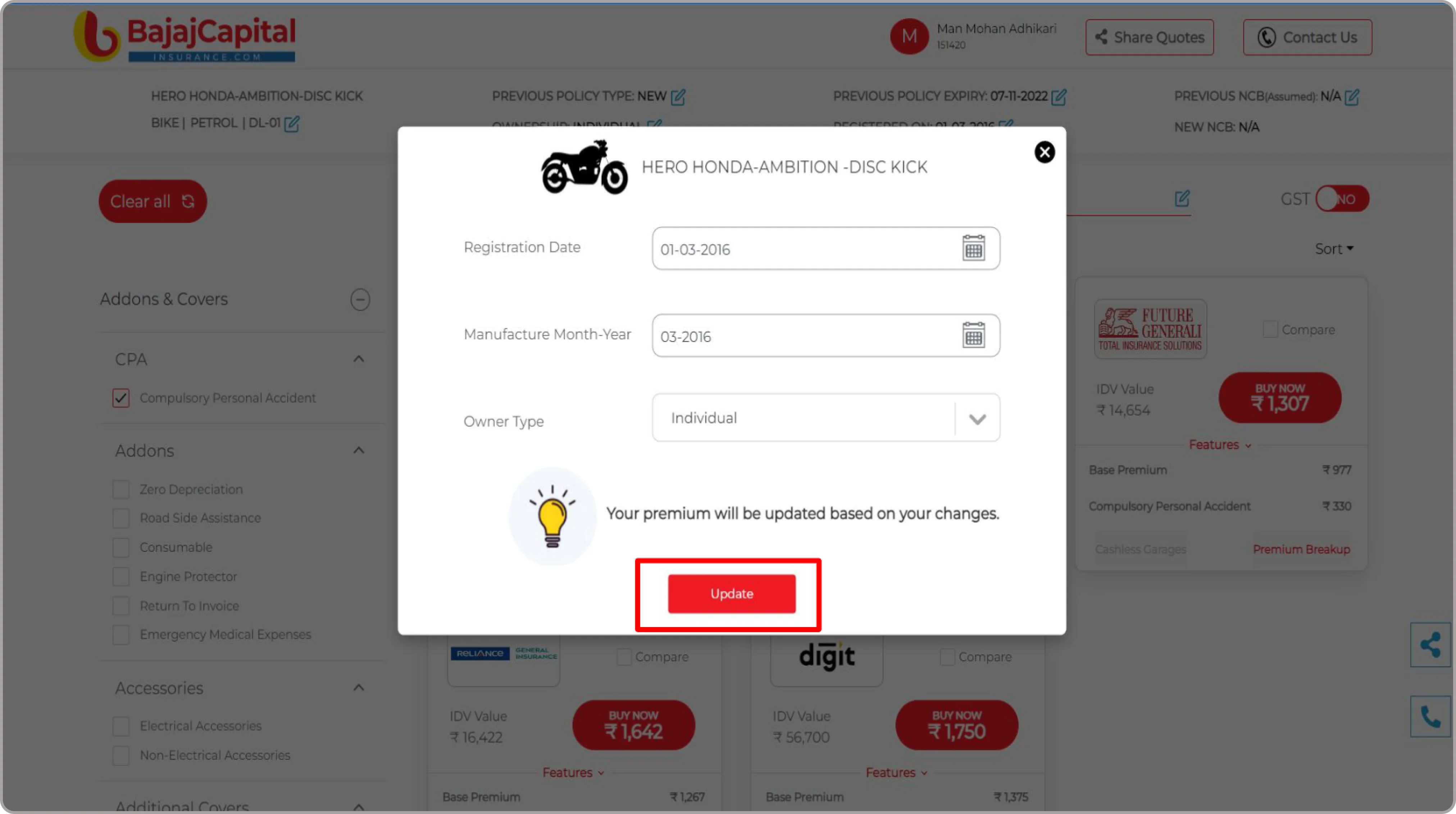

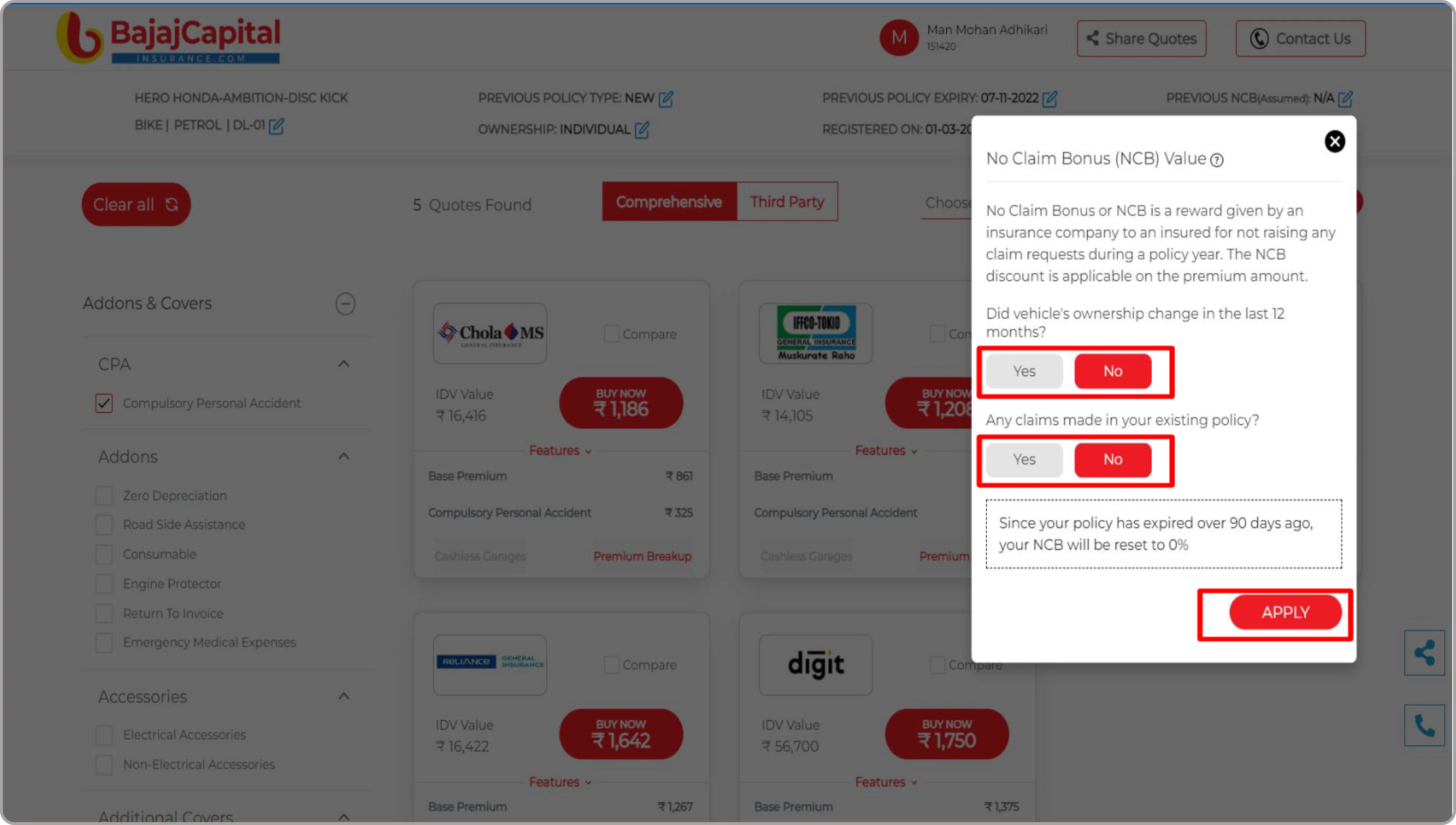

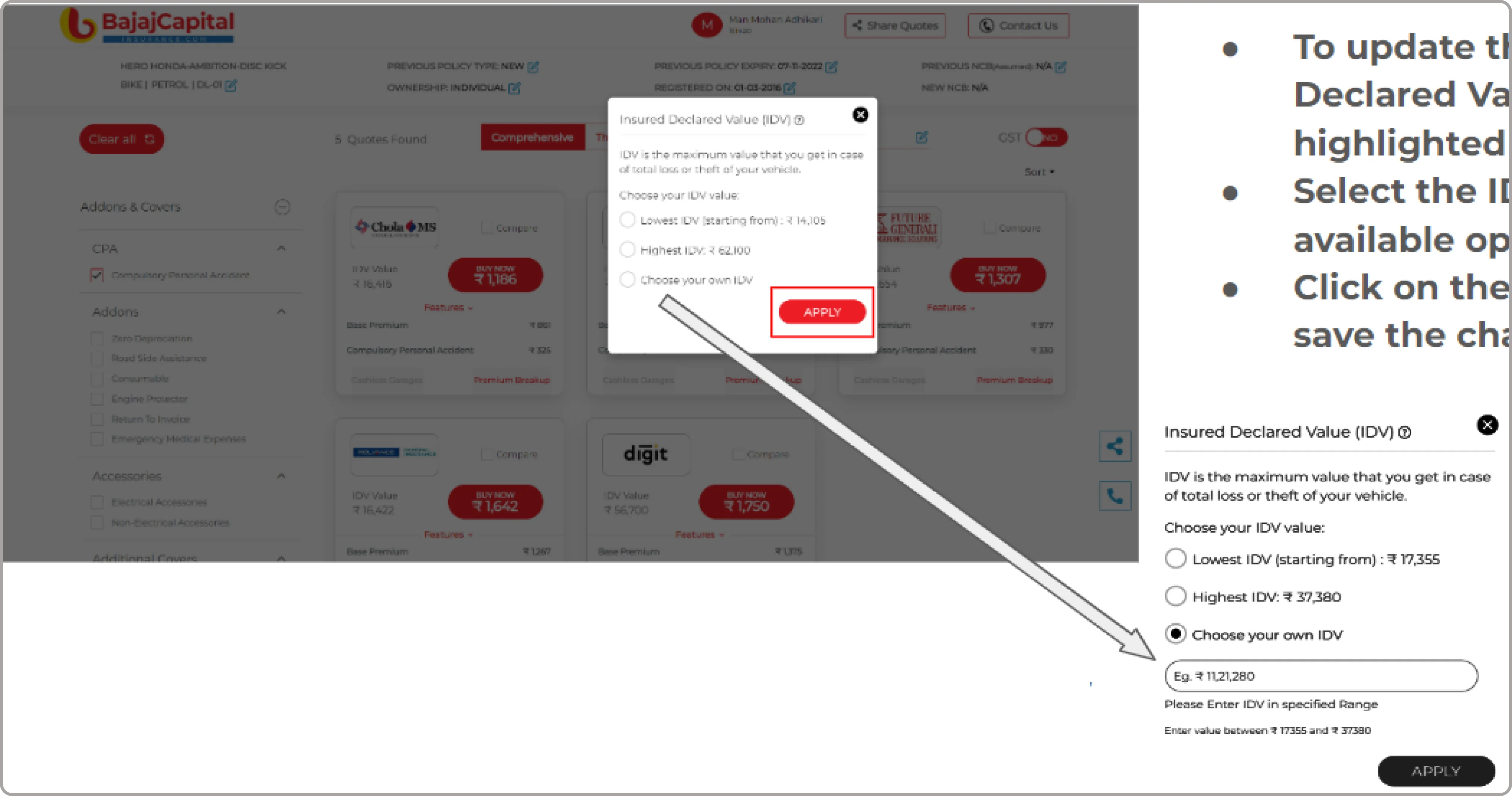

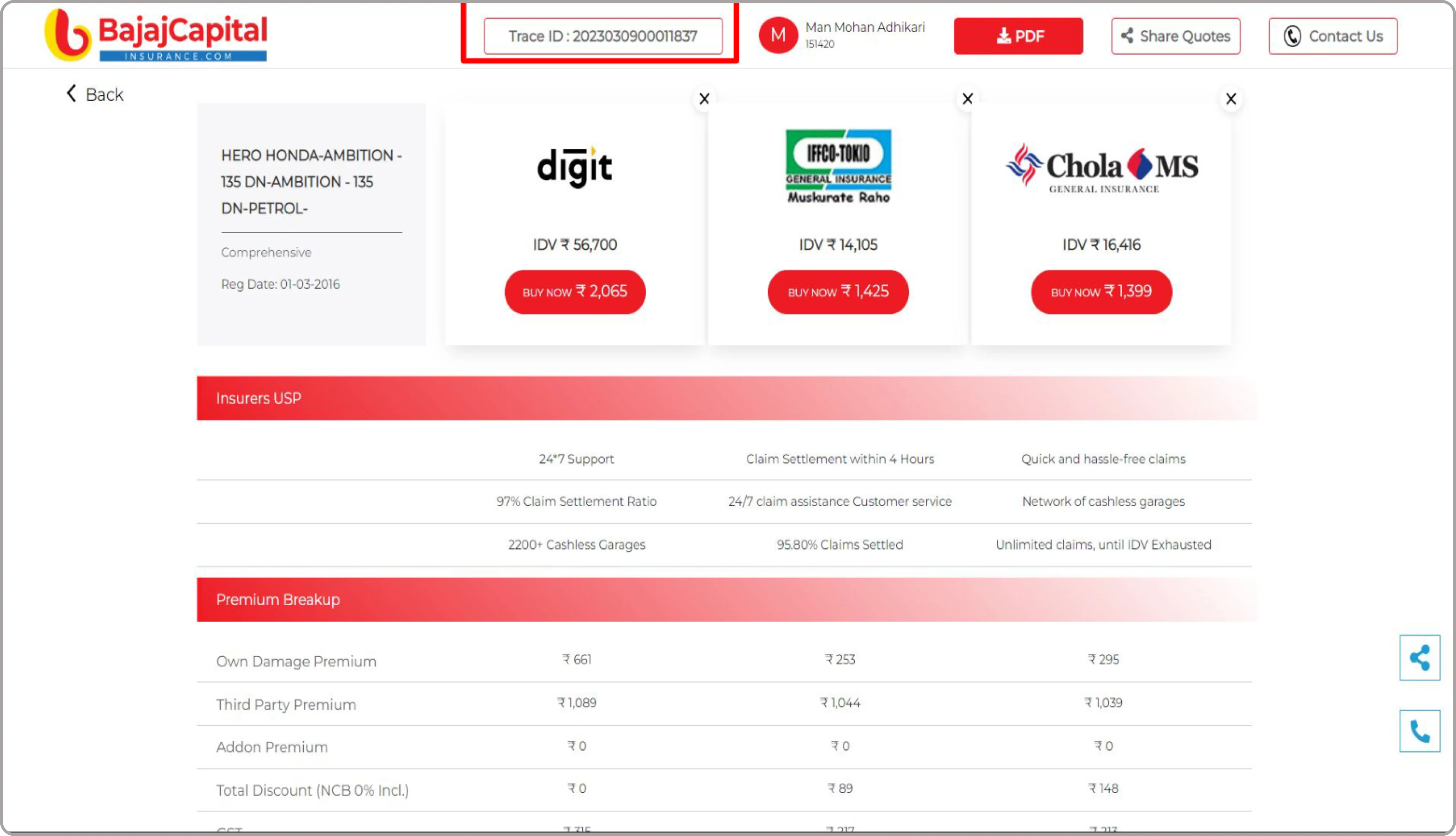

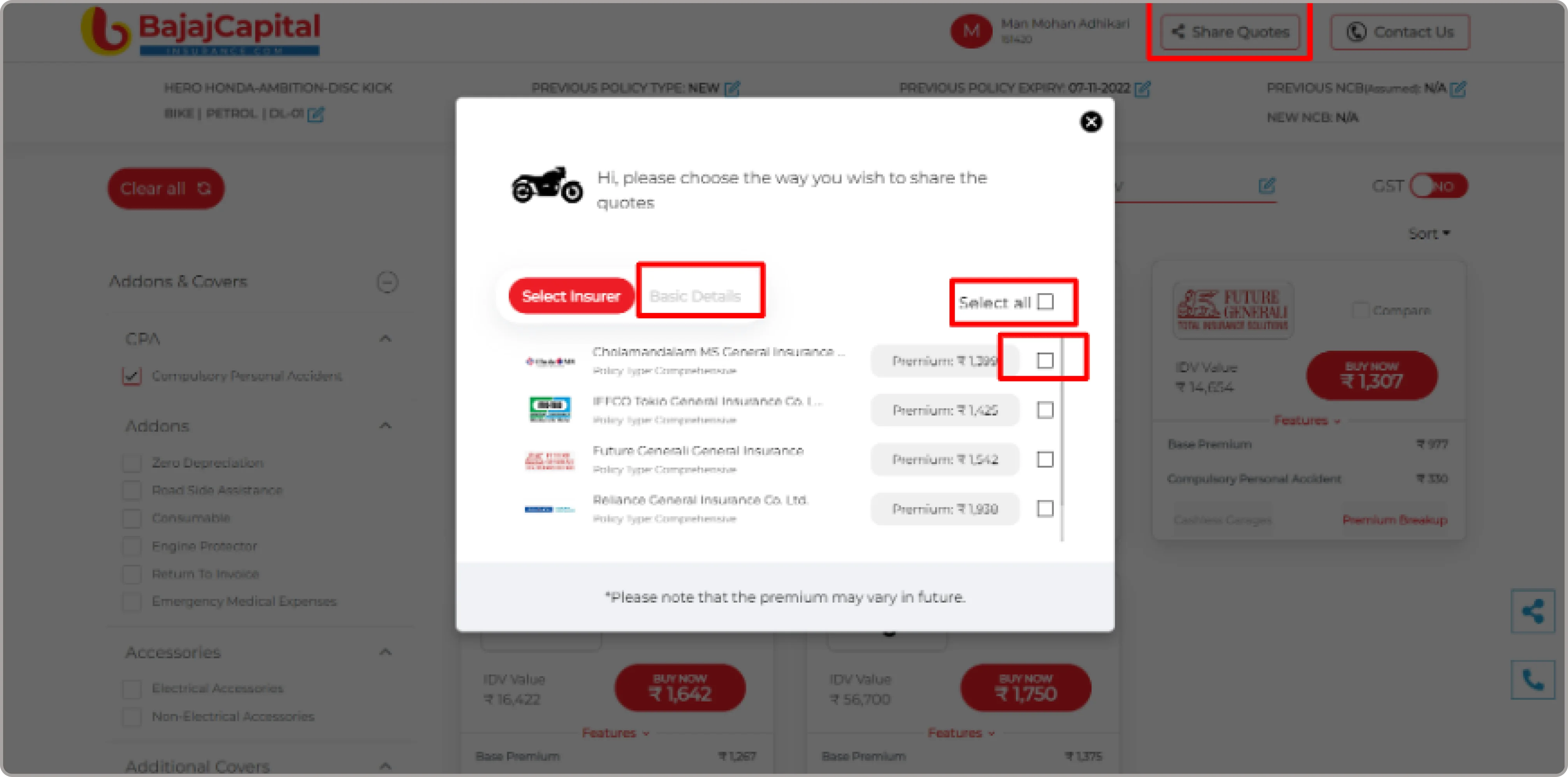

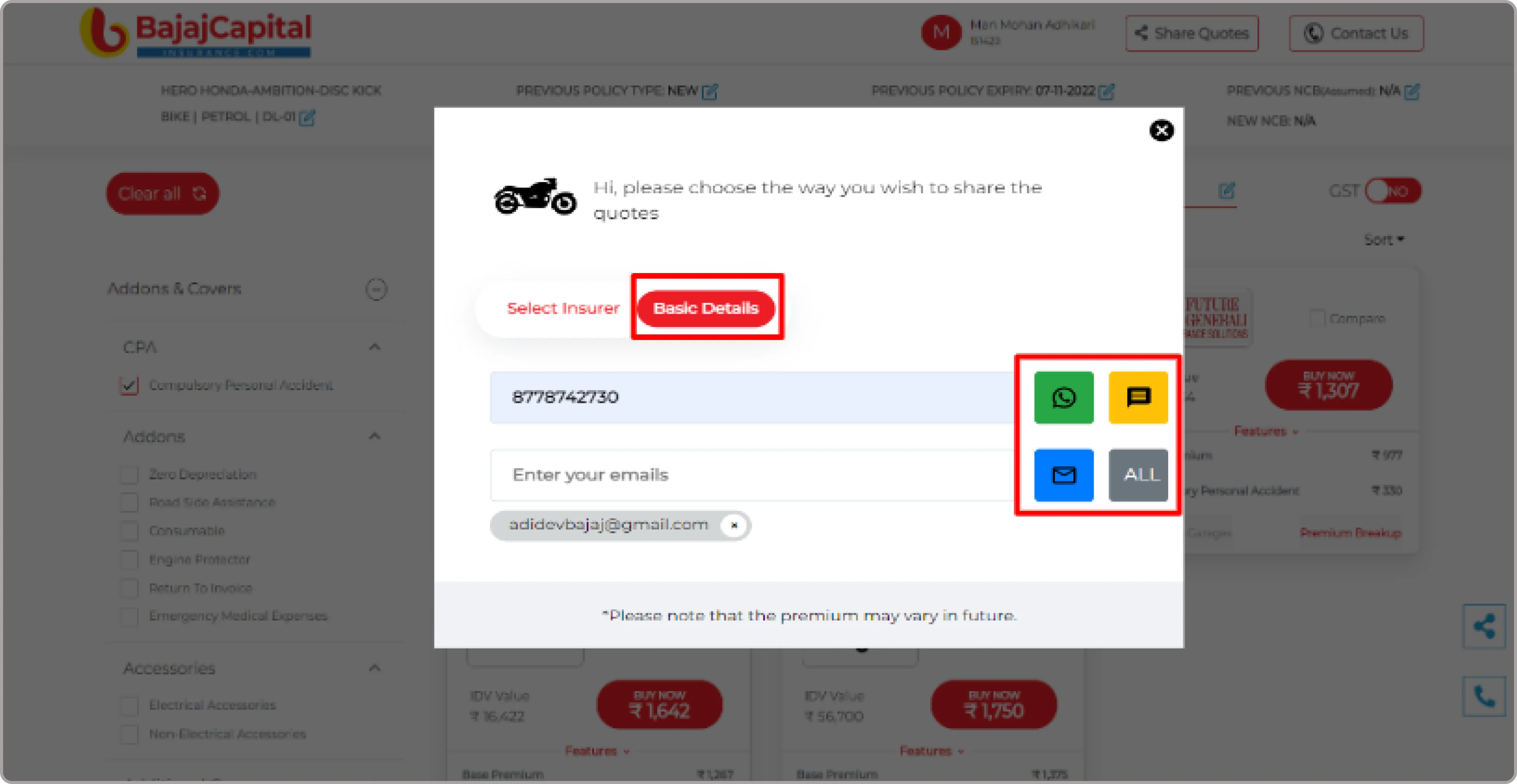

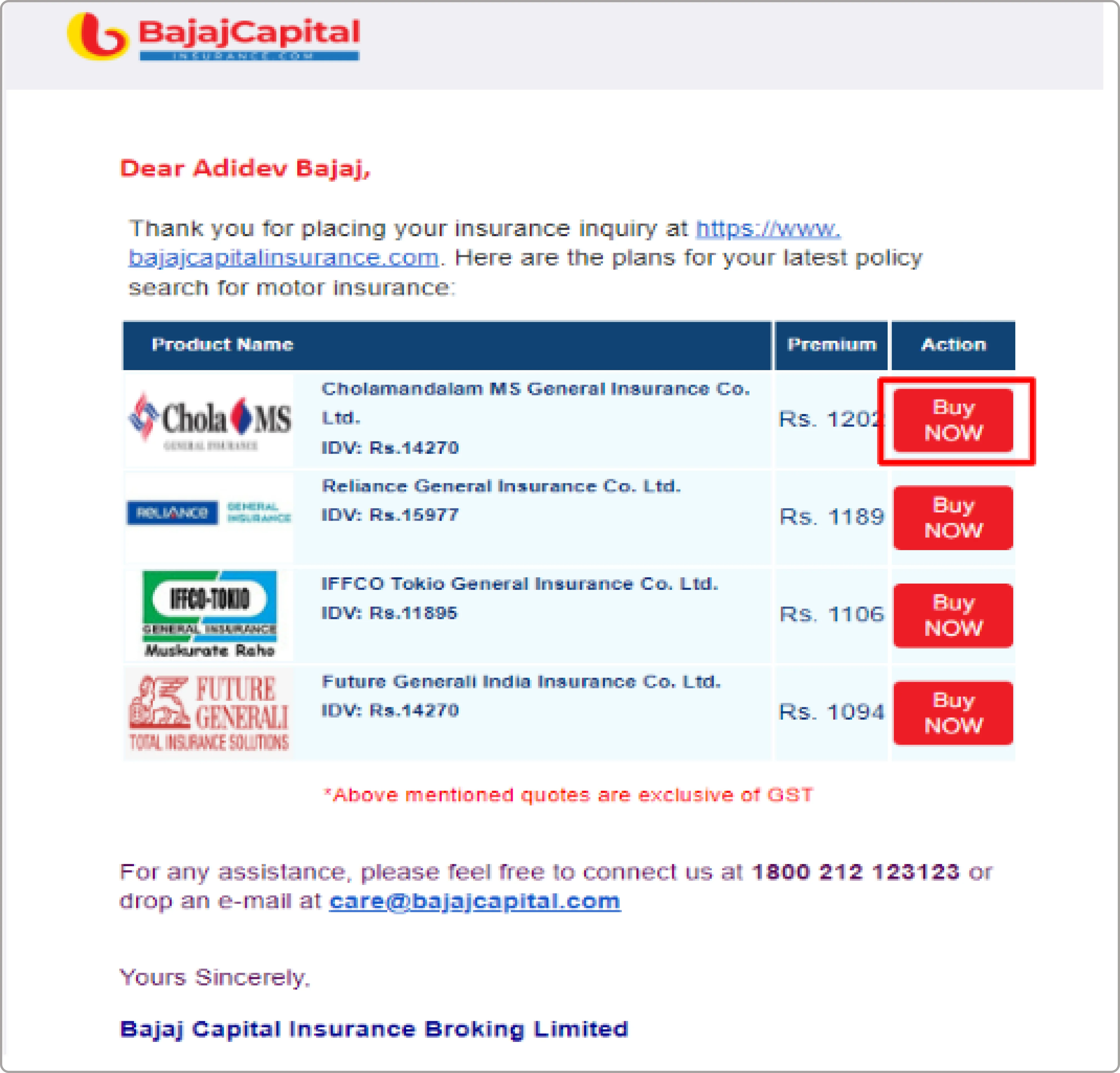

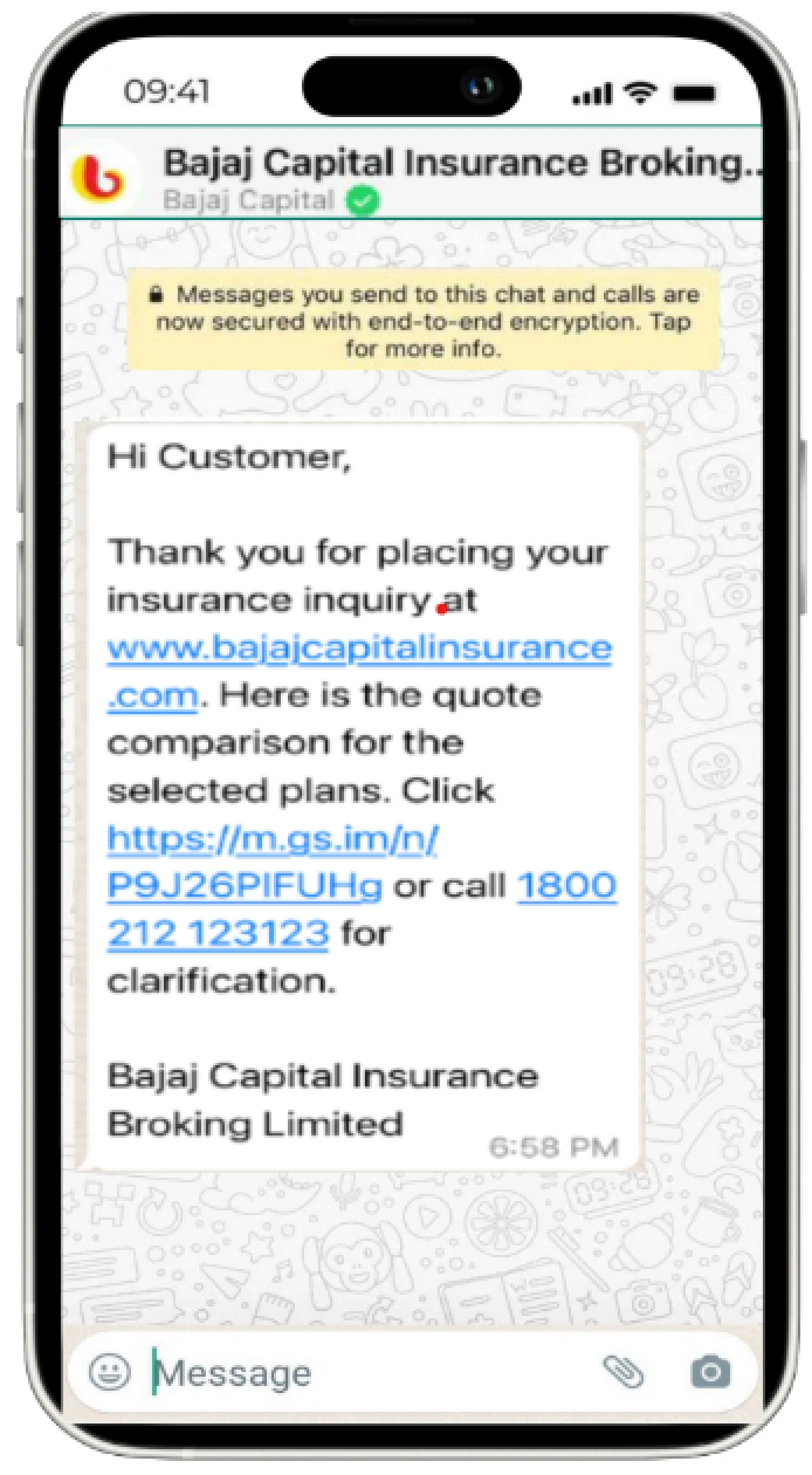

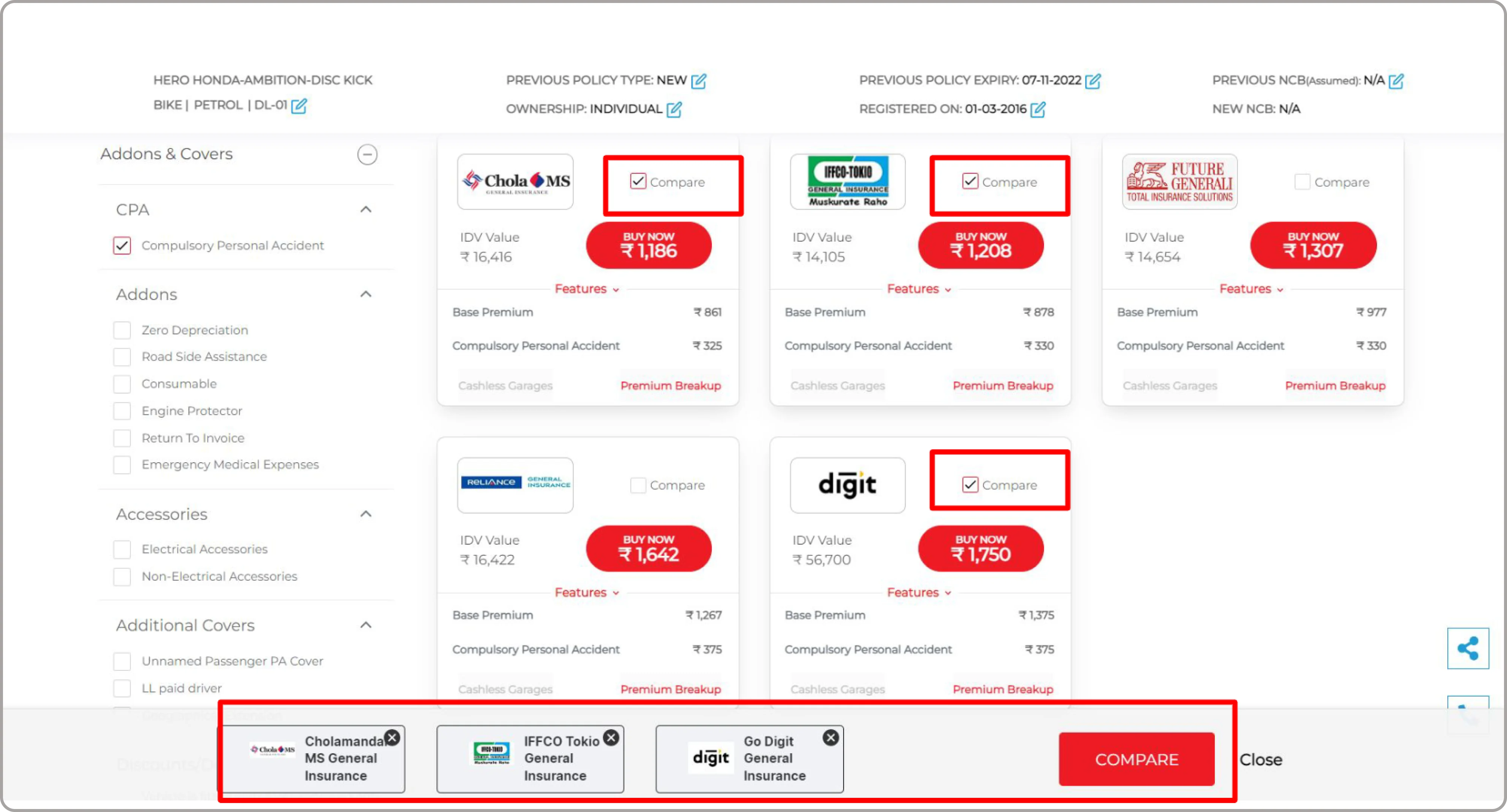

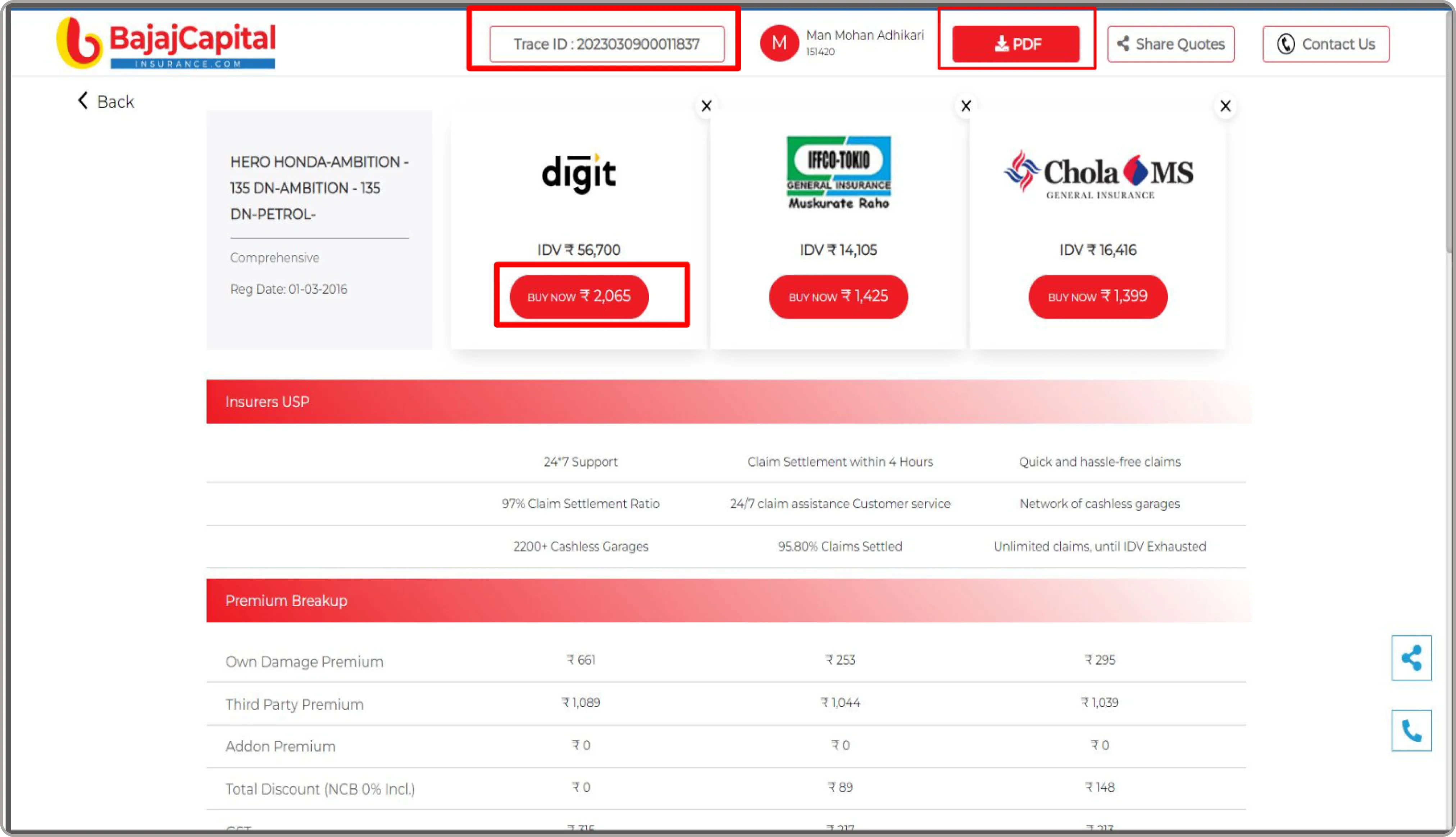

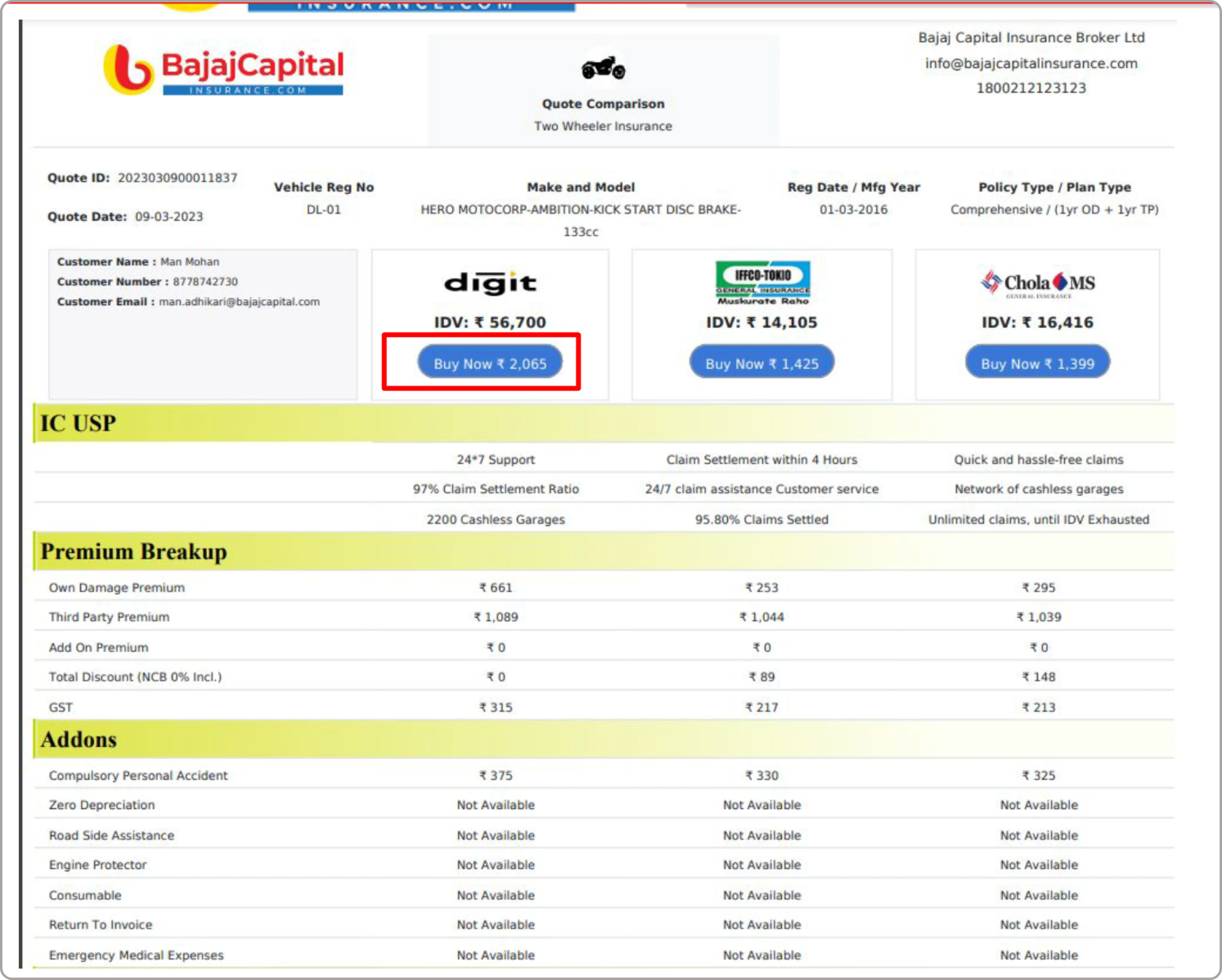

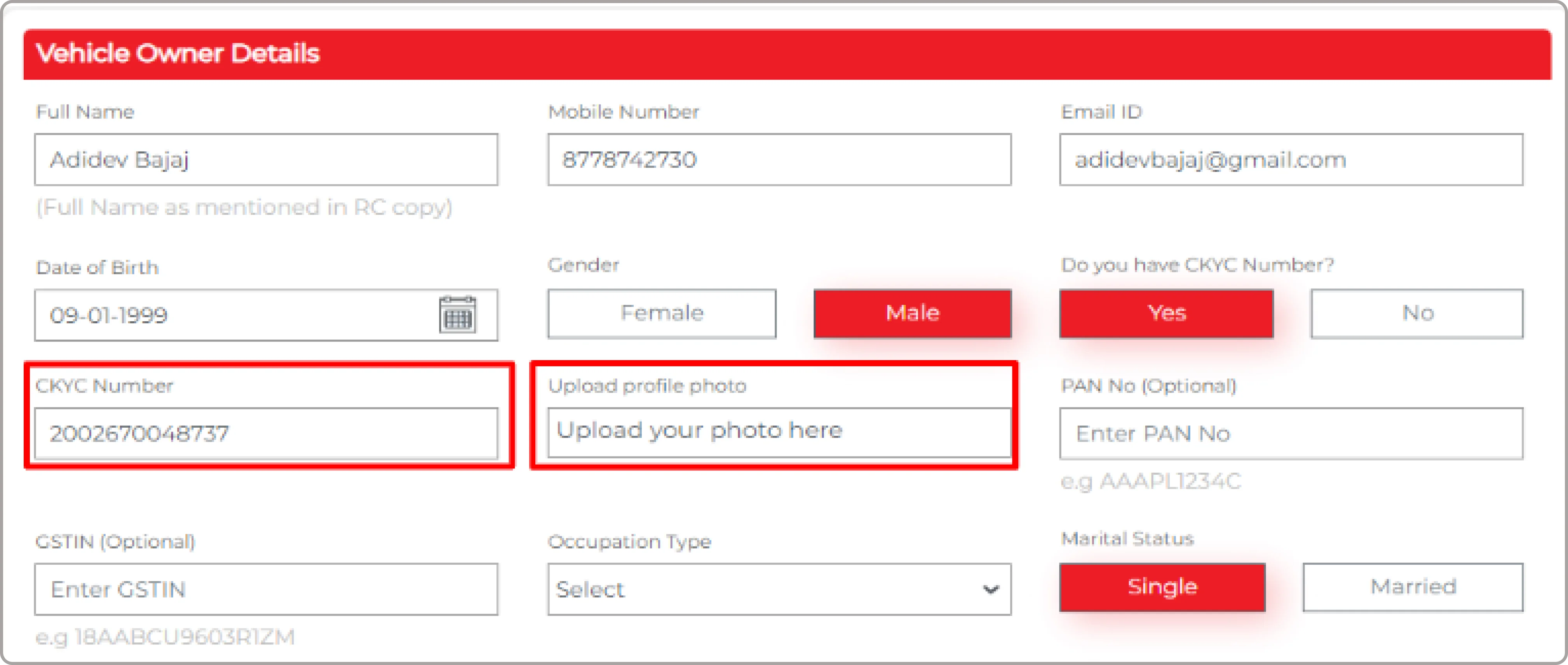

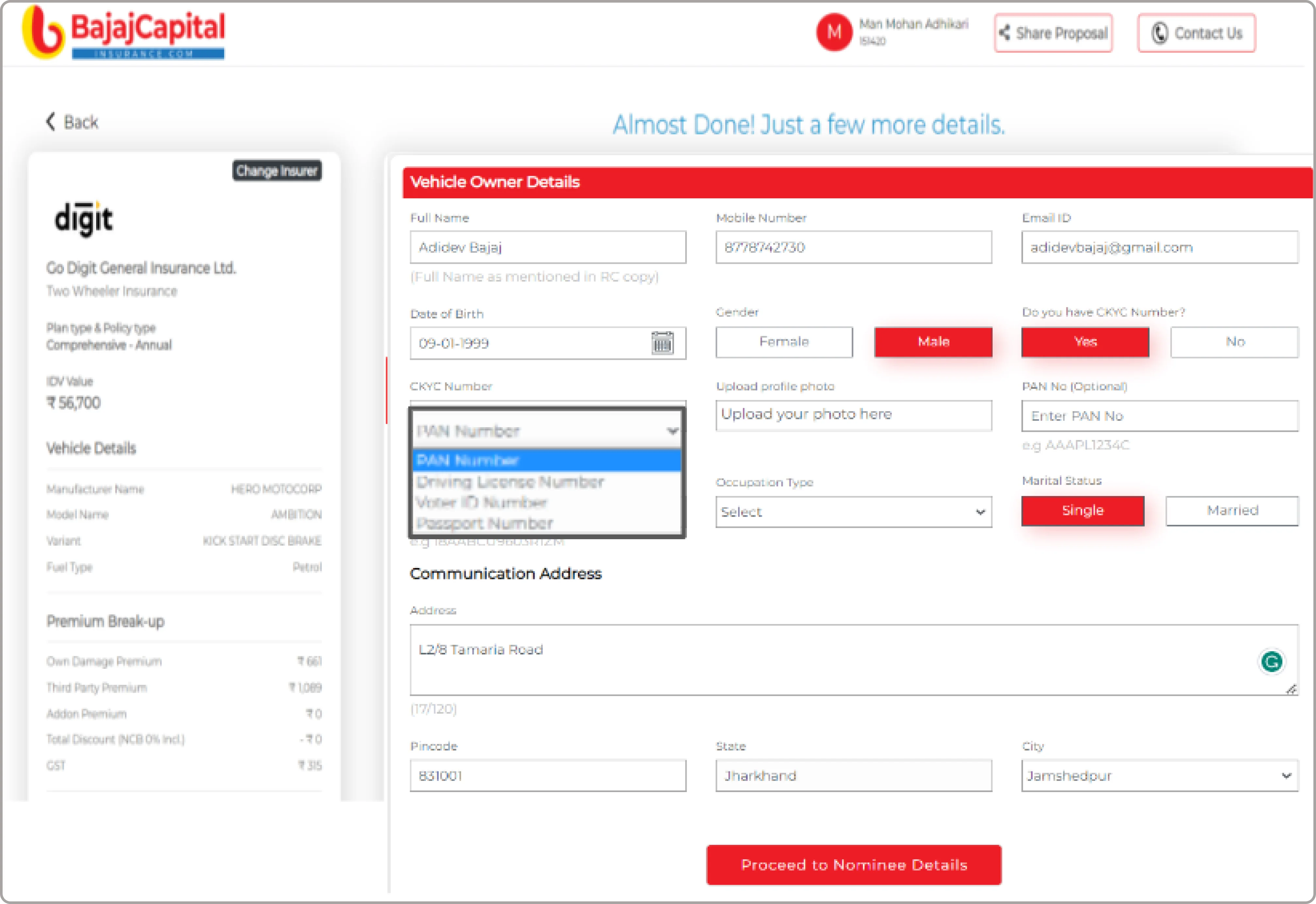

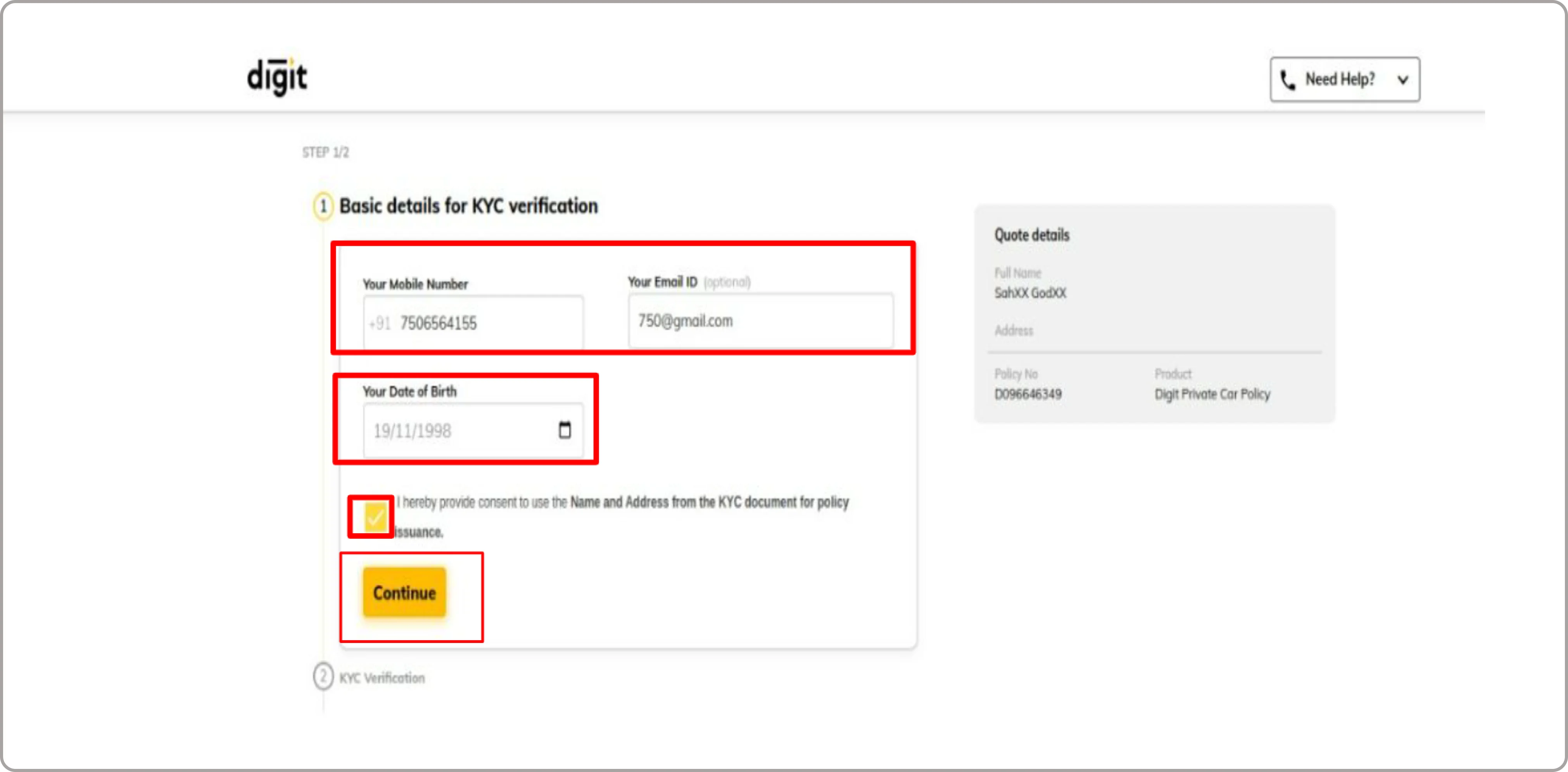

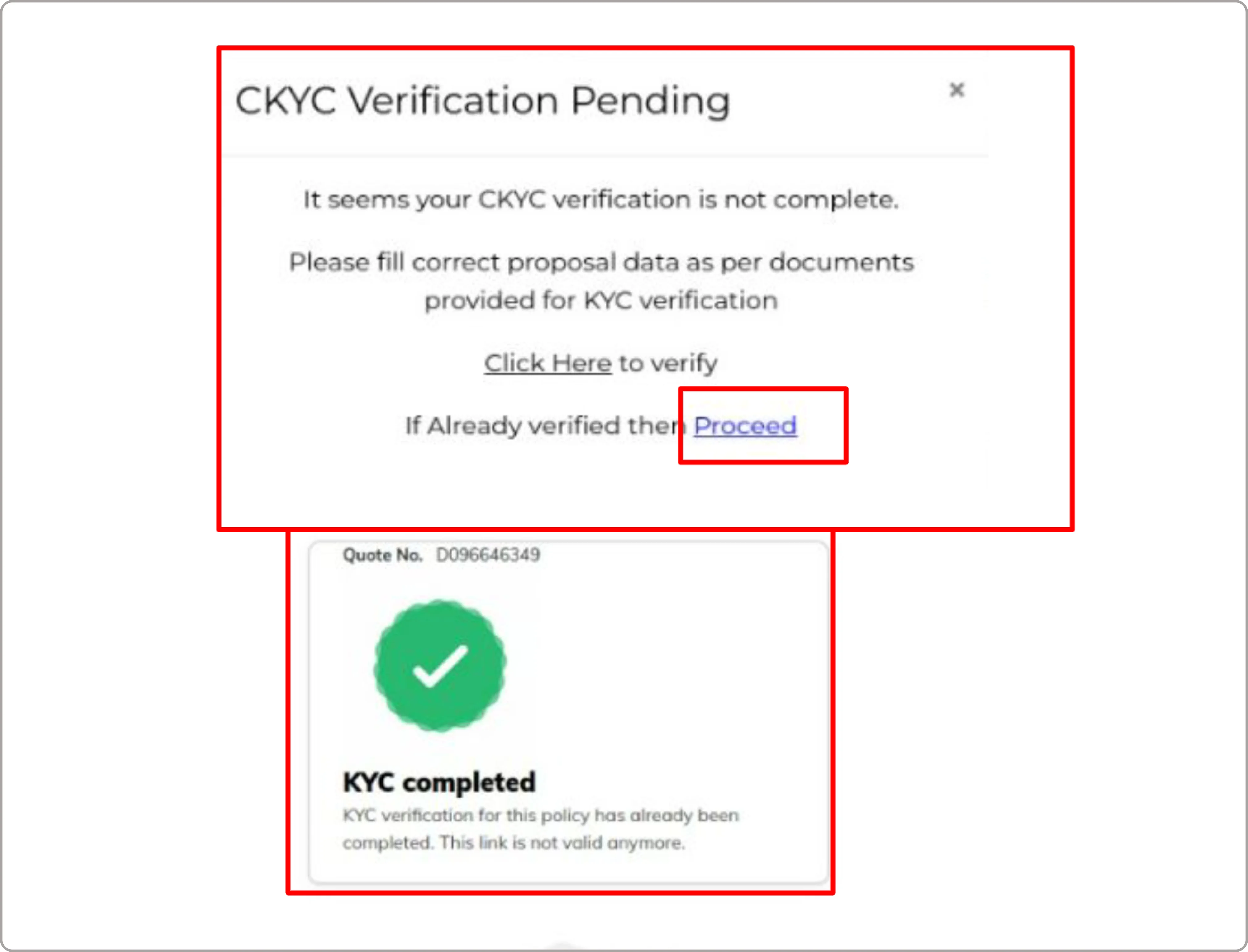

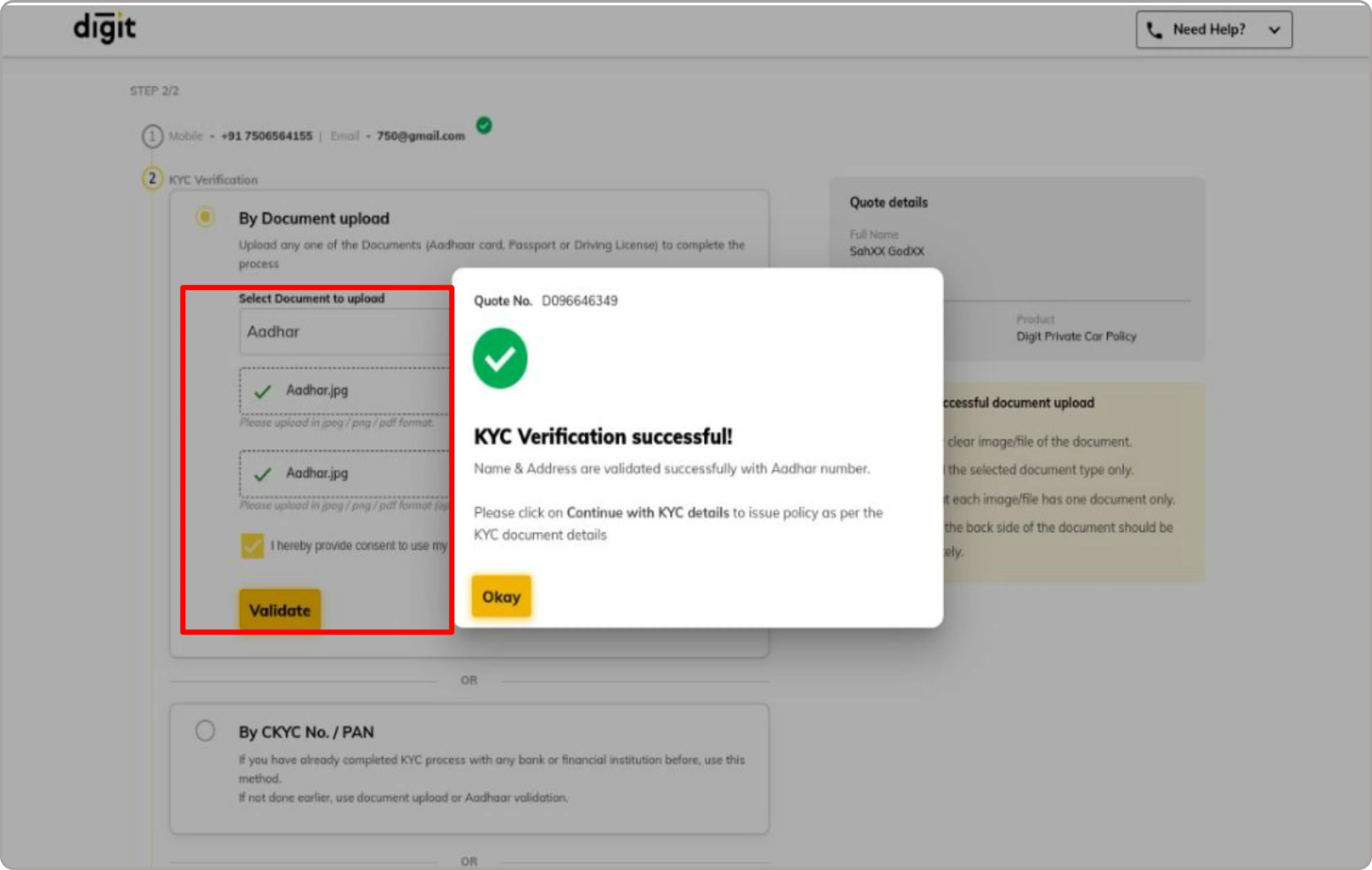

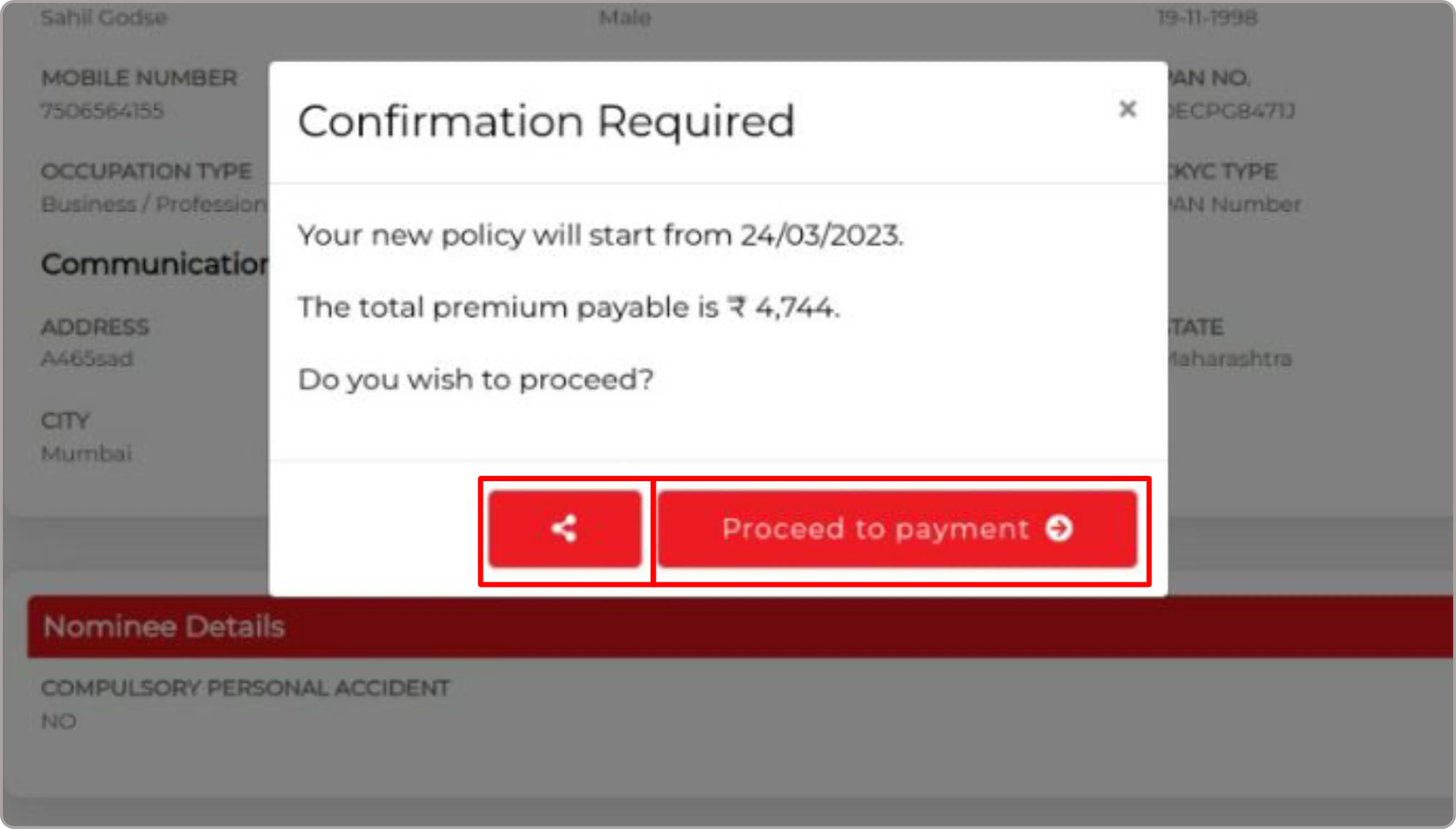

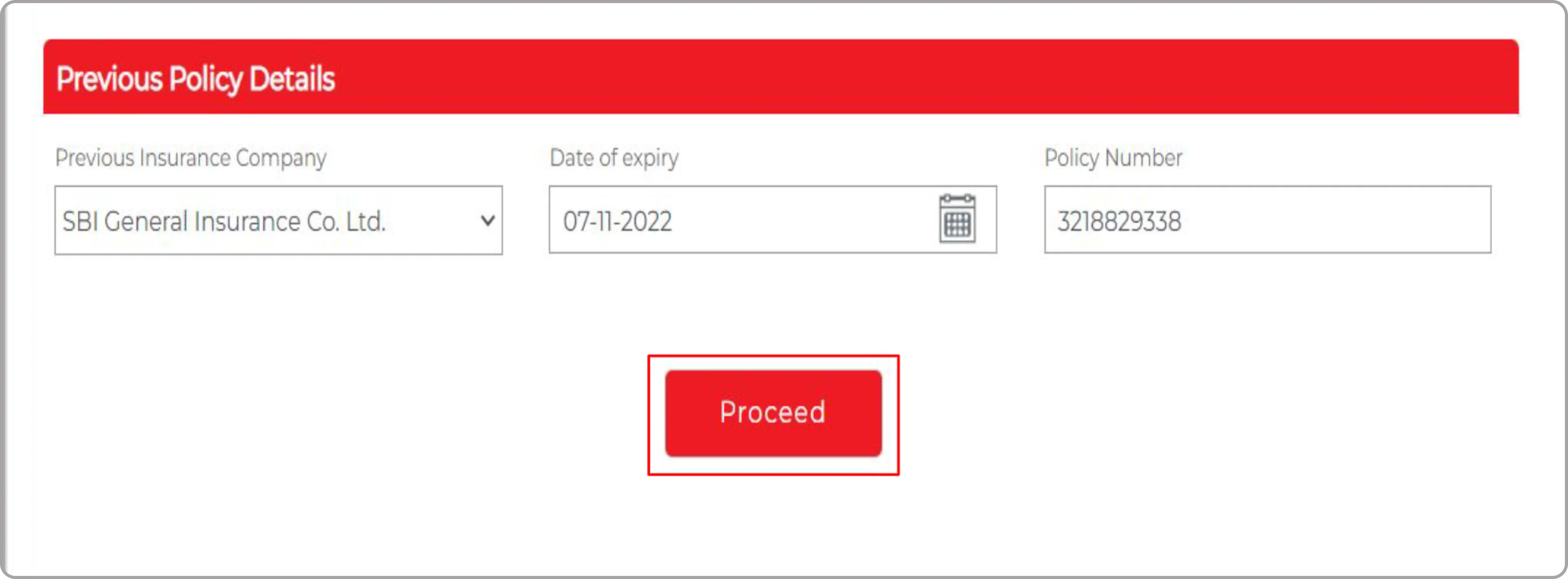

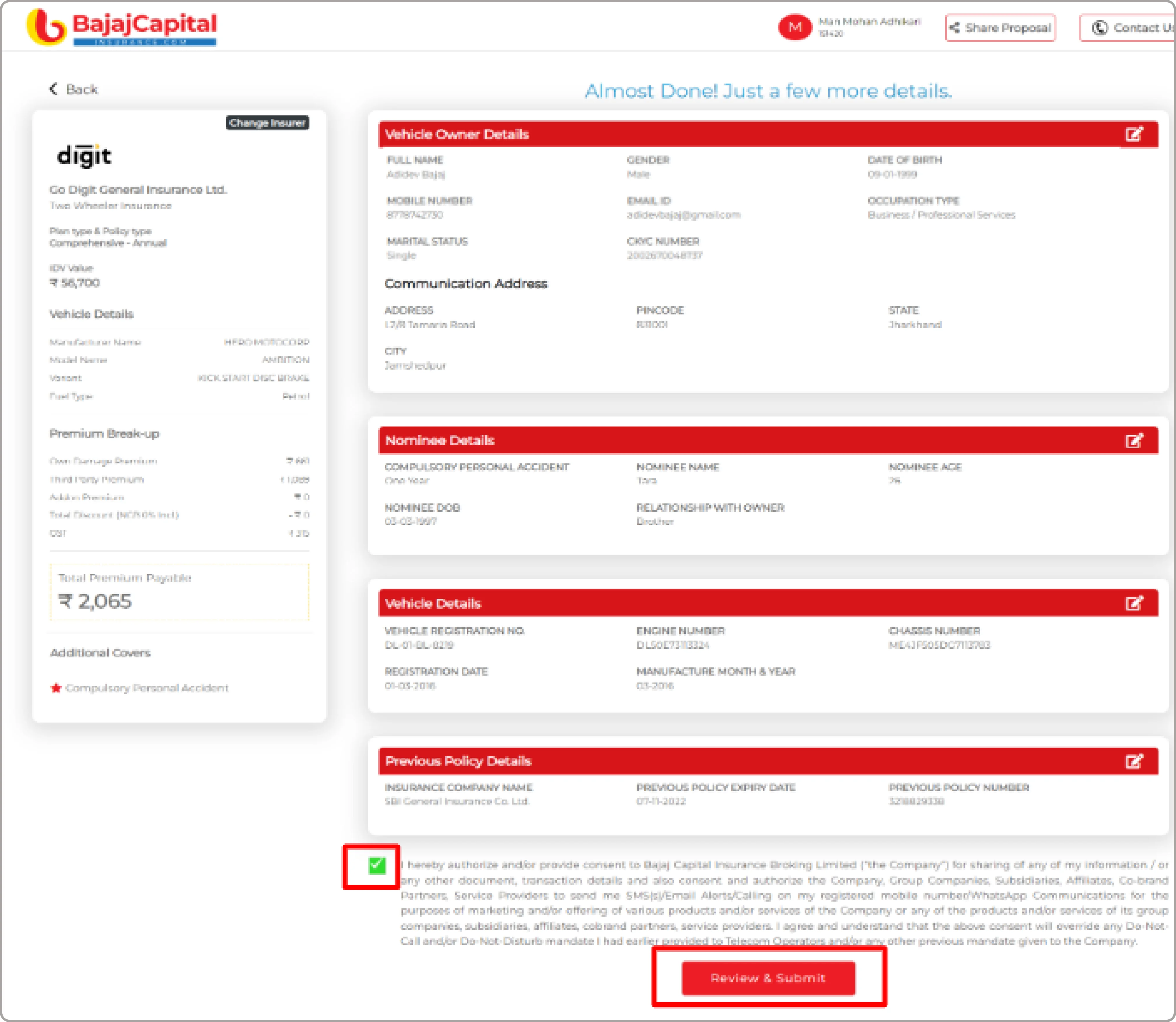

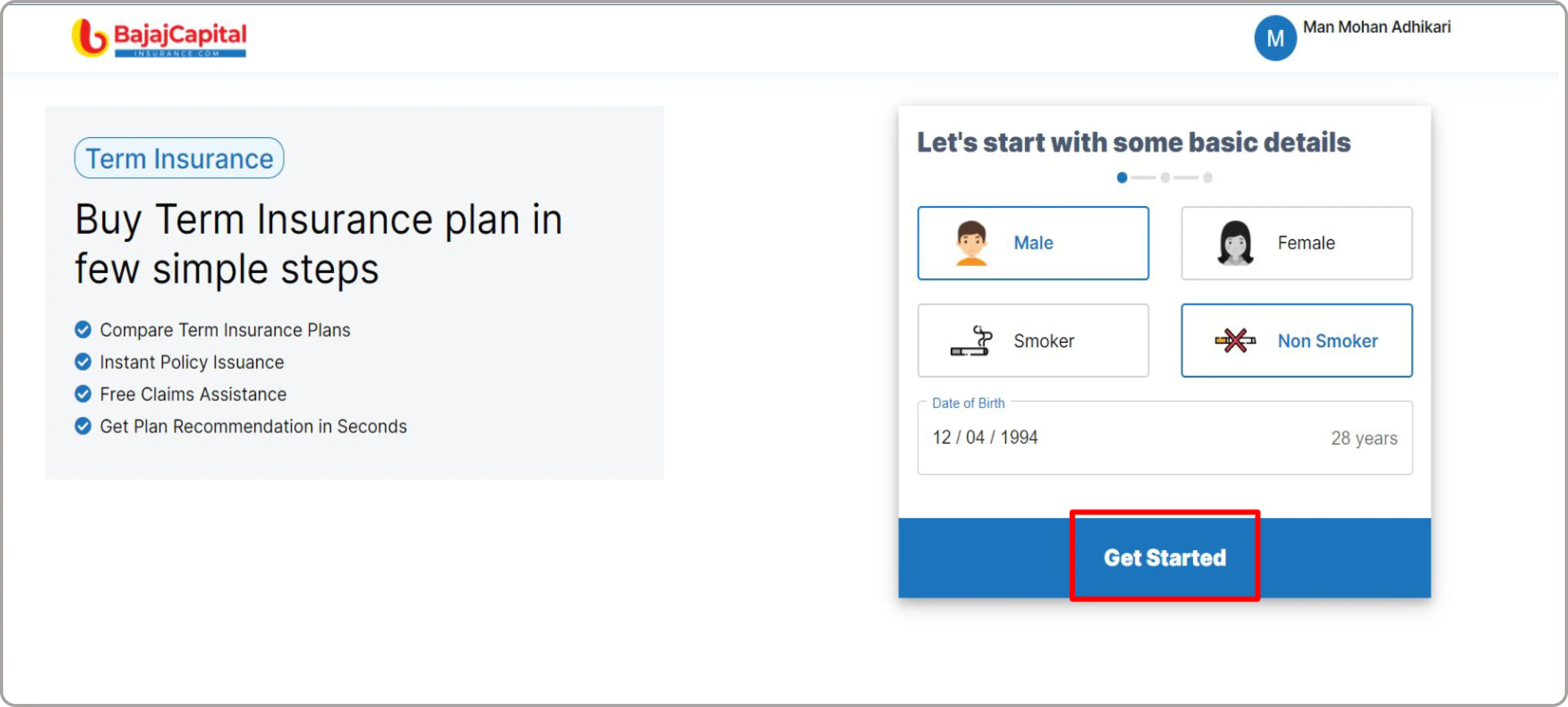

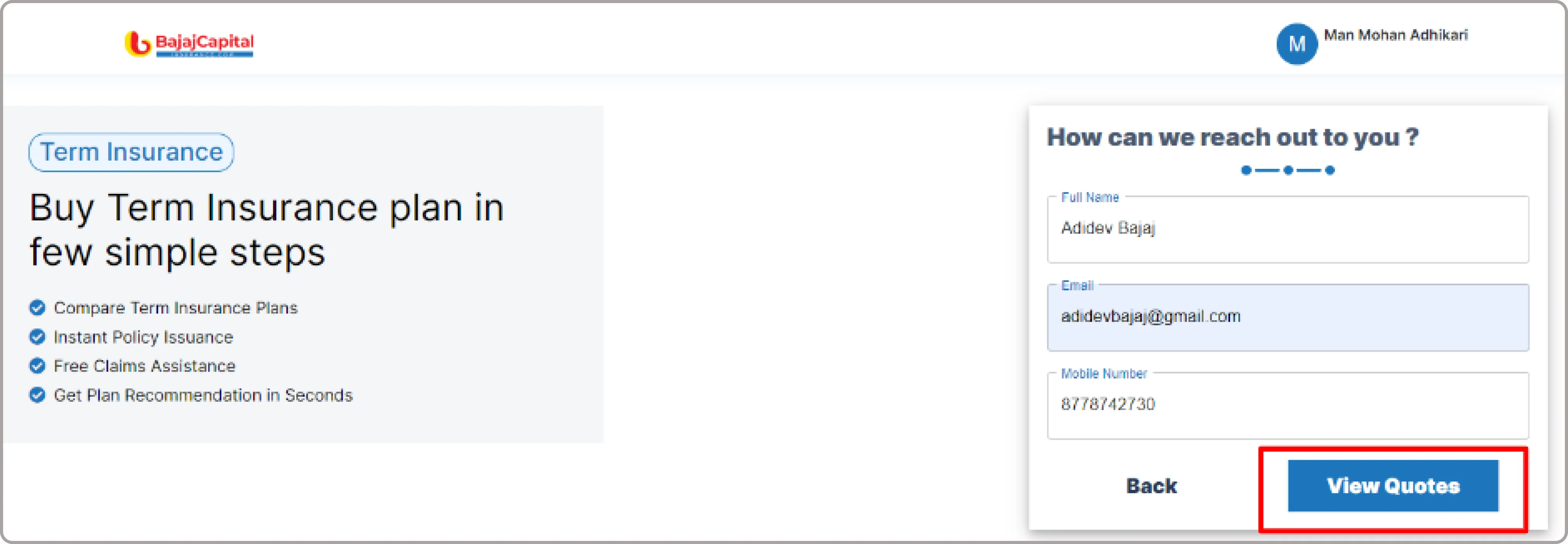

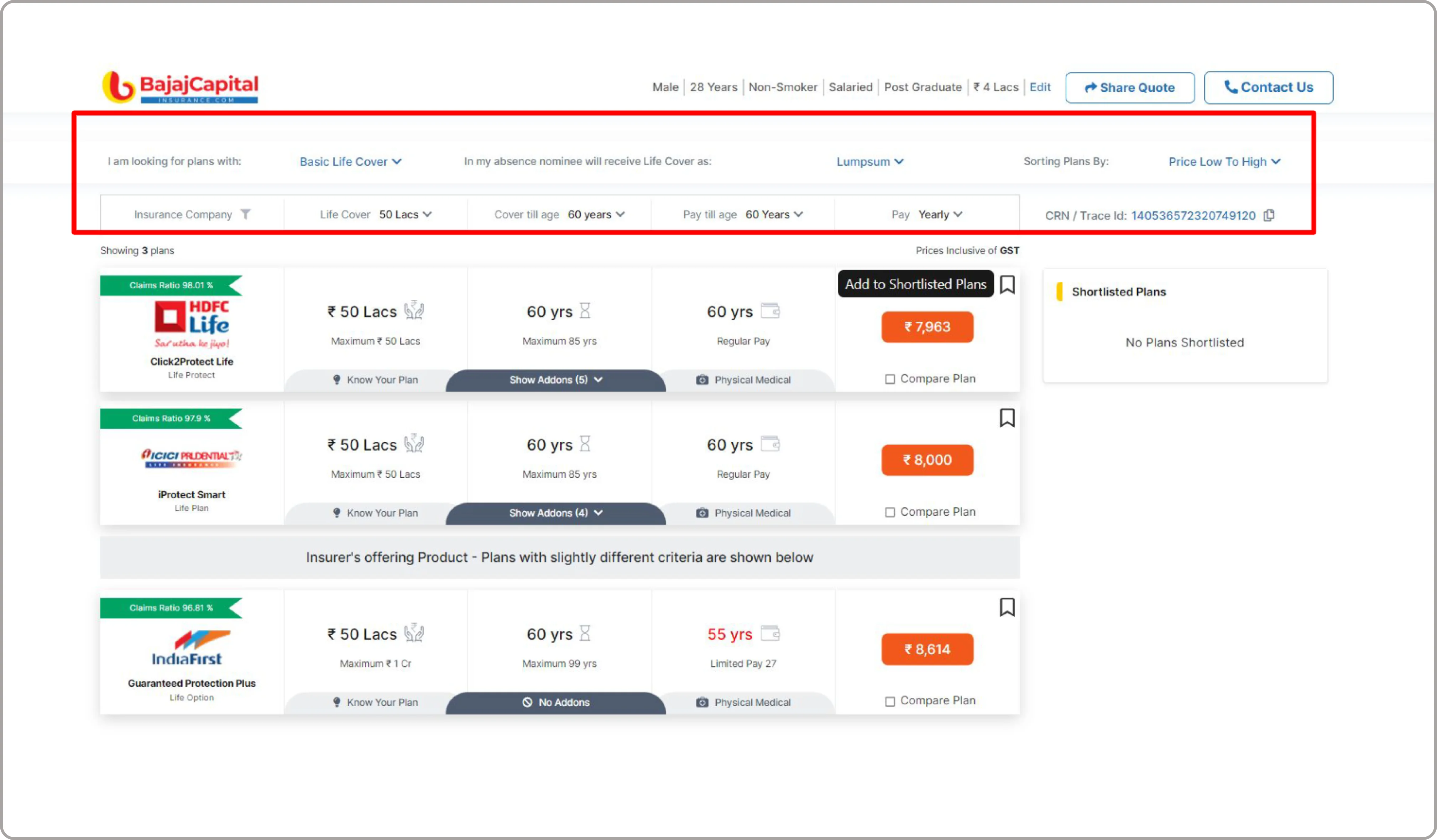

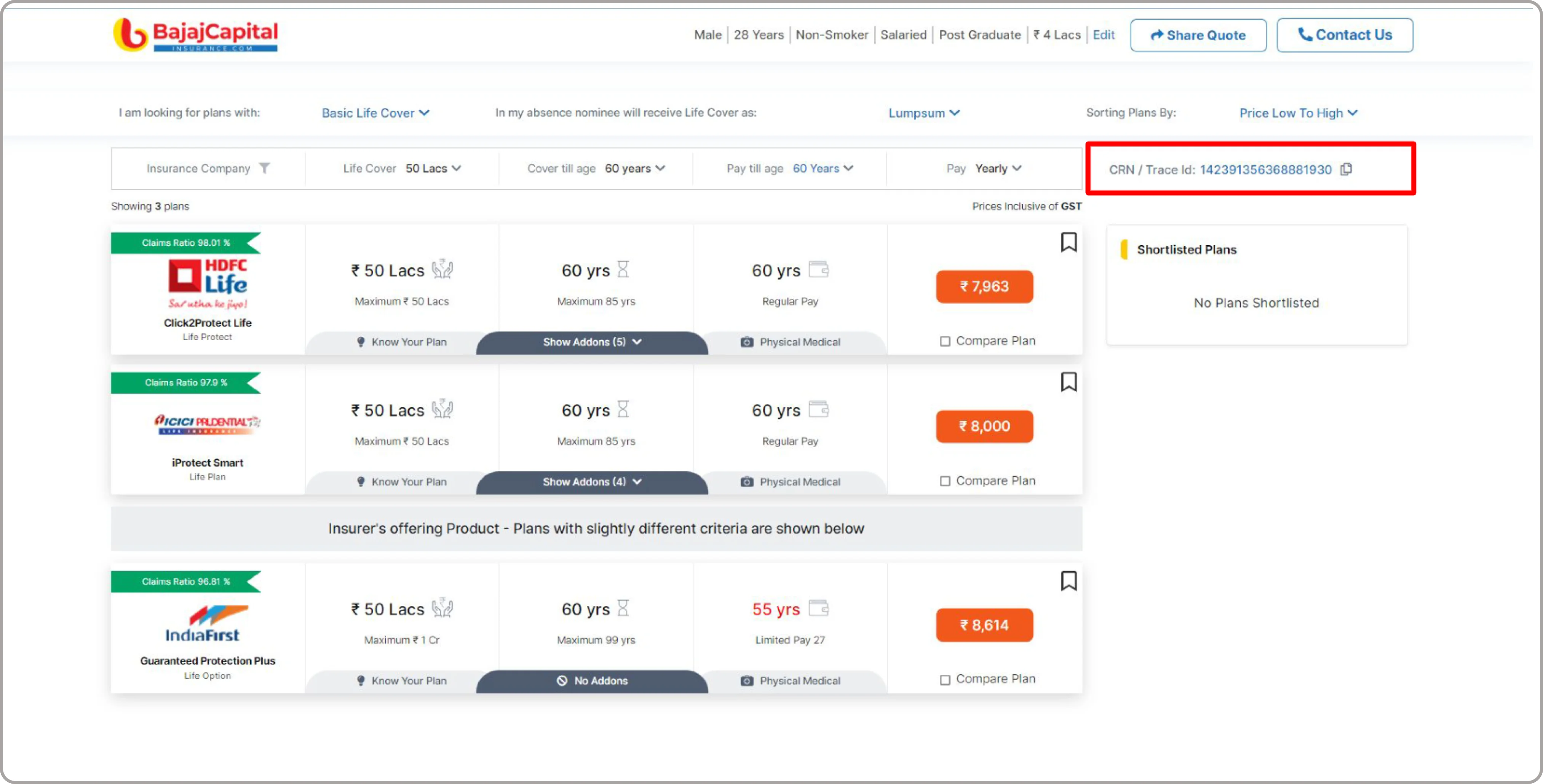

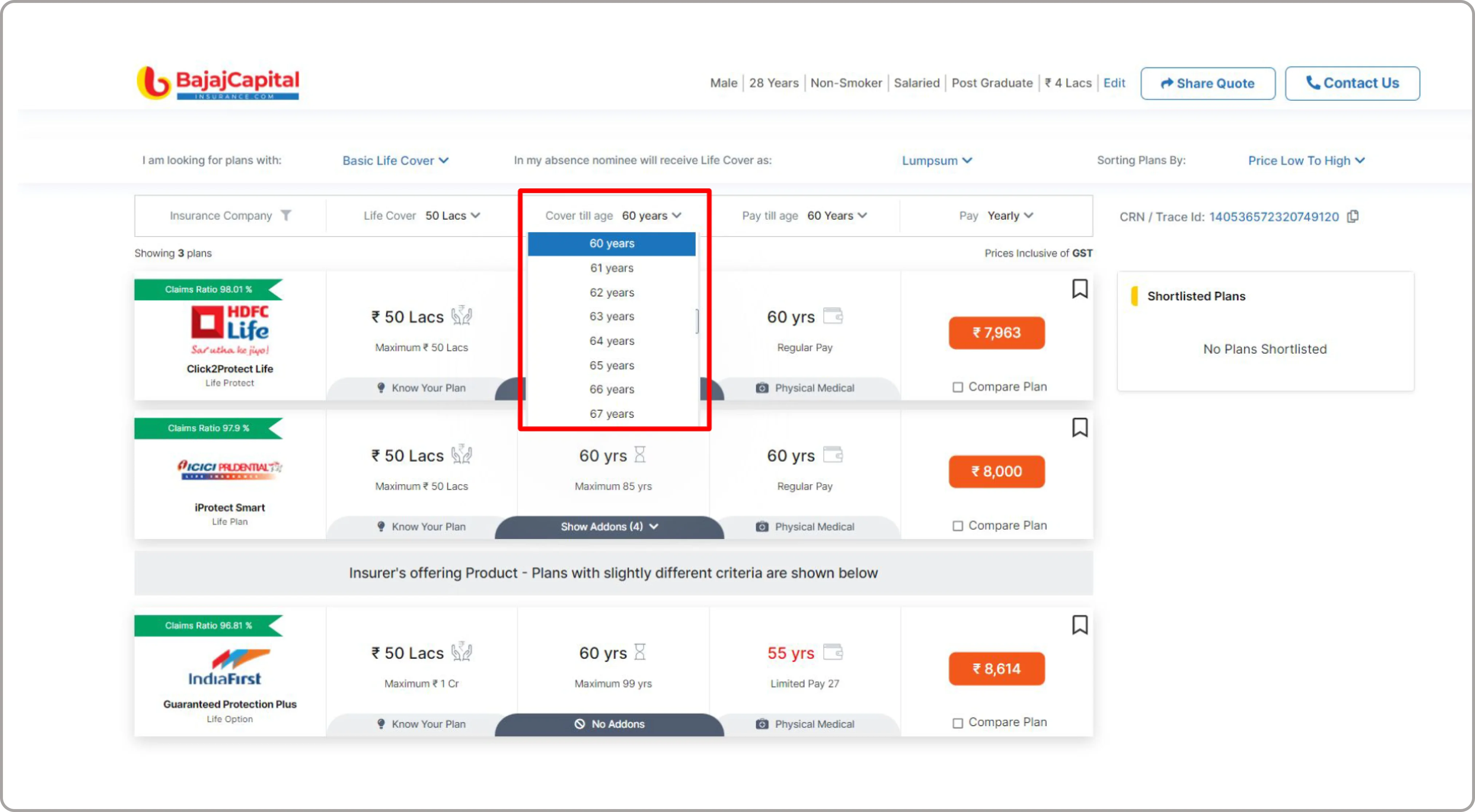

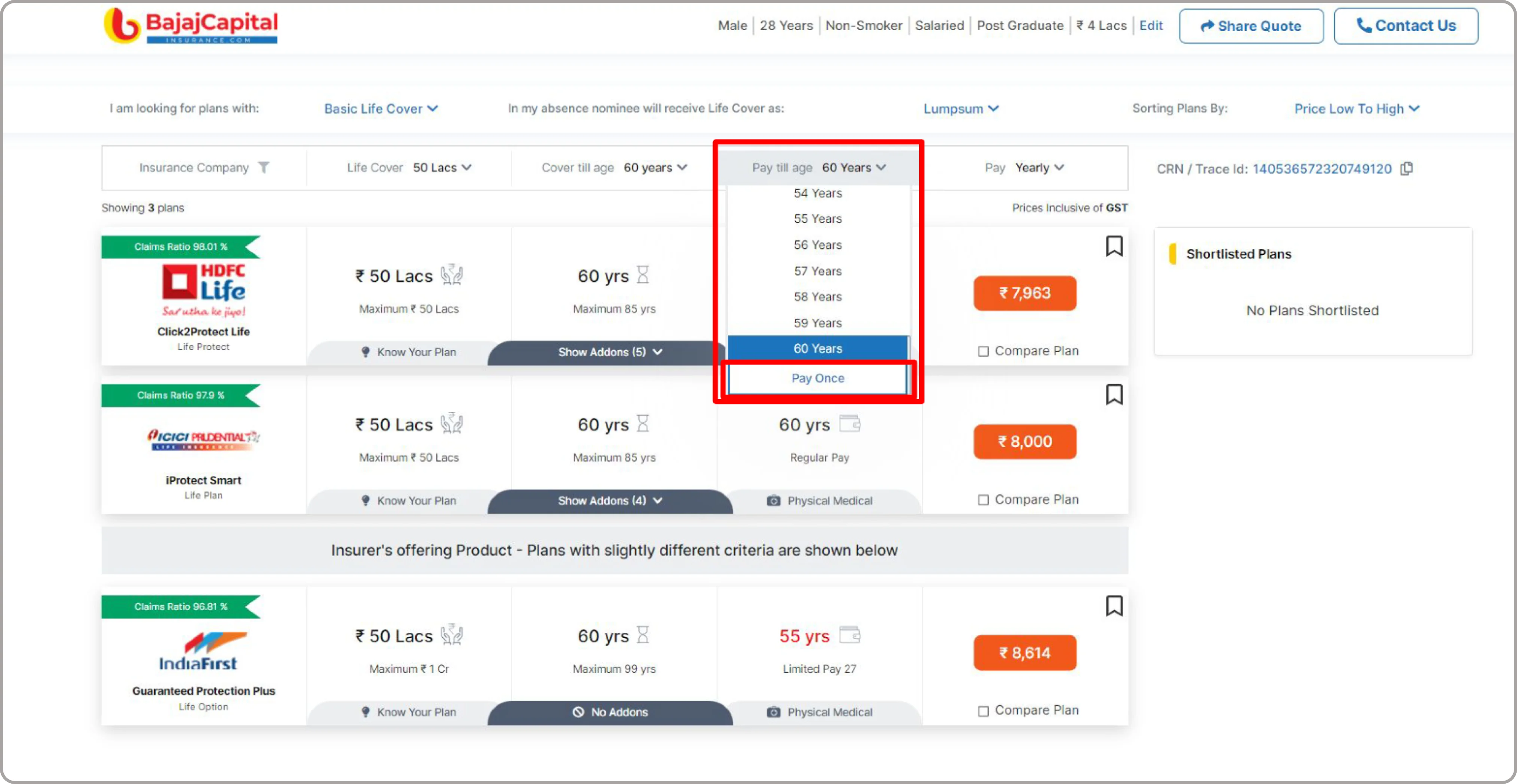

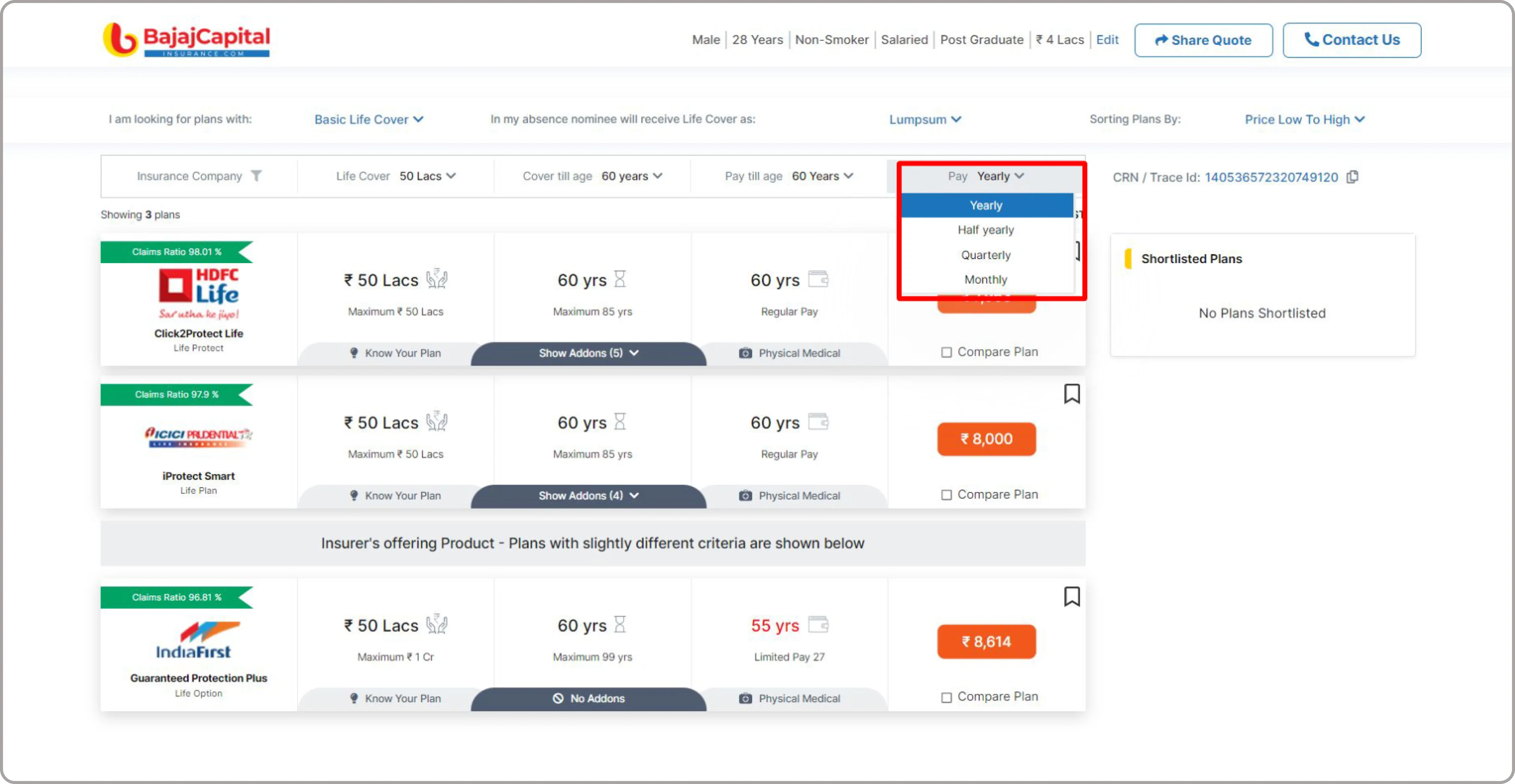

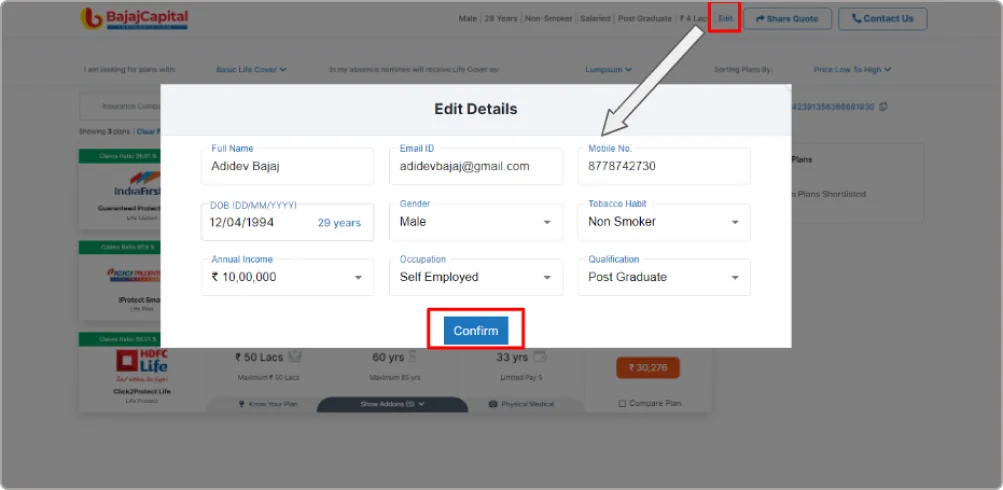

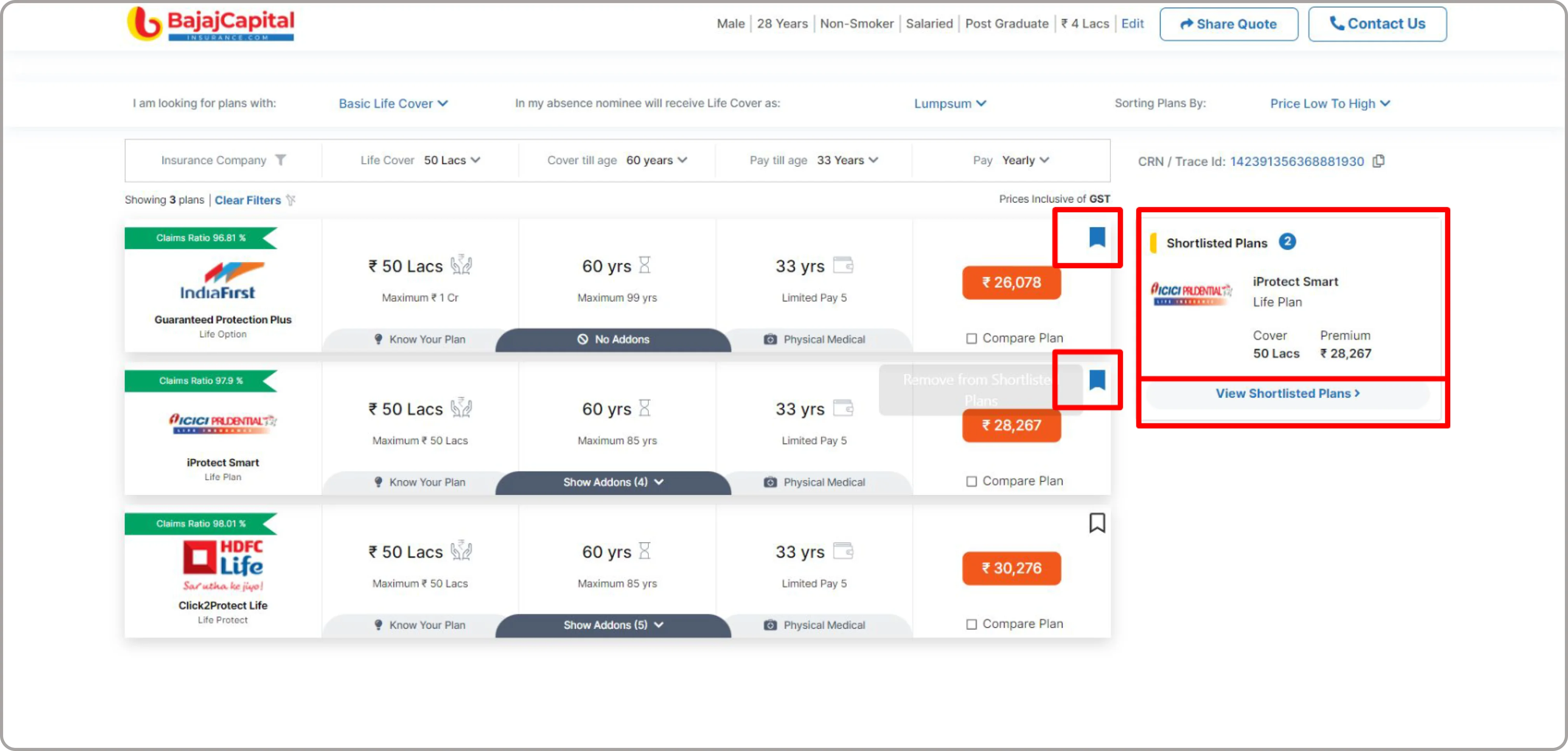

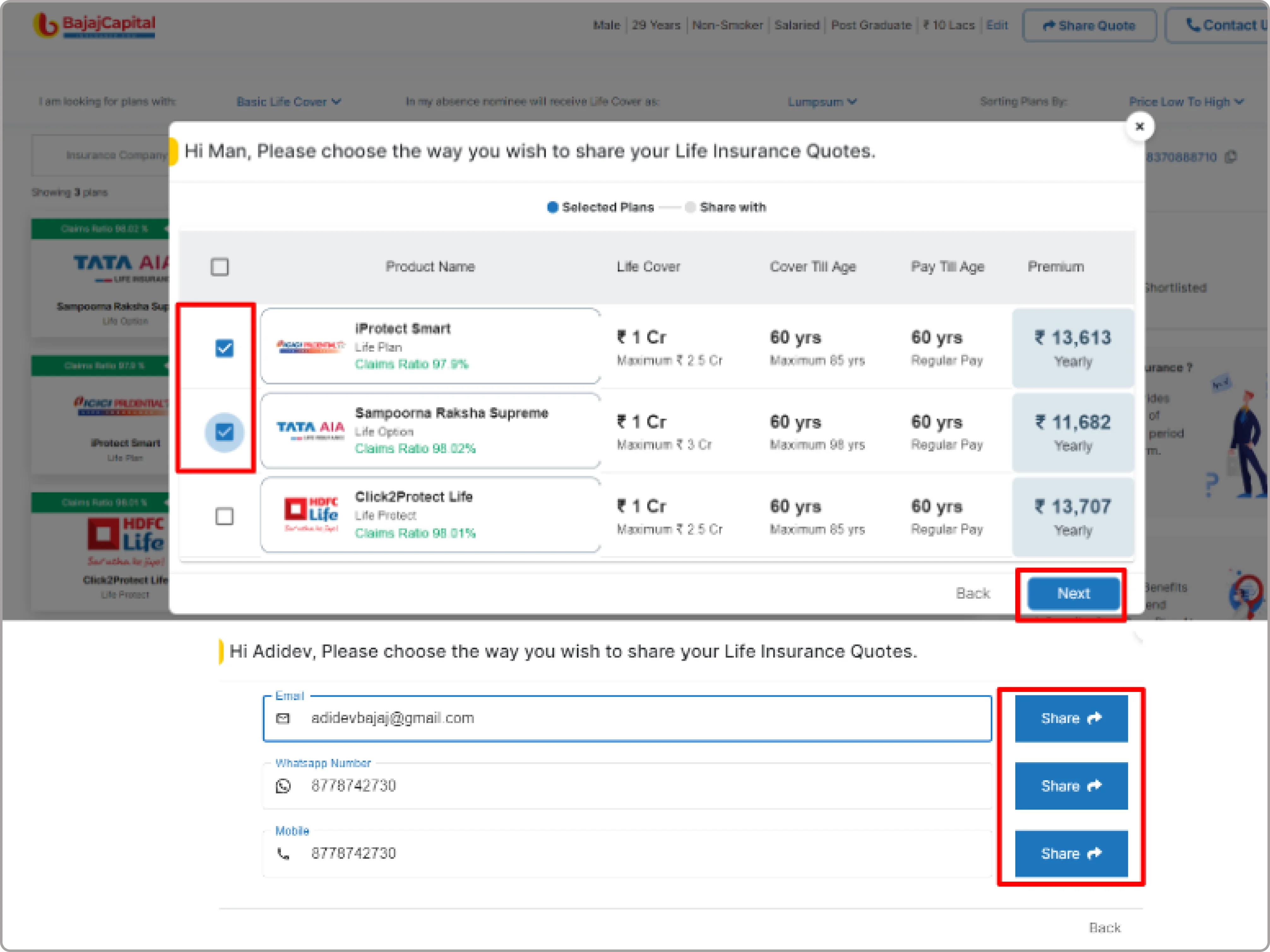

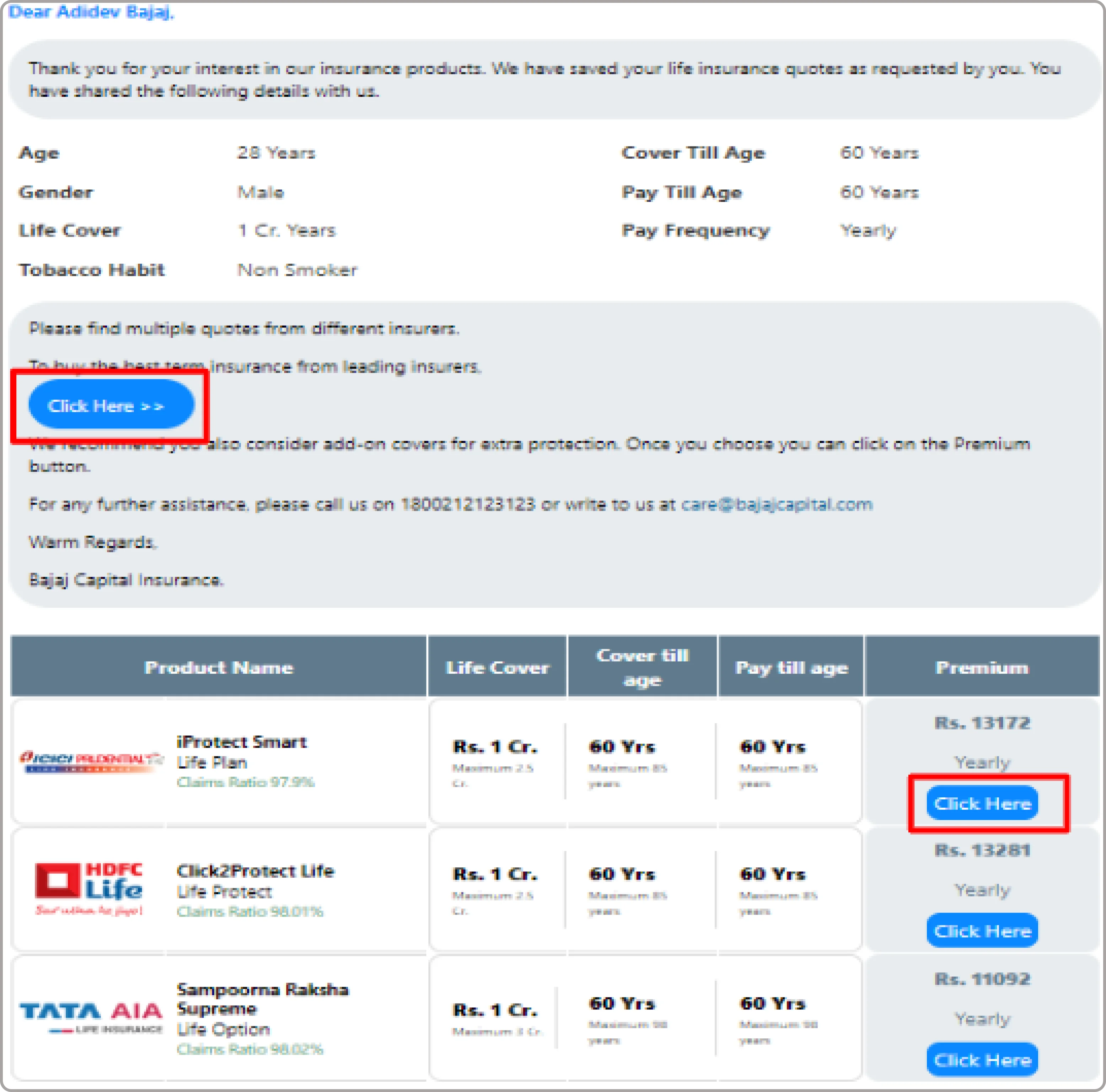

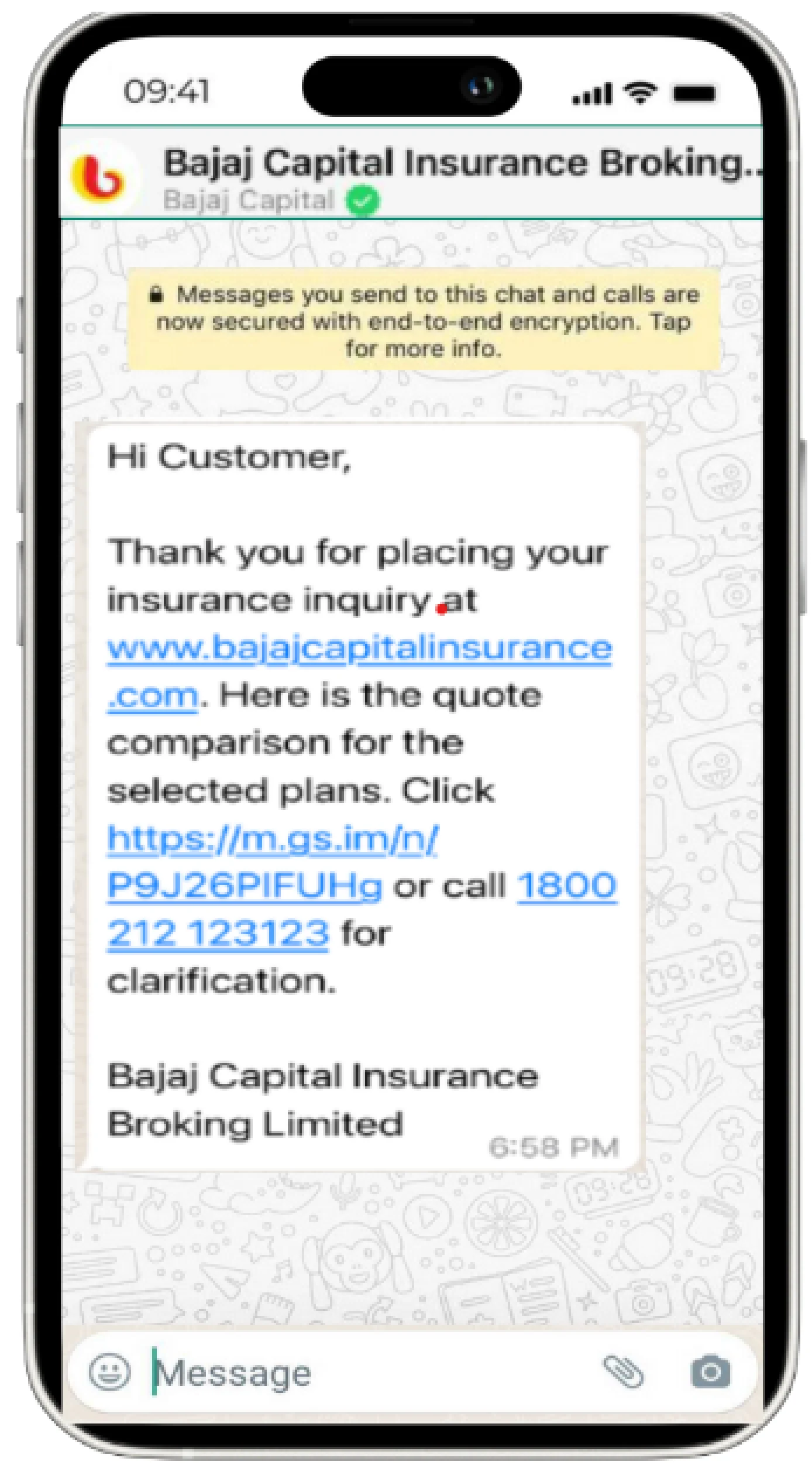

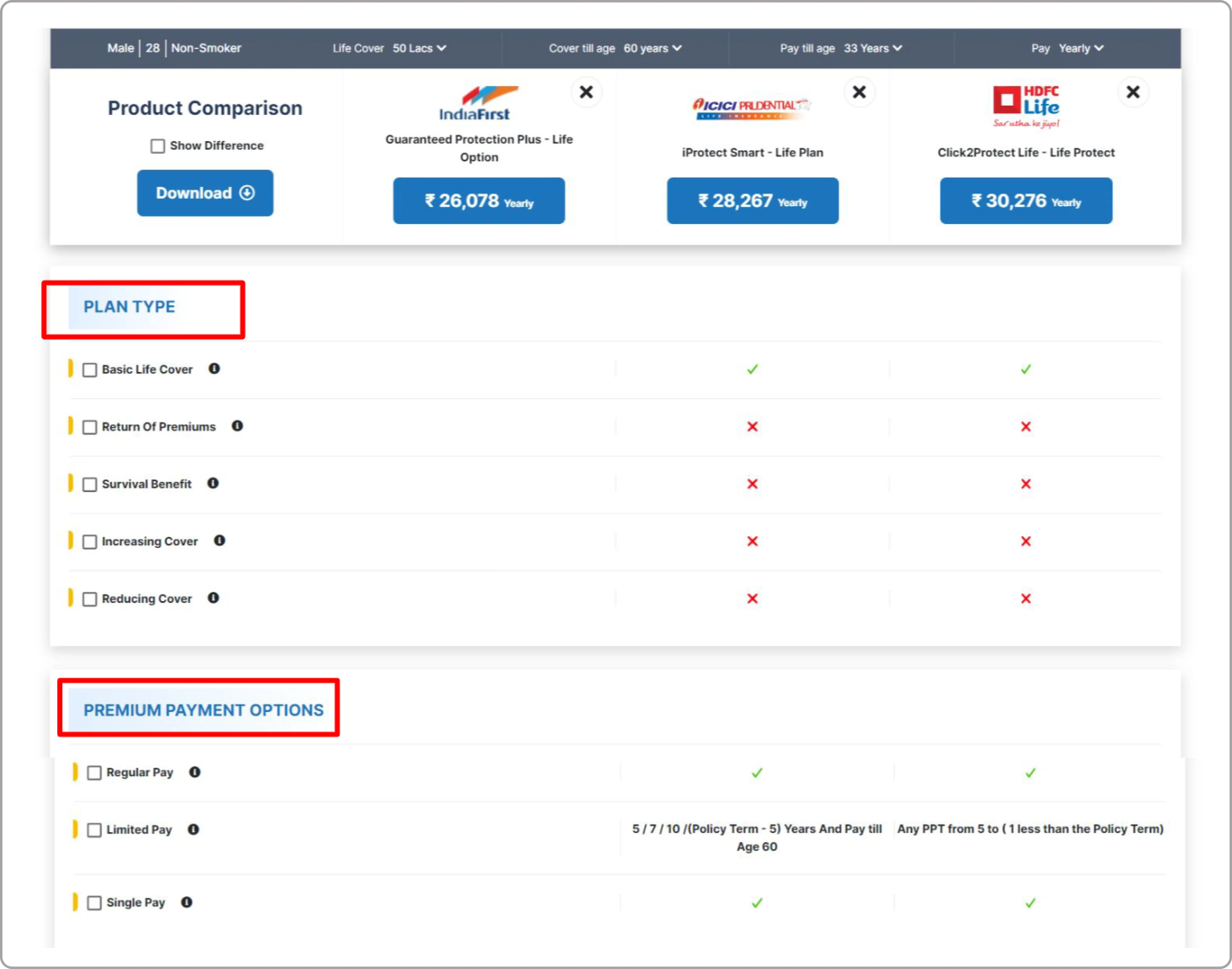

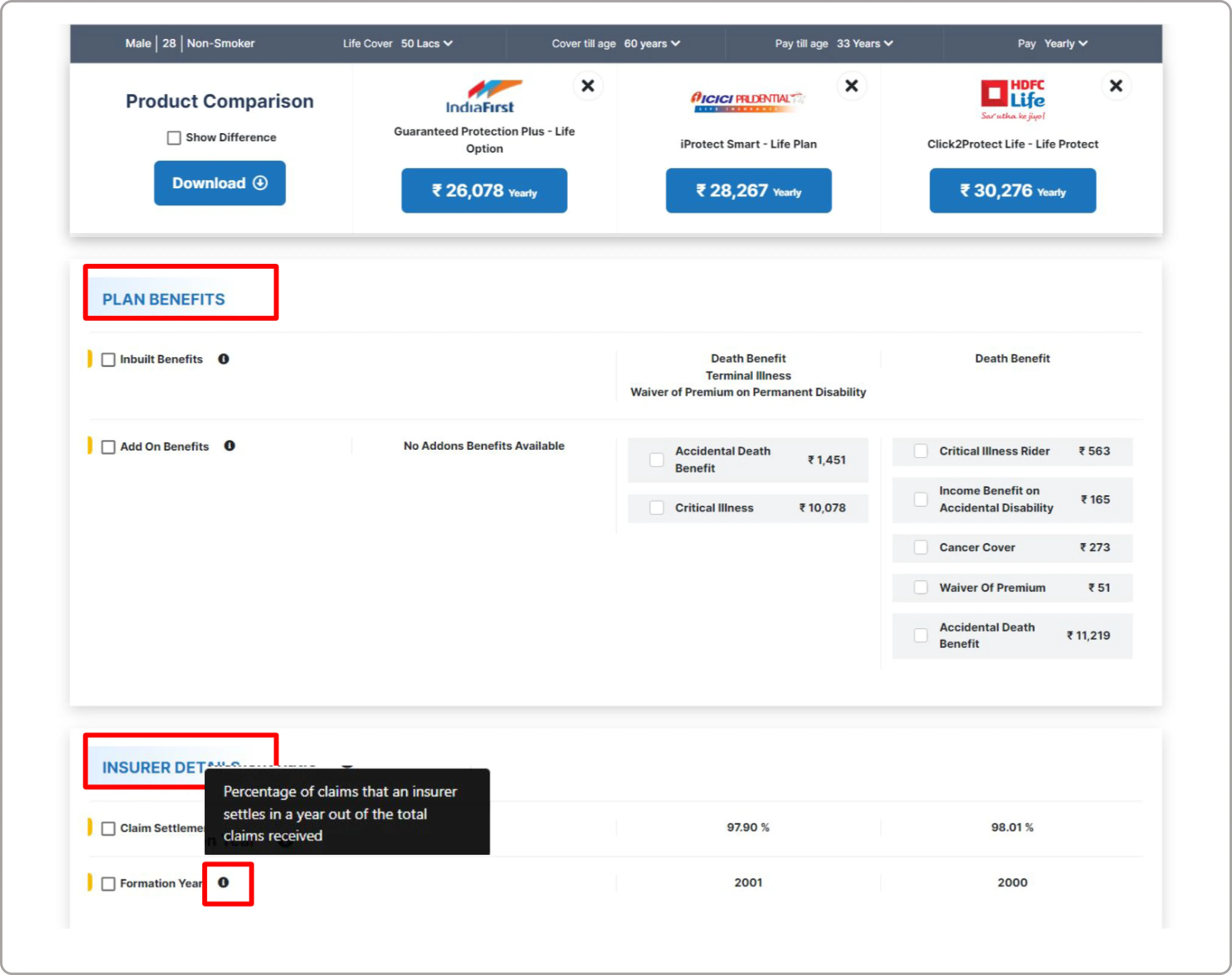

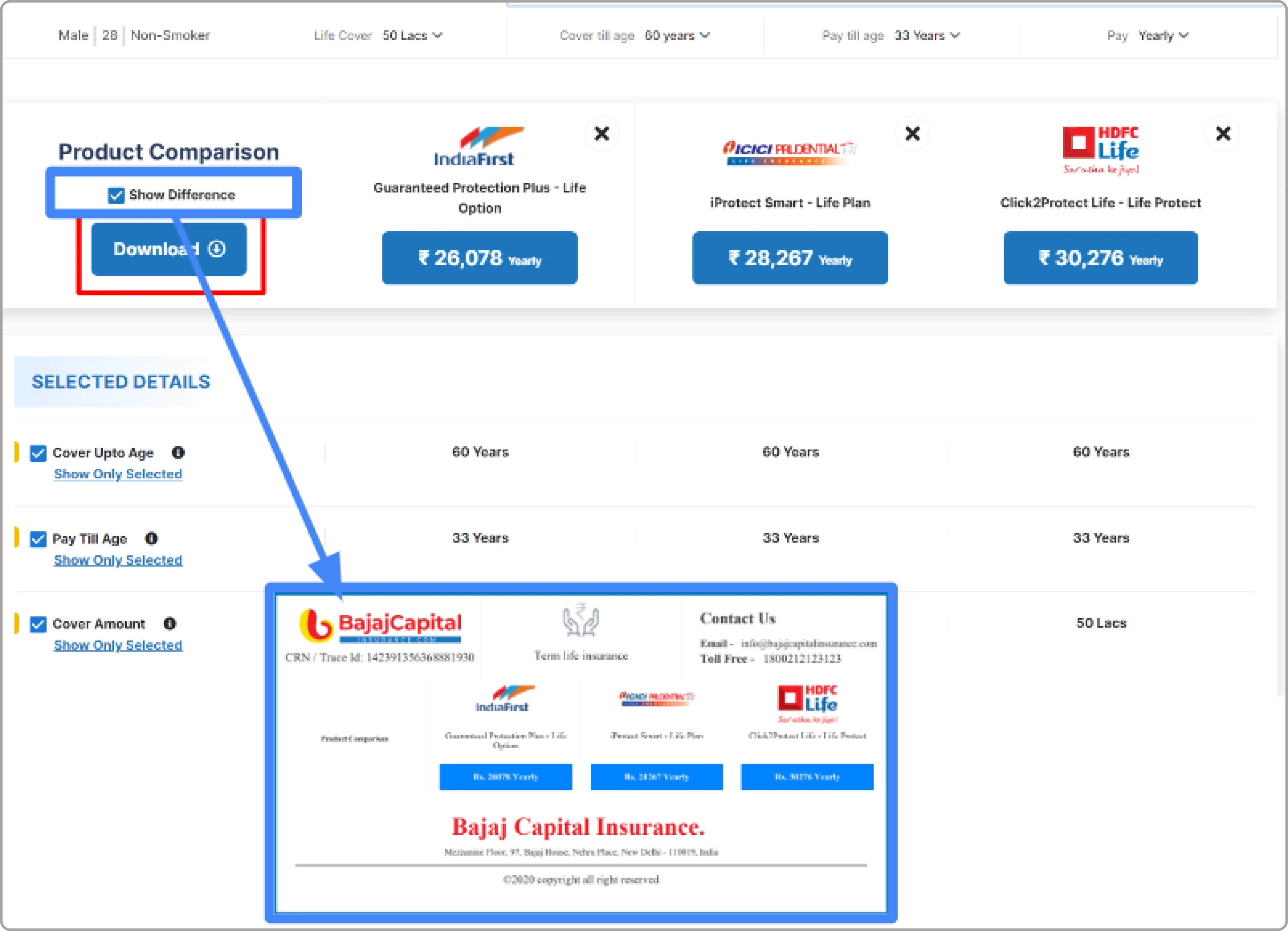

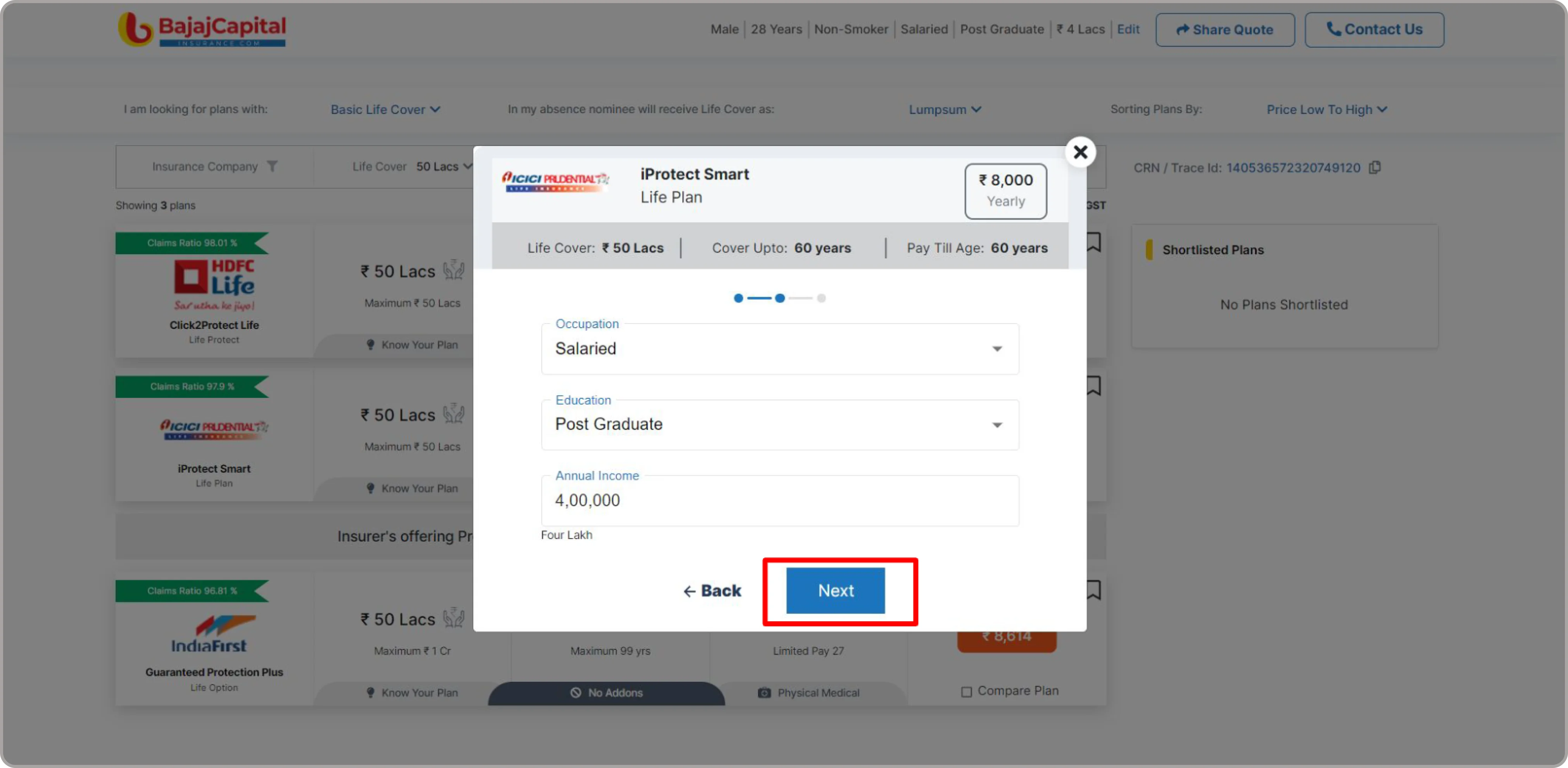

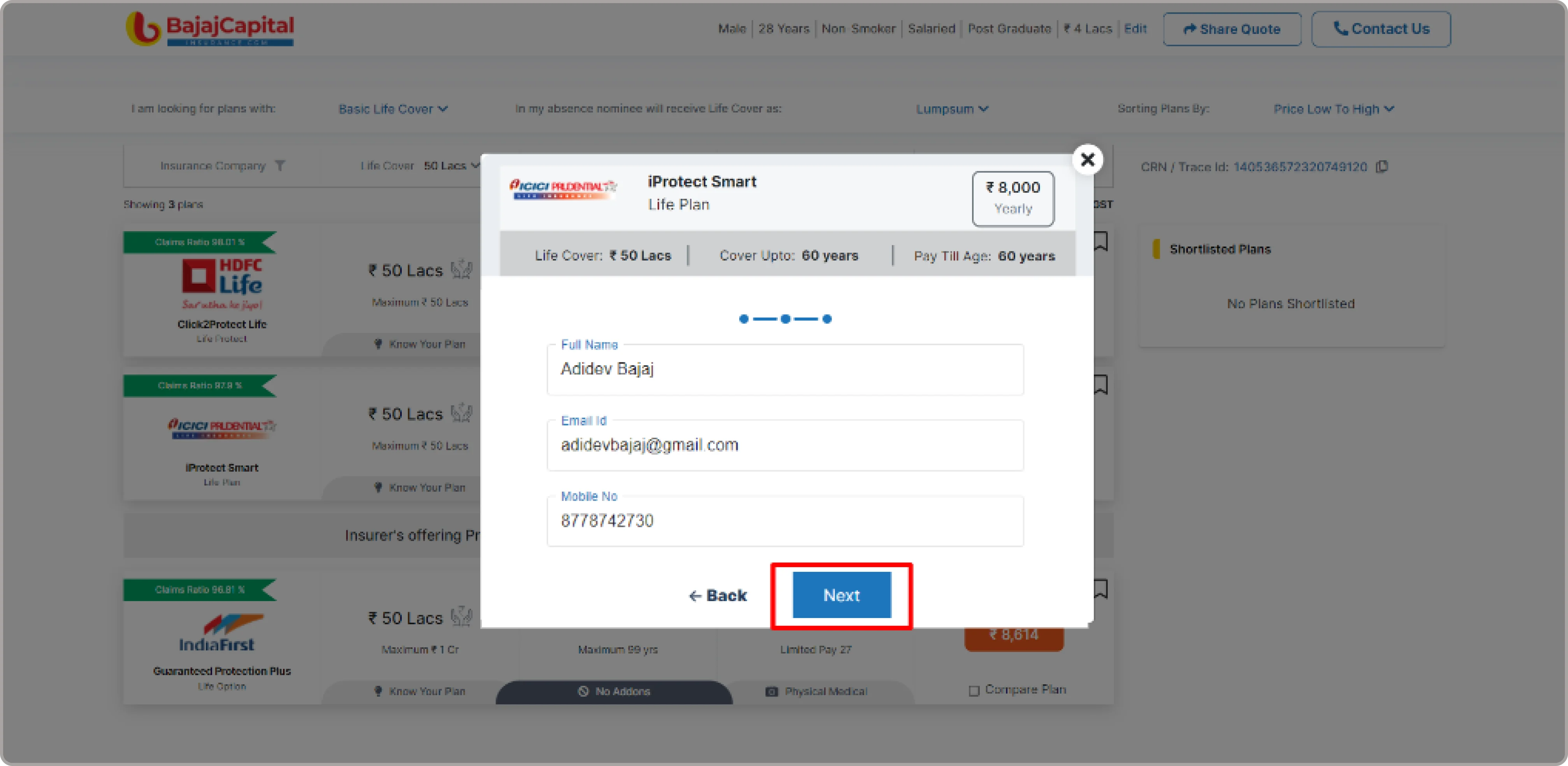

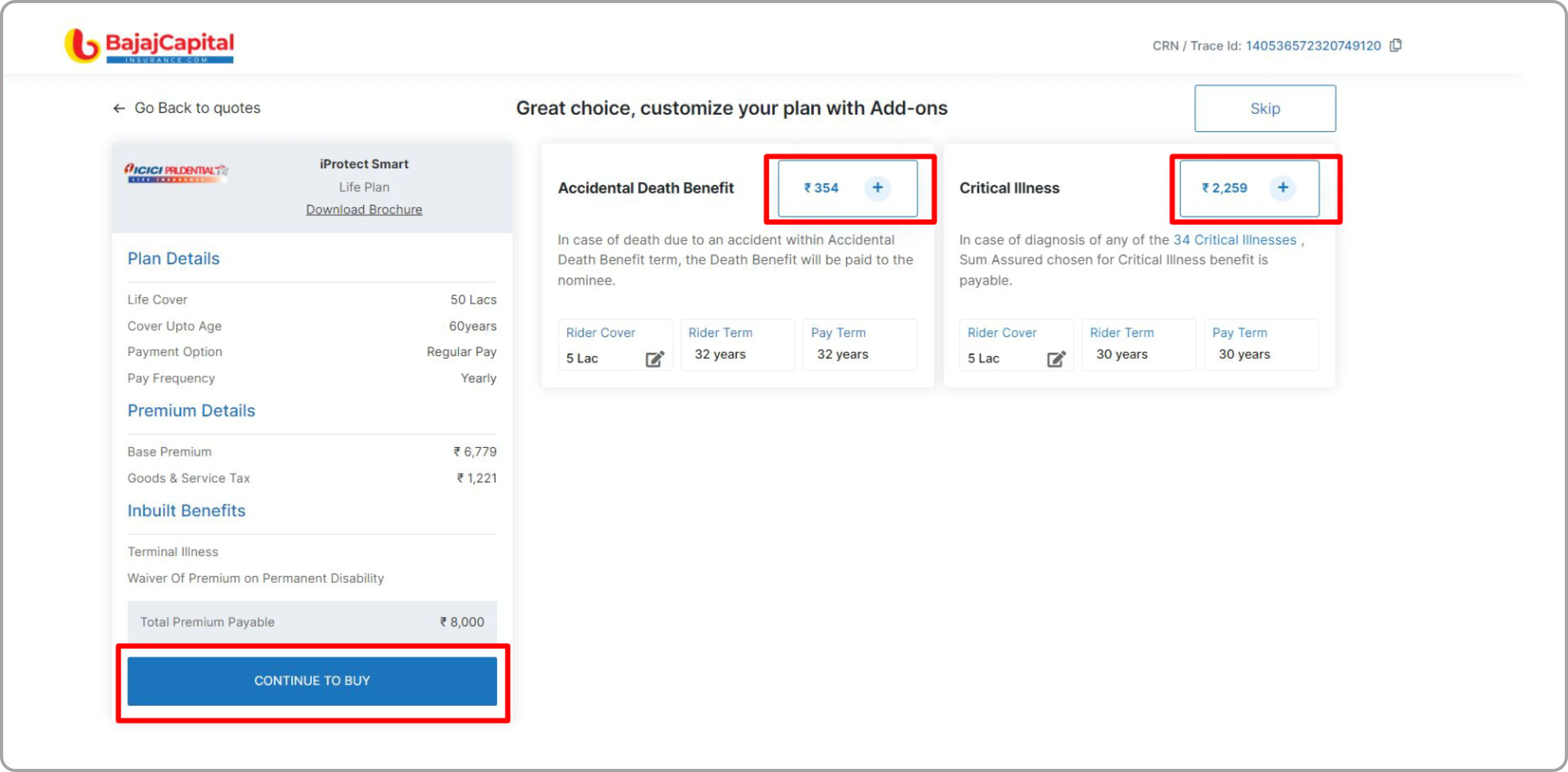

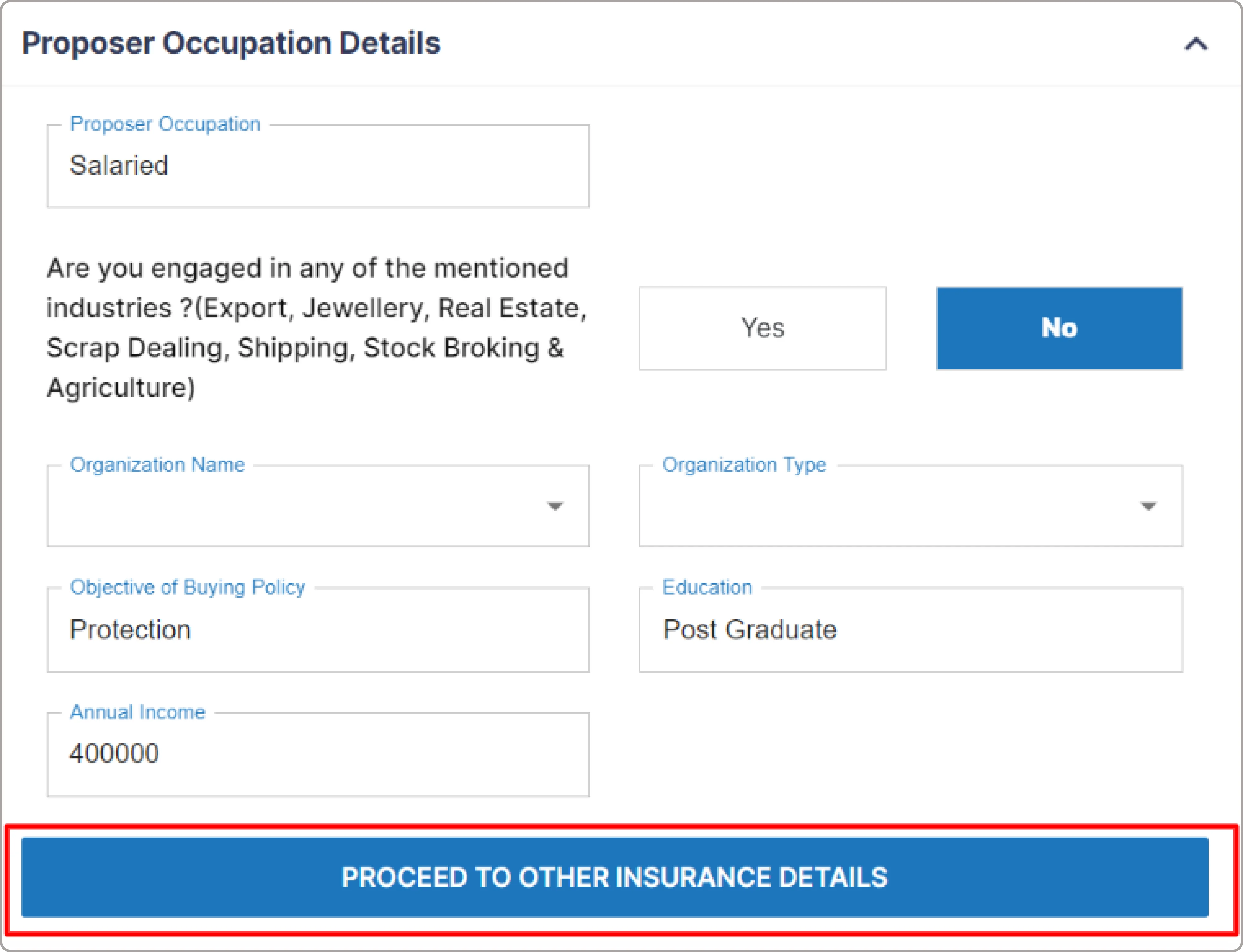

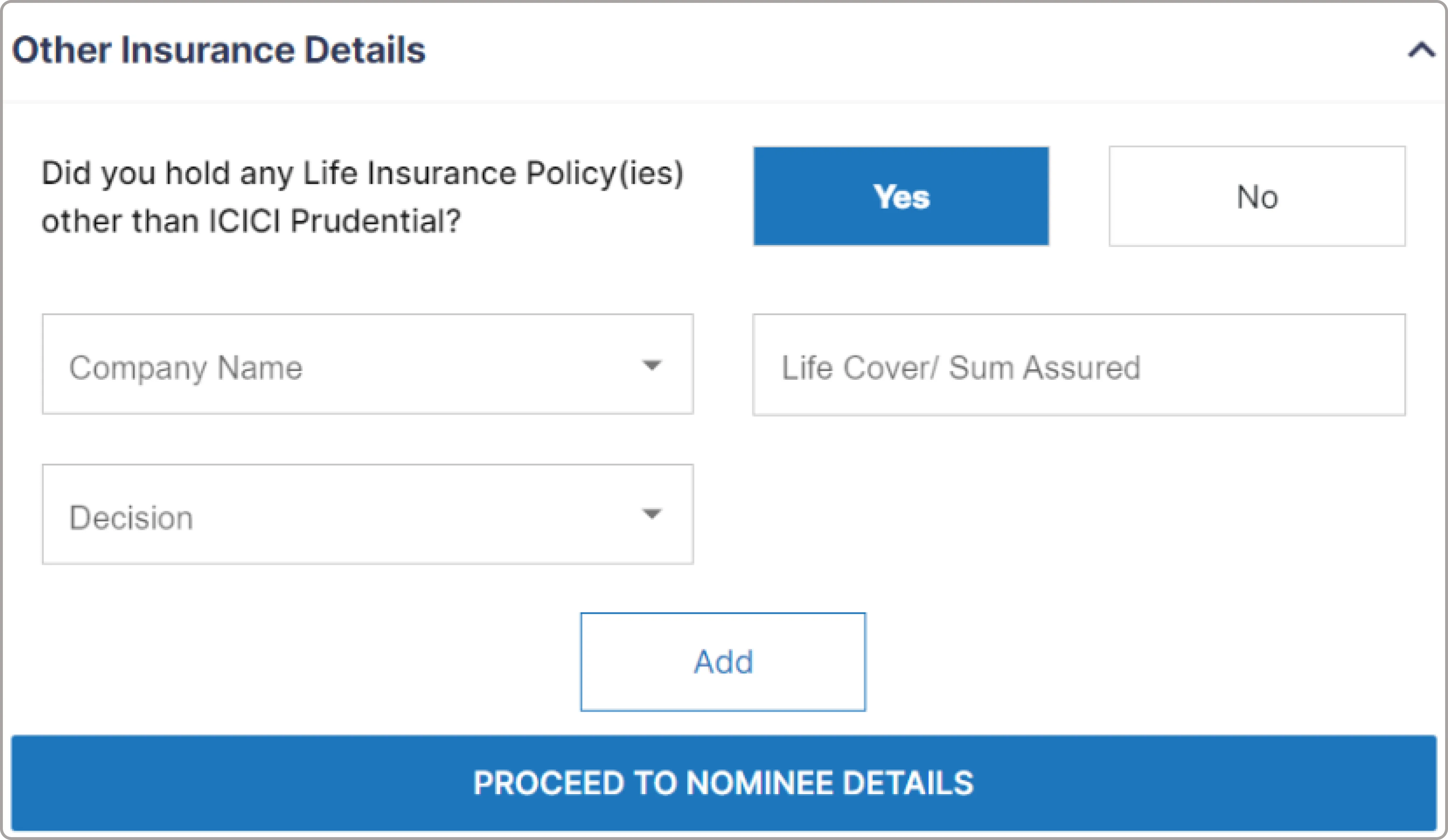

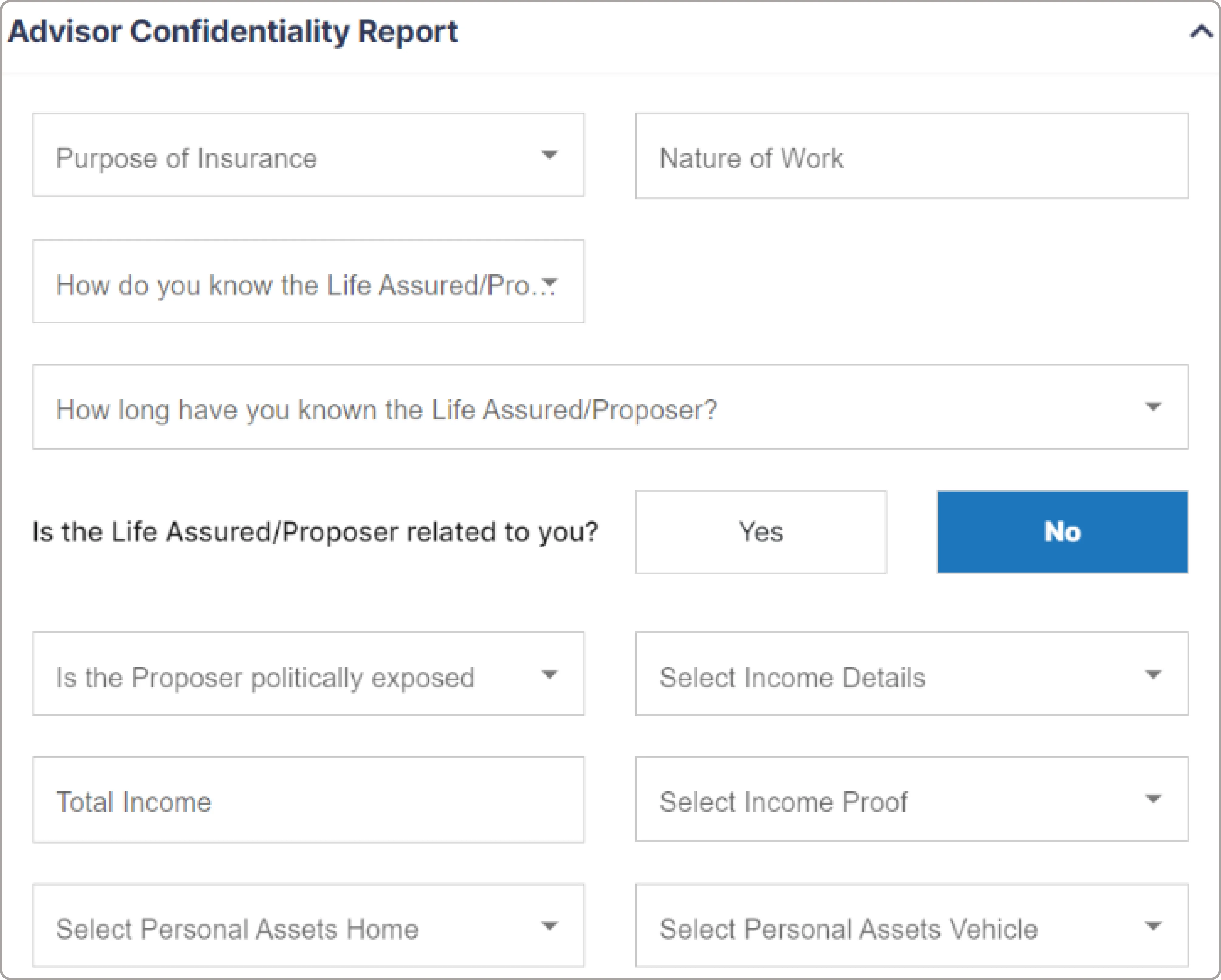

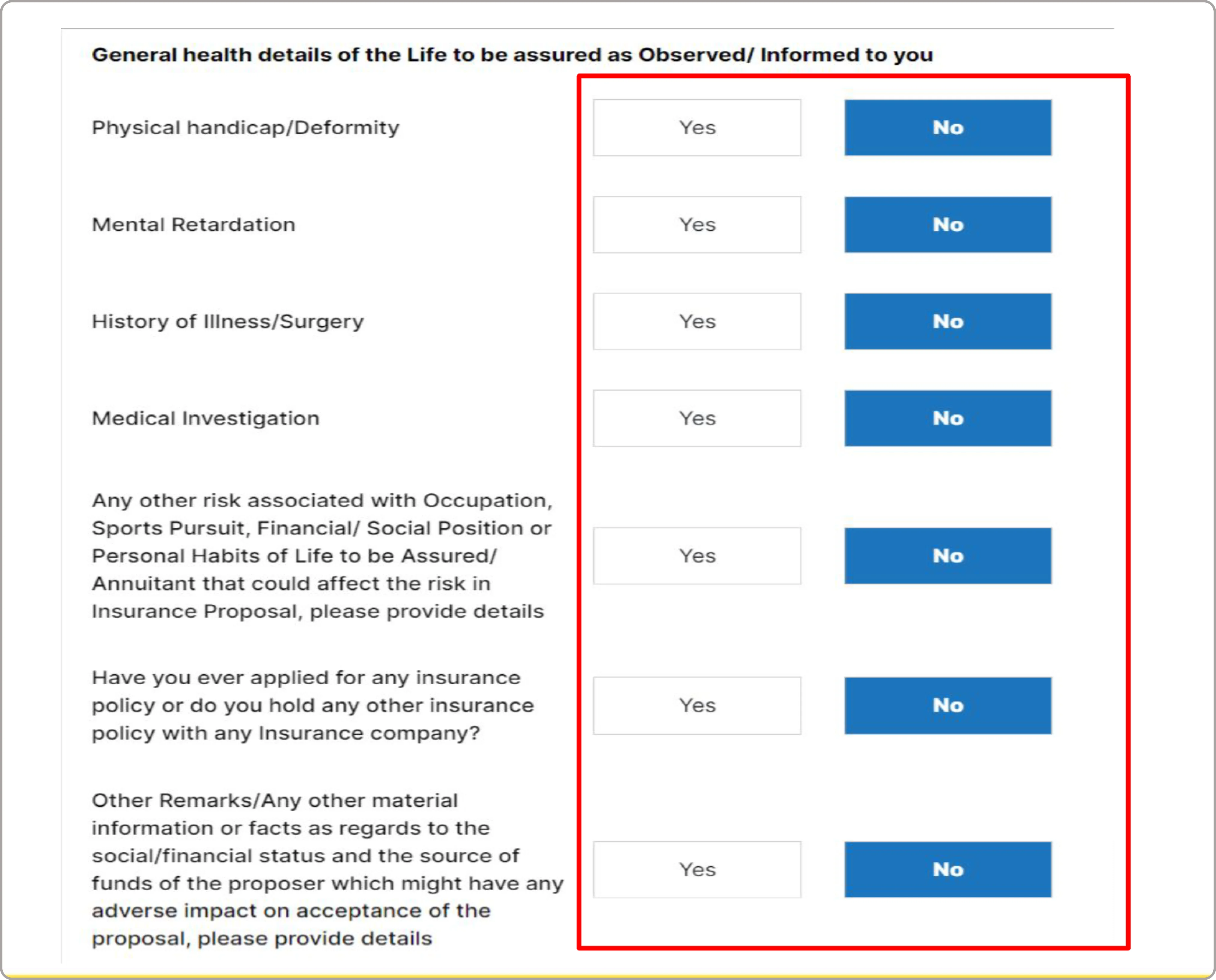

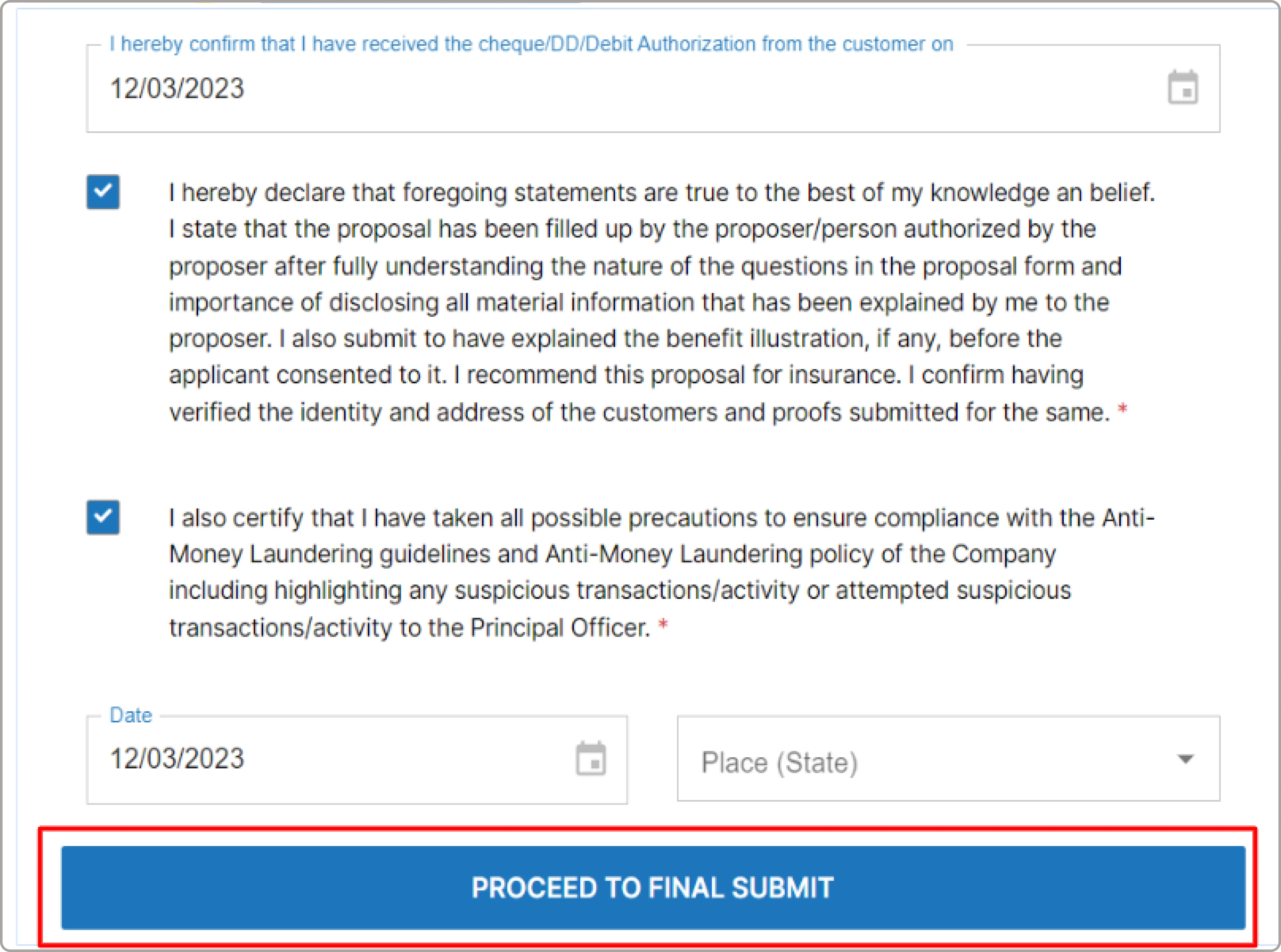

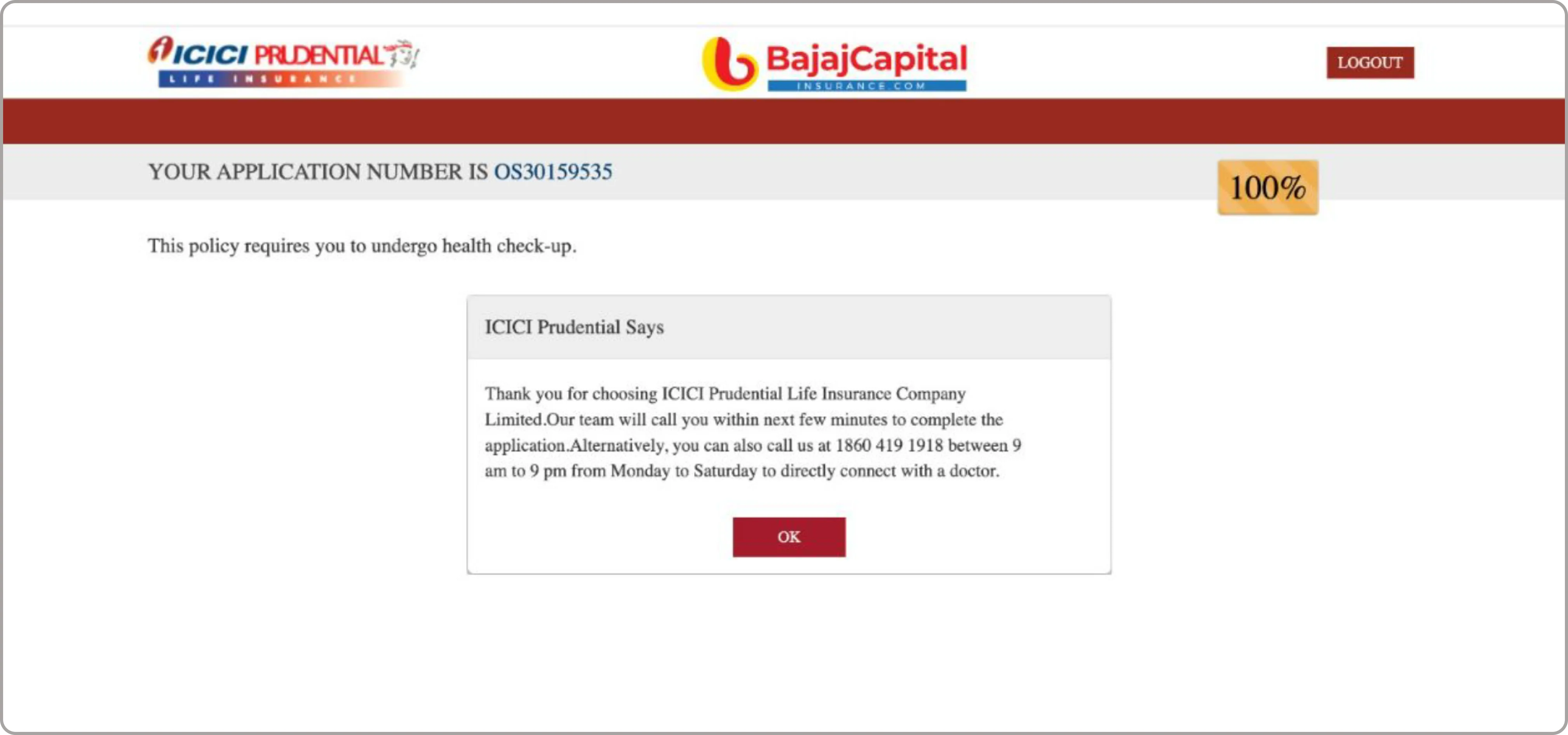

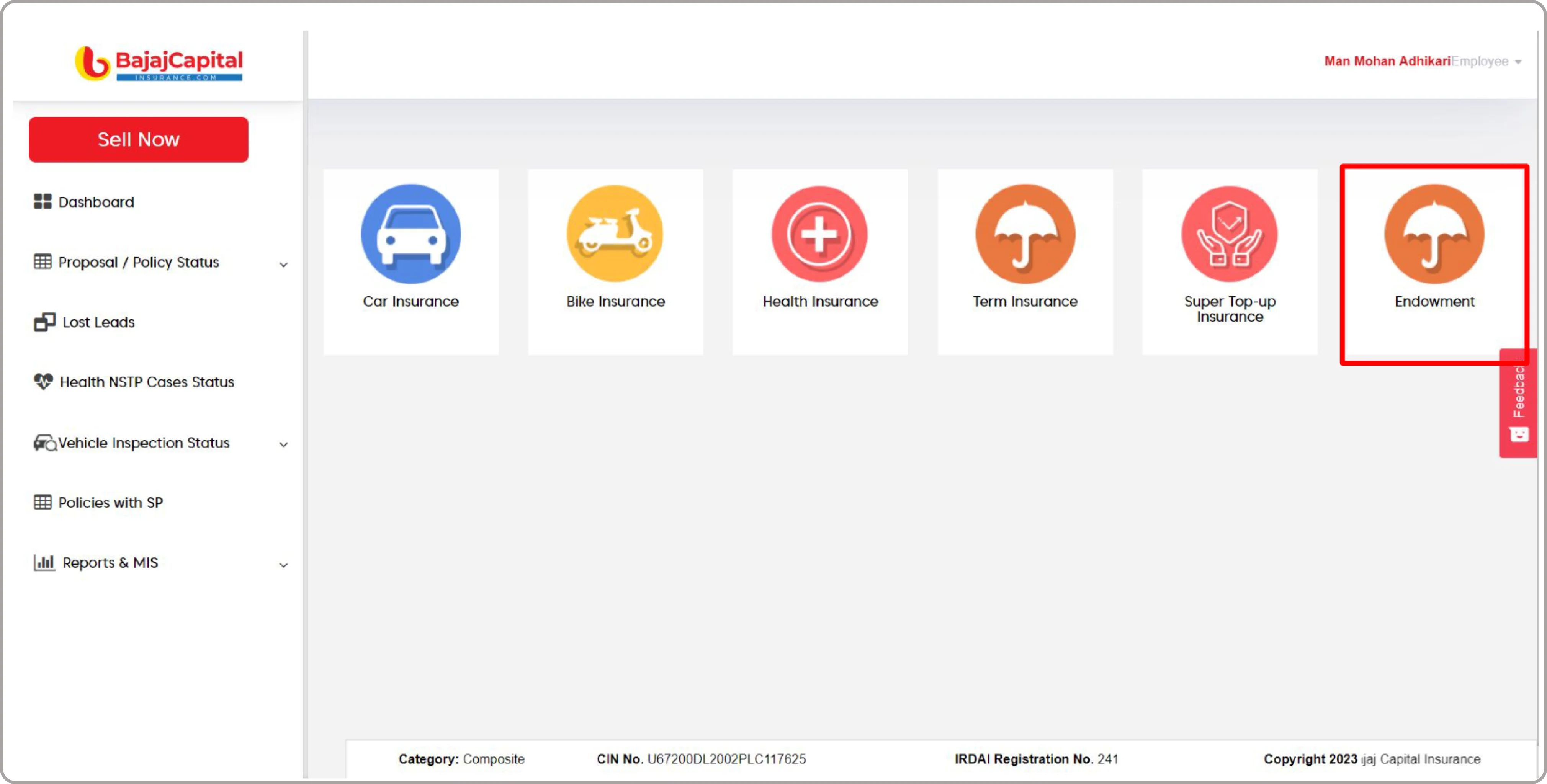

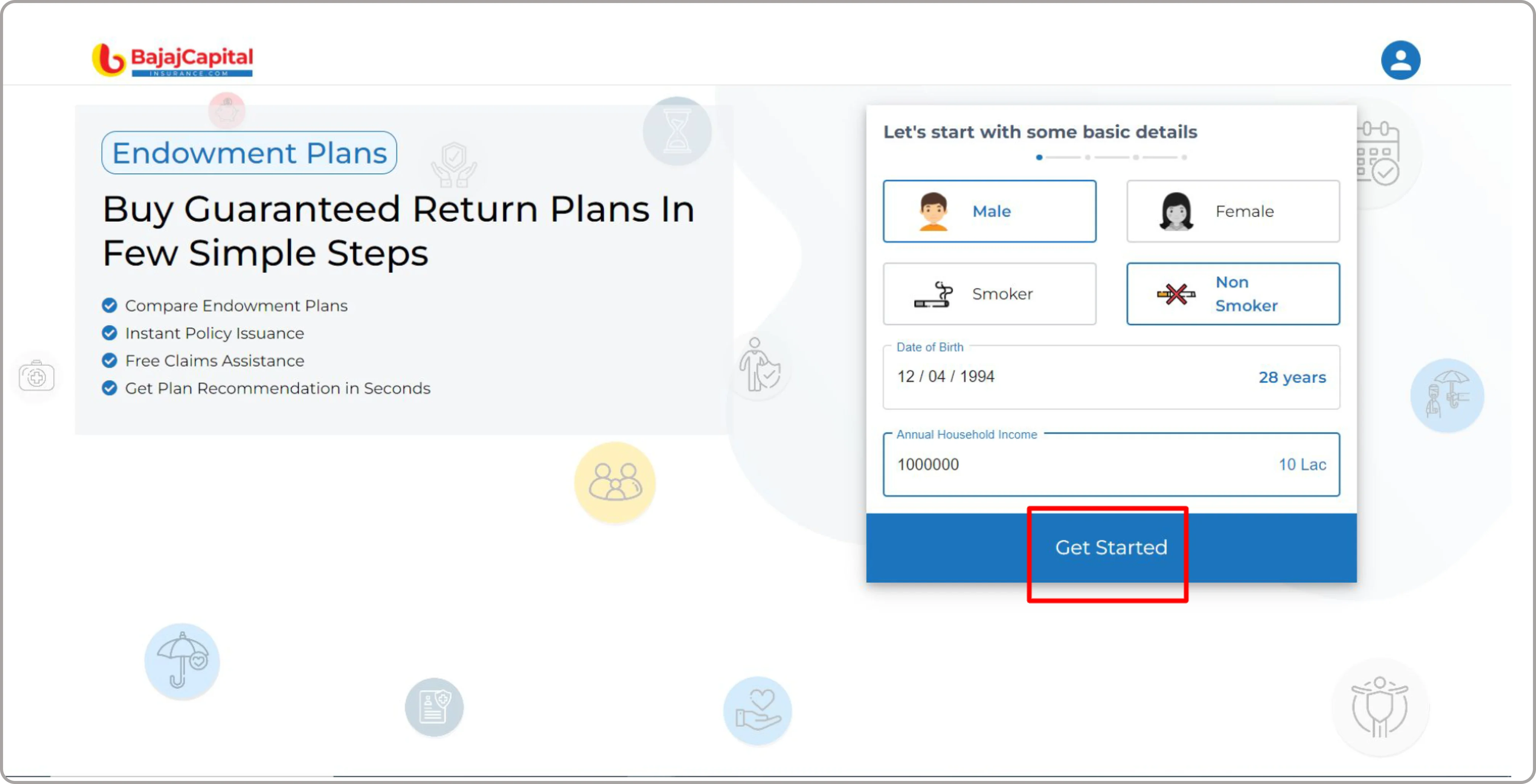

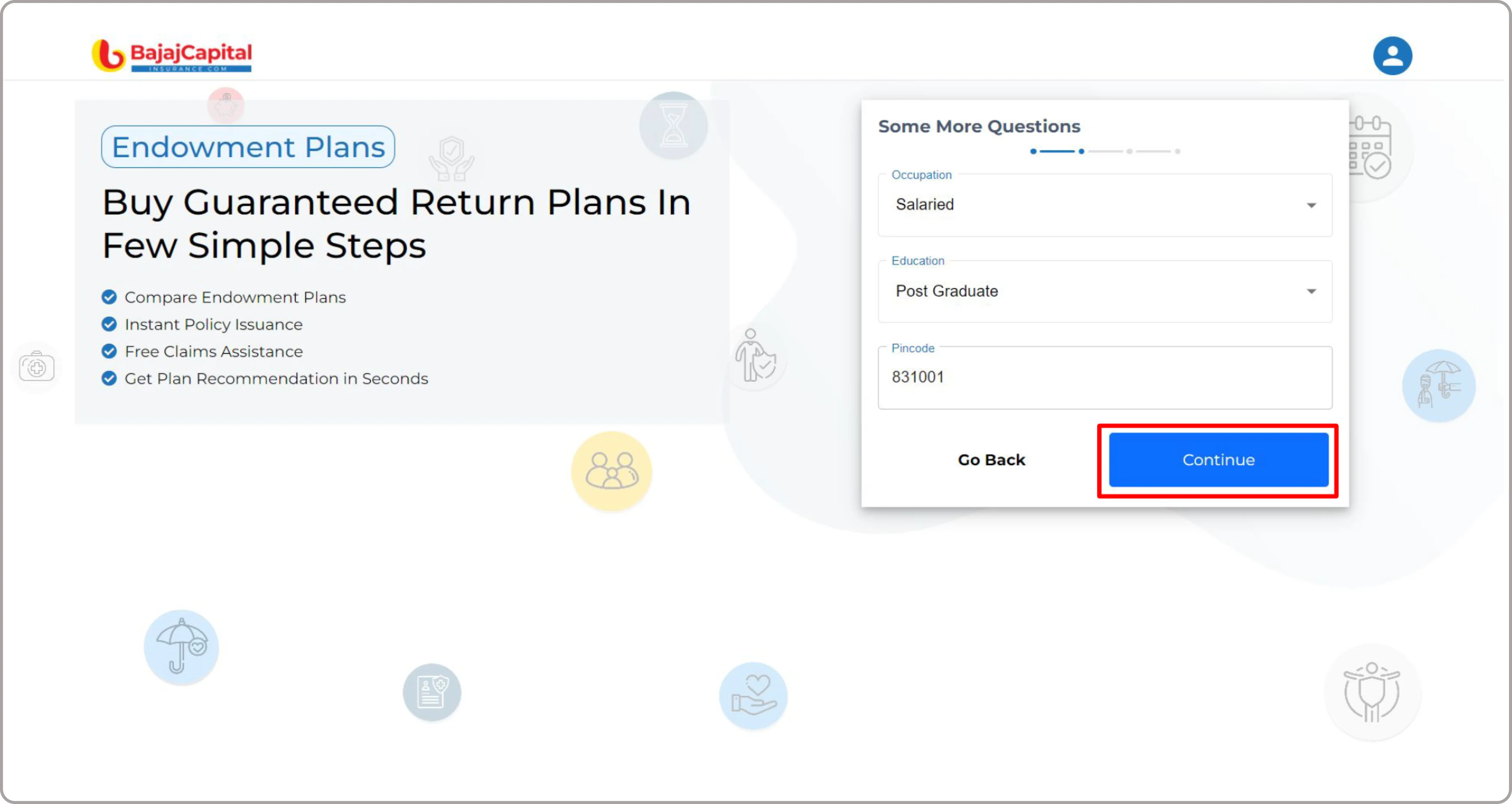

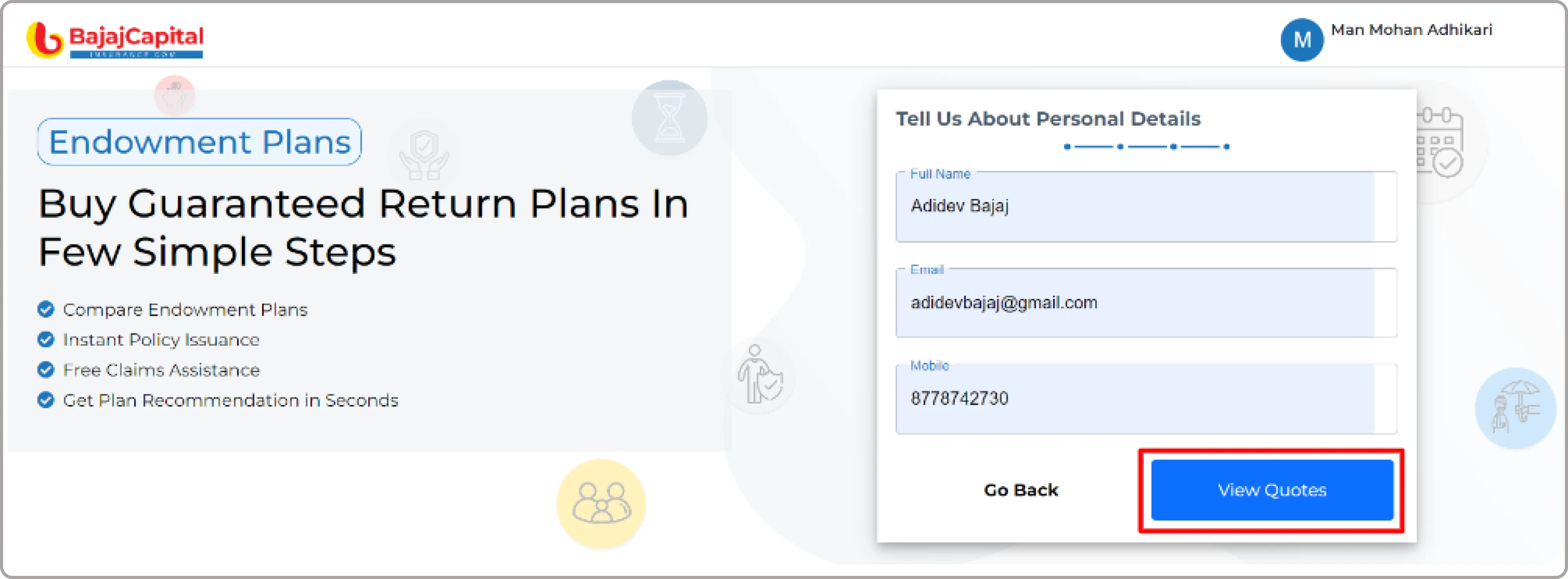

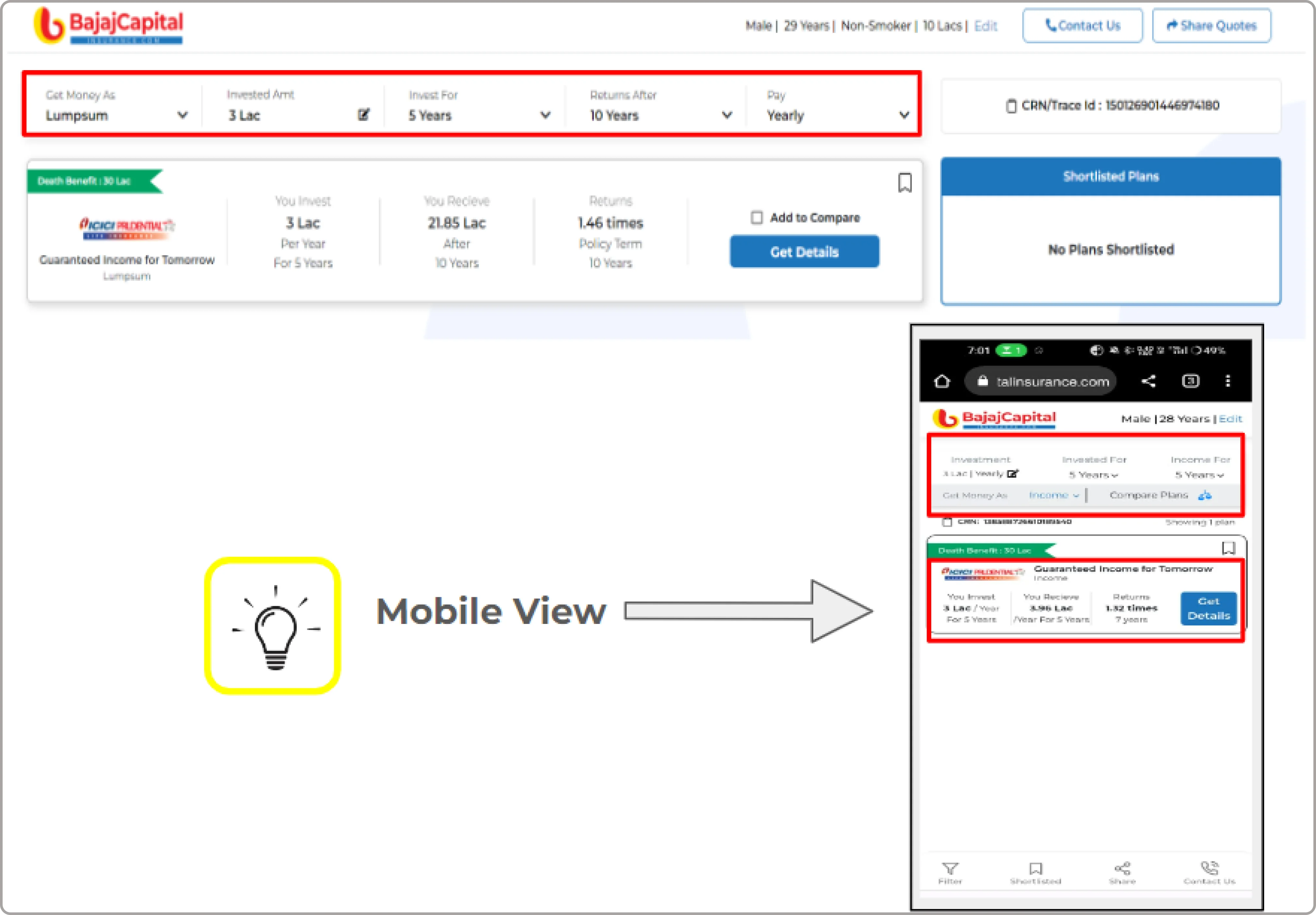

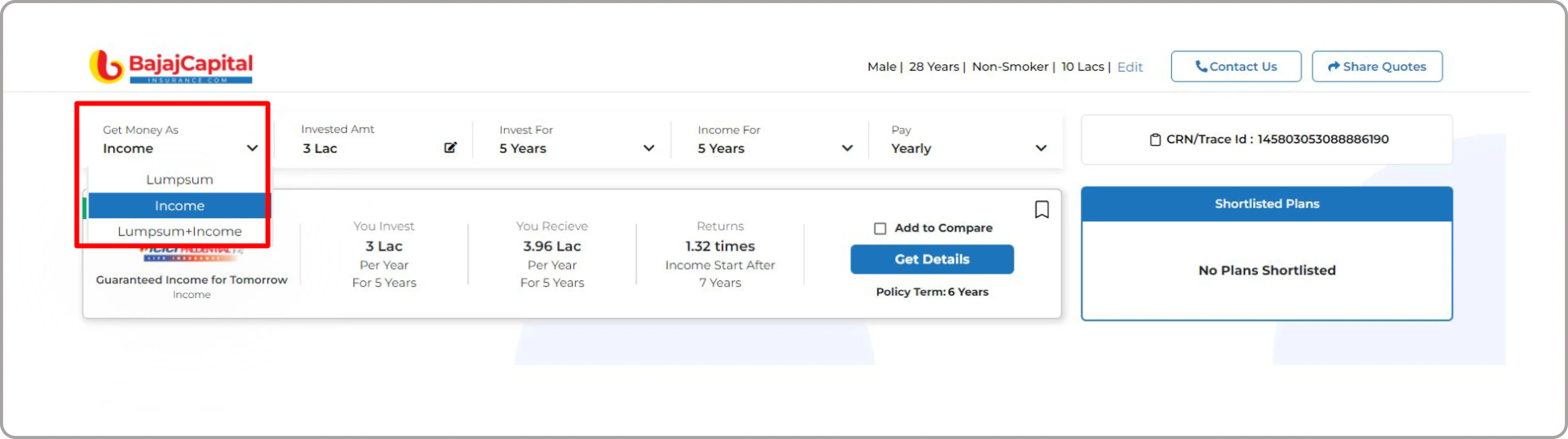

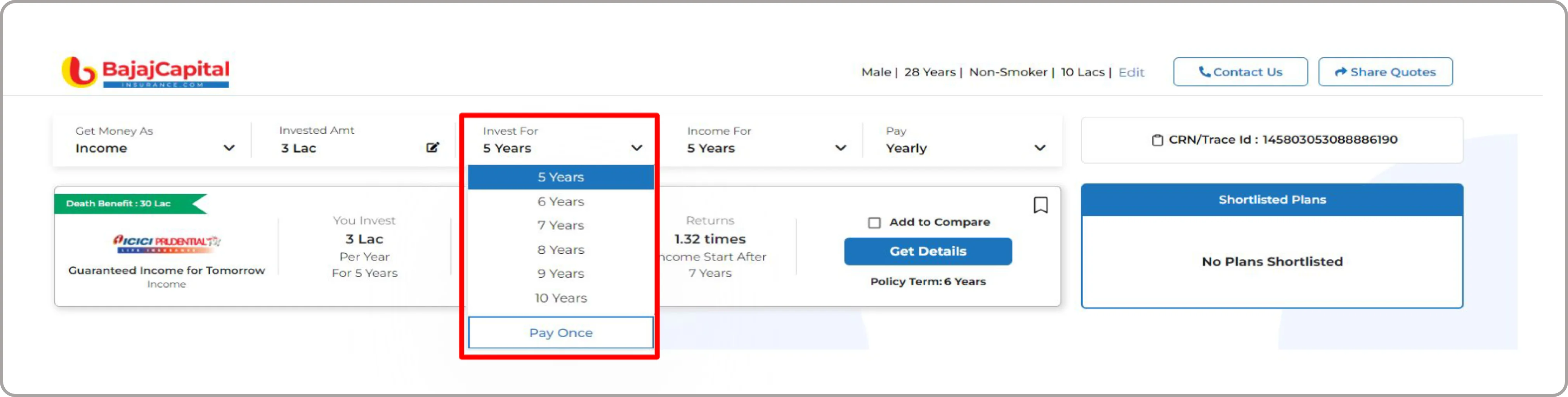

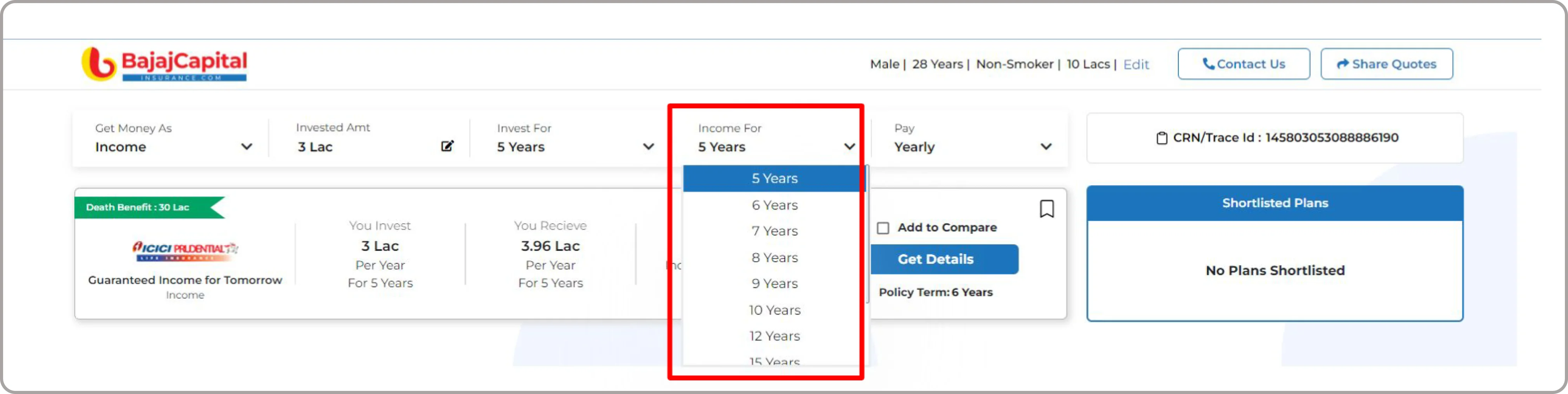

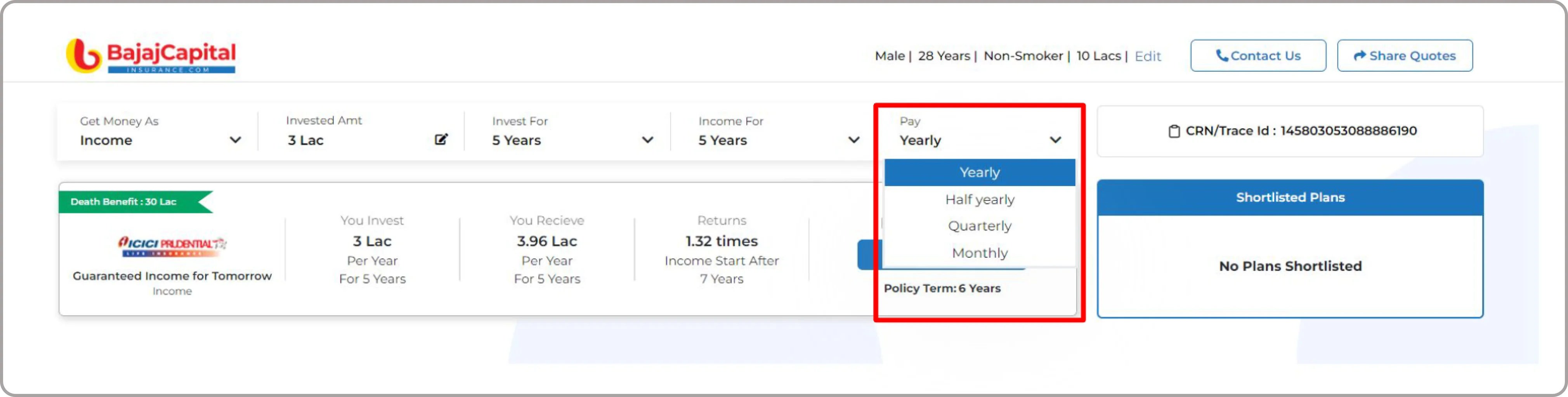

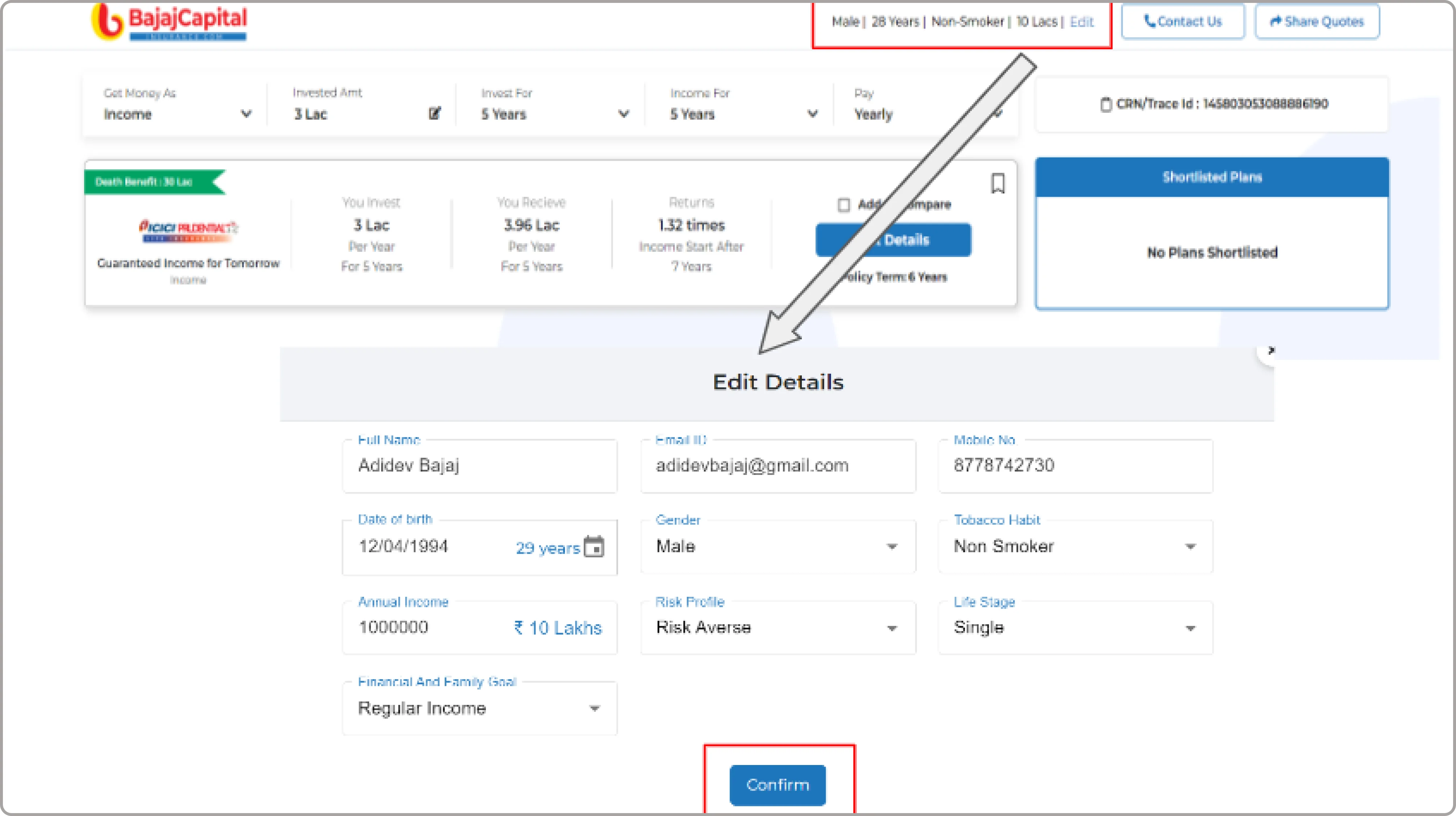

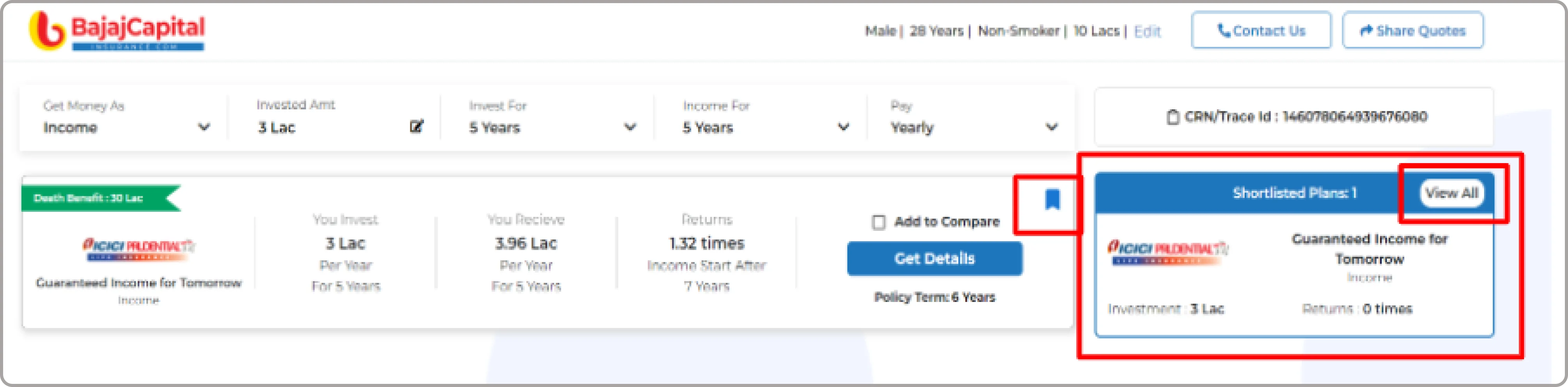

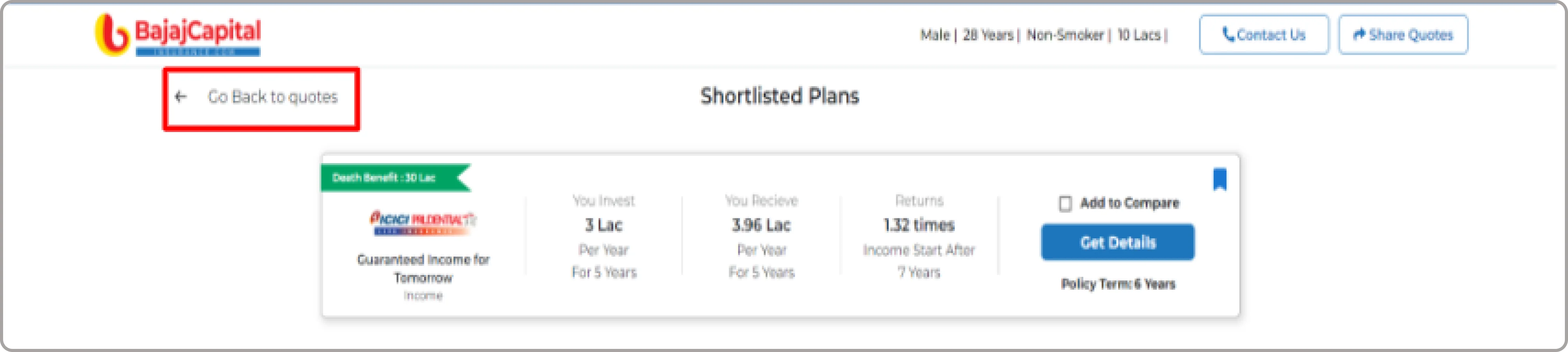

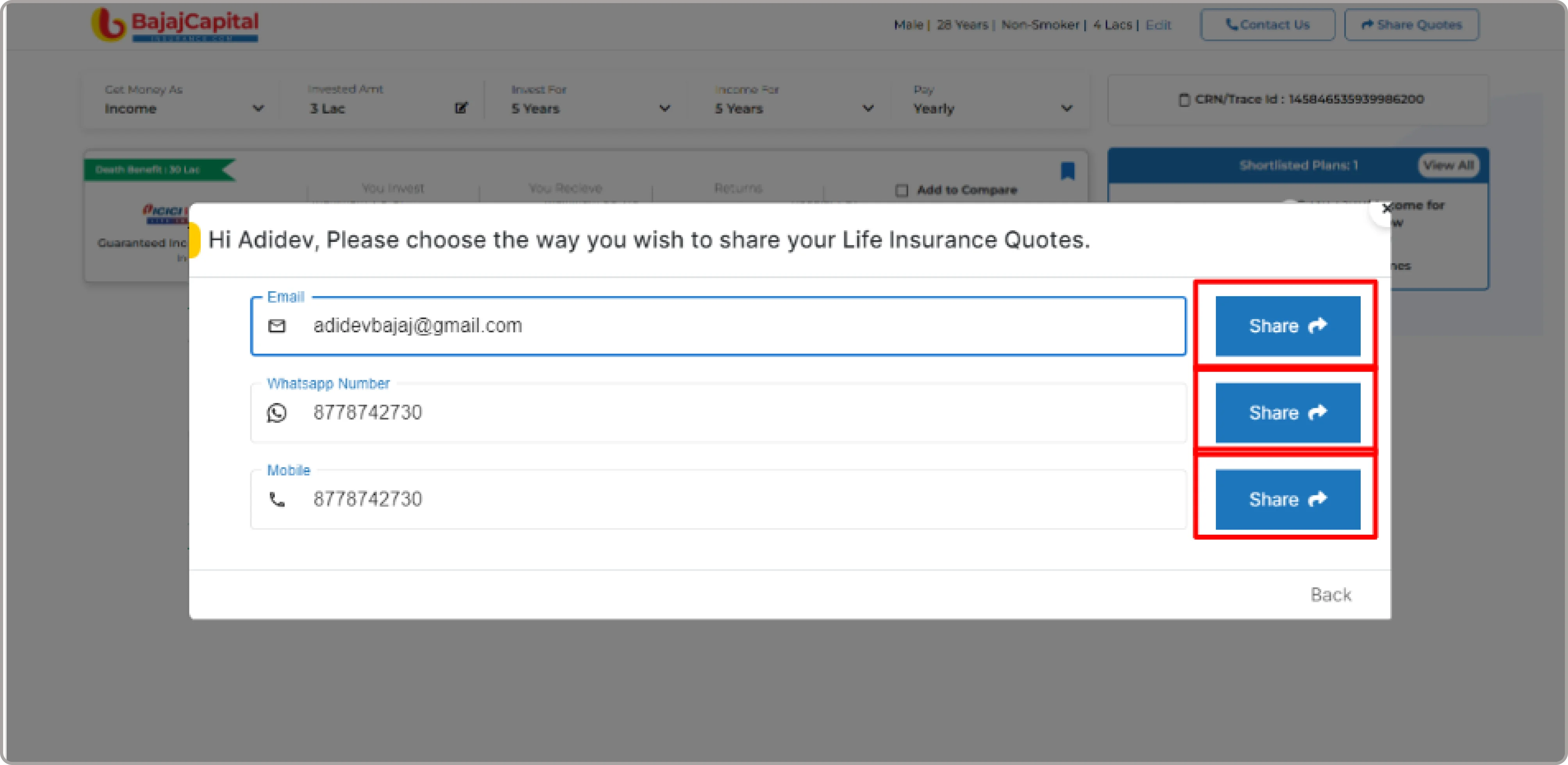

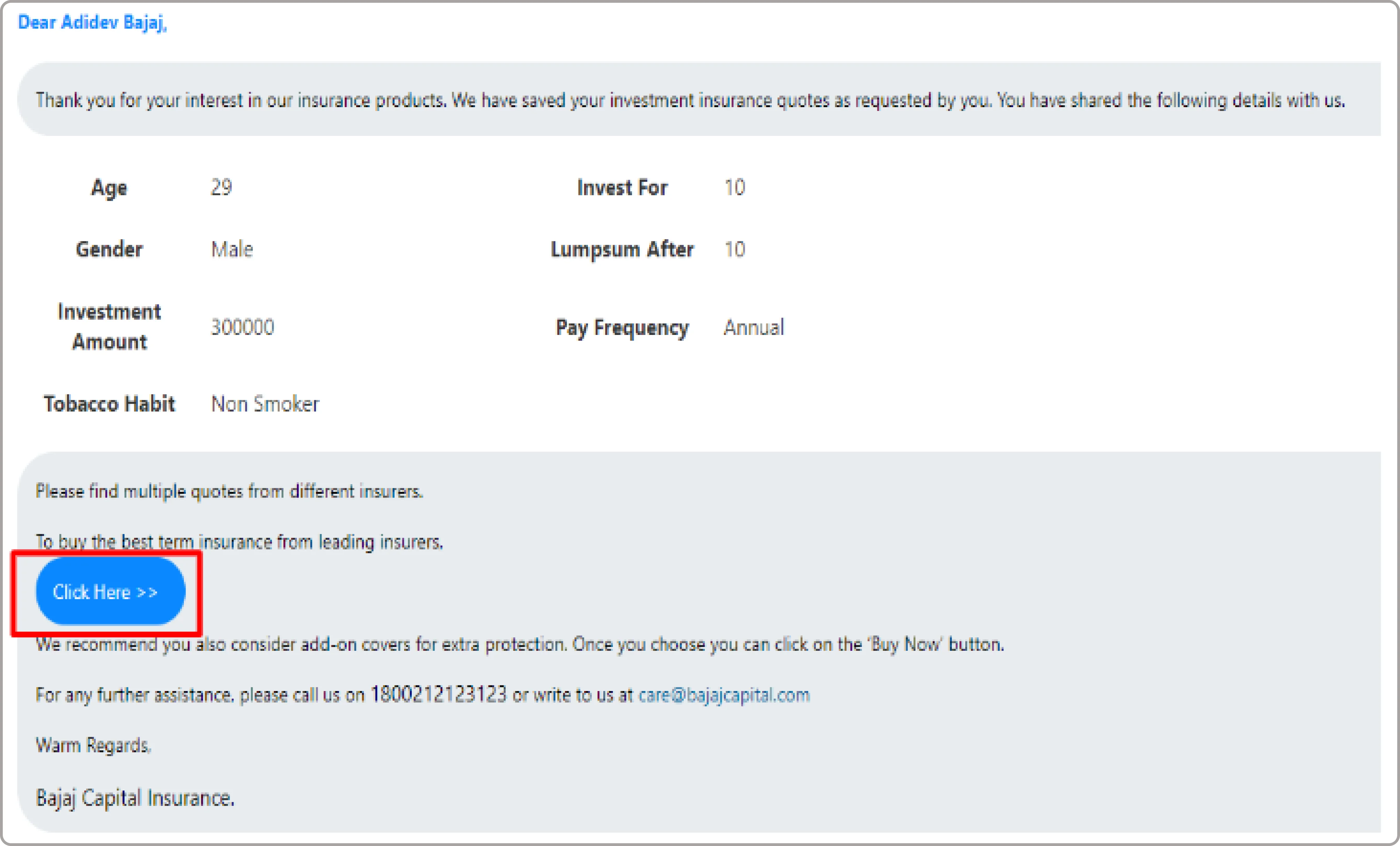

Sell NowPlatform Modules & Features

Deep dive into what all you can do. Learn about all the basic features which will help you improve your productivity.

Top Performing

Top Performing  RMs

RMs

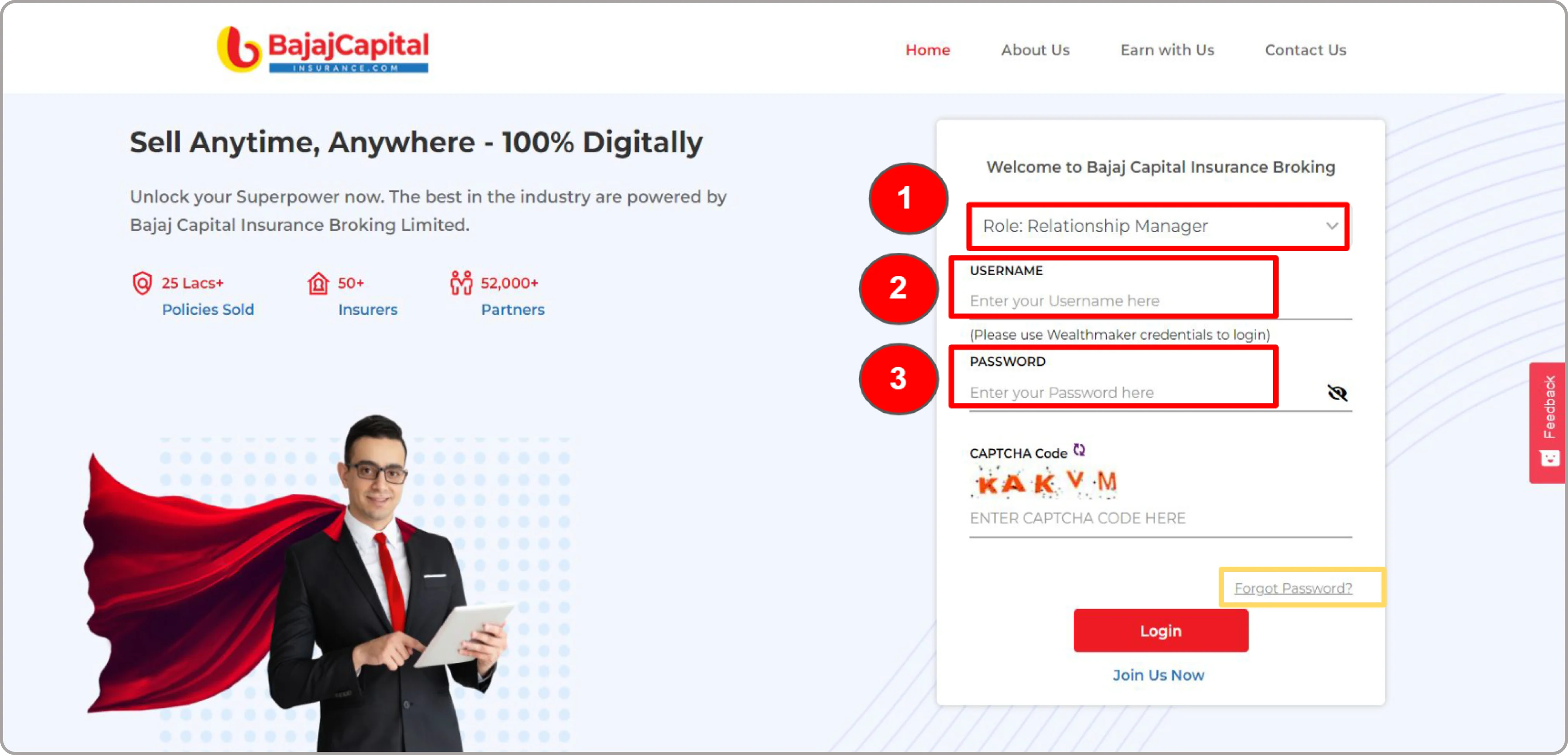

Put your Skills to Test

See how far you've come by attempting this evaluation of your Learnings. Login to WealthMaker & test your learnings in Qlik2Learn.

Our Partners

Back

Back